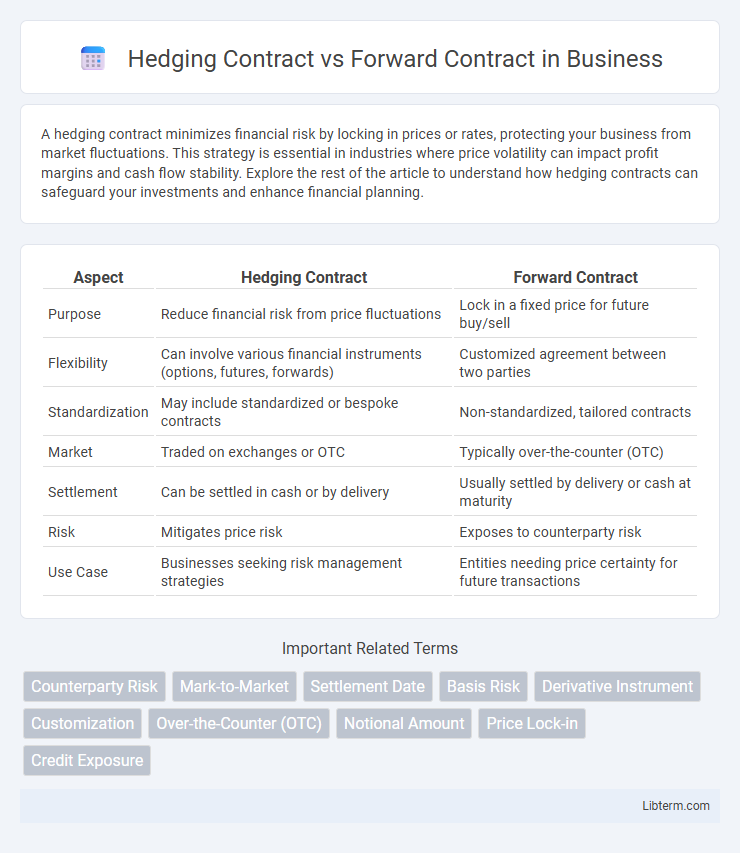

A hedging contract minimizes financial risk by locking in prices or rates, protecting your business from market fluctuations. This strategy is essential in industries where price volatility can impact profit margins and cash flow stability. Explore the rest of the article to understand how hedging contracts can safeguard your investments and enhance financial planning.

Table of Comparison

| Aspect | Hedging Contract | Forward Contract |

|---|---|---|

| Purpose | Reduce financial risk from price fluctuations | Lock in a fixed price for future buy/sell |

| Flexibility | Can involve various financial instruments (options, futures, forwards) | Customized agreement between two parties |

| Standardization | May include standardized or bespoke contracts | Non-standardized, tailored contracts |

| Market | Traded on exchanges or OTC | Typically over-the-counter (OTC) |

| Settlement | Can be settled in cash or by delivery | Usually settled by delivery or cash at maturity |

| Risk | Mitigates price risk | Exposes to counterparty risk |

| Use Case | Businesses seeking risk management strategies | Entities needing price certainty for future transactions |

Overview of Hedging Contracts

Hedging contracts are financial agreements designed to minimize risk exposure by locking in prices or rates for future transactions, providing certainty against market fluctuations. These contracts are commonly used in forex, commodities, and interest rate markets to protect businesses and investors from adverse price movements. Forward contracts are a type of hedging instrument, customized between parties to fix the price and date of an asset's delivery, effectively managing future financial risks.

Understanding Forward Contracts

Forward contracts are tailored agreements between two parties to buy or sell an asset at a specific price on a future date, commonly used in hedging to manage price risk. These contracts are customizable regarding quantity, delivery date, and underlying asset, which contrasts with standardized futures contracts traded on exchanges. Understanding forward contracts is essential for businesses seeking precise risk mitigation strategies in uncertain markets.

Key Differences Between Hedging and Forward Contracts

Hedging contracts are financial strategies used by businesses to reduce the risk of price fluctuations in assets, commodities, or currencies, while forward contracts are specific agreements to buy or sell an asset at a predetermined price on a future date. The key difference lies in purpose: hedging contracts broadly aim at risk management across various instruments, whereas forward contracts are a type of derivative used specifically to lock in prices and hedge against market volatility. Forward contracts involve custom terms and counterparty risk, unlike standardized hedging instruments like futures or options that enhance liquidity and reduce default risk.

Purpose and Objectives of Each Contract Type

Hedging contracts primarily aim to reduce or eliminate the risk of price fluctuations in commodities, currencies, or securities, providing financial stability and predictability for businesses. Forward contracts are designed to lock in a specific price for an asset at a future date, enabling firms to manage exposure to price volatility and secure costs or revenues. Both contract types serve risk management objectives but differ in flexibility and standardized terms, with forwards often customized and hedging contracts including various derivatives like futures and options.

Mechanisms and Structure Explained

Hedging contracts involve financial instruments designed to reduce risk by locking in prices or rates, often using derivatives such as futures or options to protect against market fluctuations. Forward contracts are customized agreements between two parties to buy or sell an asset at a specified future date for a price agreed upon today, with no standardized exchange involvement. The key structural difference is that forwards are over-the-counter contracts tailored to specific needs, while hedging strategies can incorporate a variety of instruments to provide risk management across multiple market variables.

Risk Management in Hedging vs Forward Contracts

Hedging contracts and forward contracts both serve as crucial tools in risk management by mitigating exposure to price fluctuations in assets or currencies. Hedging contracts strategically offset potential losses in an underlying asset through derivatives, providing flexibility and protection against adverse market movements. Forward contracts lock in prices for future transactions, eliminating uncertainty but introducing counterparty risk and less adaptability compared to dynamic hedging strategies.

Market Participants and Use Cases

Hedging contracts are widely used by producers, exporters, and importers seeking to mitigate price fluctuations and secure predictable costs, particularly in commodity and currency markets. Forward contracts primarily attract financial institutions, corporations, and investors aiming to lock in future prices or rates, facilitating risk management and speculative opportunities in currencies, interest rates, and commodities. While hedging contracts focus on reducing exposure to market volatility for operational stability, forward contracts serve both hedging and investment purposes with customizable terms for delivery and settlement.

Advantages and Disadvantages of Each Contract

Hedging contracts provide protection against price volatility and limit financial risk by locking in prices but may result in missed profit opportunities if market prices move favorably. Forward contracts offer customized agreements with fixed terms tailored to the needs of both parties, ensuring price certainty, but carry counterparty risk due to lack of standardization and limited liquidity compared to exchange-traded derivatives. While hedging contracts improve budget predictability and financial planning, they may reduce flexibility, whereas forward contracts enhance risk management but require careful assessment of credit exposure.

Regulatory and Legal Considerations

Hedging contracts are often subject to comprehensive regulatory oversight, including compliance with the Dodd-Frank Act in the United States and EMIR in the European Union, ensuring transparency and risk mitigation in derivative trading. Forward contracts, typically customized agreements between two parties, may escape some standardized regulatory requirements but still face legal considerations related to enforceability, counterparty risk, and jurisdictional dispute resolution. Understanding the nuances of regulatory frameworks and legal enforceability is critical for both hedging and forward contracts to manage financial risk effectively.

Choosing the Right Contract for Your Needs

Selecting between a hedging contract and a forward contract depends on your risk management objectives and market exposure. Hedging contracts offer broader protection against price fluctuations by incorporating options and futures, while forward contracts provide a fixed price agreement tailored to specific delivery dates, ideal for businesses seeking certainty in cash flow. Assessing factors such as flexibility, cost, and counterparty risk ensures the right contract aligns with your financial goals and operational requirements.

Hedging Contract Infographic

libterm.com

libterm.com