A partnership agreement outlines the roles, responsibilities, and profit-sharing arrangements between business partners, ensuring clarity and legal protection. Clearly defined terms prevent conflicts and provide a framework for resolving disputes should they arise. Discover essential elements to include in your partnership agreement by reading the full article.

Table of Comparison

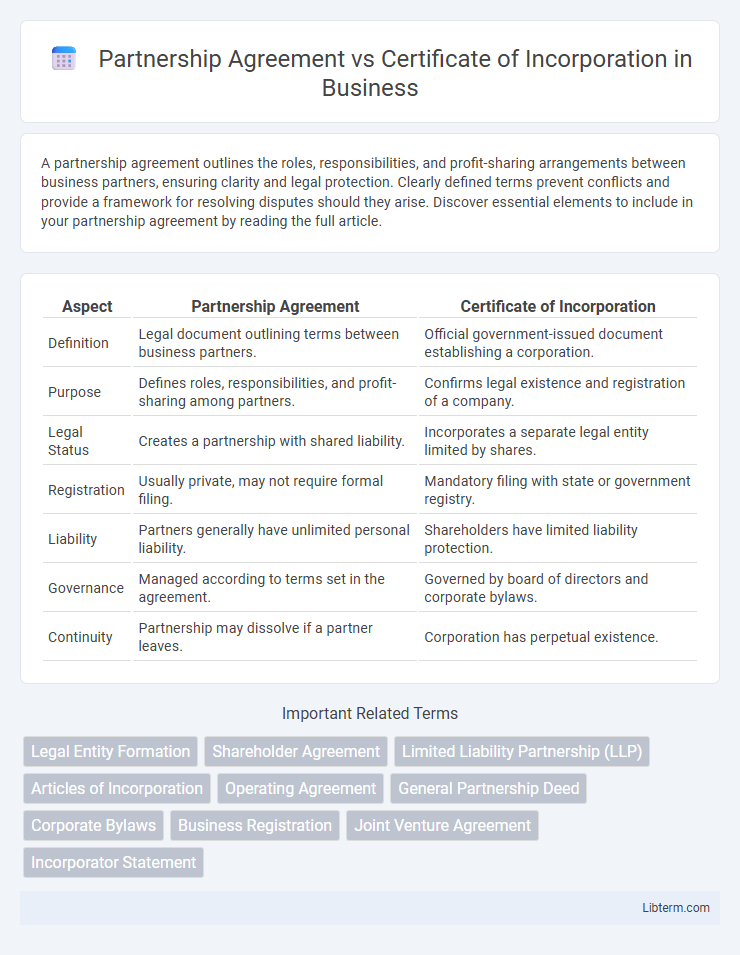

| Aspect | Partnership Agreement | Certificate of Incorporation |

|---|---|---|

| Definition | Legal document outlining terms between business partners. | Official government-issued document establishing a corporation. |

| Purpose | Defines roles, responsibilities, and profit-sharing among partners. | Confirms legal existence and registration of a company. |

| Legal Status | Creates a partnership with shared liability. | Incorporates a separate legal entity limited by shares. |

| Registration | Usually private, may not require formal filing. | Mandatory filing with state or government registry. |

| Liability | Partners generally have unlimited personal liability. | Shareholders have limited liability protection. |

| Governance | Managed according to terms set in the agreement. | Governed by board of directors and corporate bylaws. |

| Continuity | Partnership may dissolve if a partner leaves. | Corporation has perpetual existence. |

Introduction to Partnership Agreement and Certificate of Incorporation

A Partnership Agreement is a legal document that outlines the roles, responsibilities, profit-sharing, and operational procedures between partners in a business, establishing the framework for their collaborative relationship. In contrast, a Certificate of Incorporation is an official government-issued document that legally registers a company as a corporation, confirming its existence and compliance with statutory requirements. While the Partnership Agreement governs internal arrangements among partners, the Certificate of Incorporation provides formal recognition and legal status to a corporate entity.

Definition of Partnership Agreement

A Partnership Agreement is a legally binding contract between two or more individuals who agree to share profits, losses, and management responsibilities of a business jointly. It outlines the terms of partnership, including capital contributions, roles, decision-making processes, and dispute resolution mechanisms, ensuring clarity and protection for all partners involved. Unlike a Certificate of Incorporation, which is a legal document that officially registers a corporation, a Partnership Agreement governs the internal operations and relationships within a partnership.

Definition of Certificate of Incorporation

A Certificate of Incorporation is a legal document issued by a government authority that officially recognizes the formation of a corporation, detailing its name, purpose, registered office, and initial directors. Unlike a Partnership Agreement, which outlines the roles, responsibilities, and profit-sharing arrangements between partners, the Certificate of Incorporation serves as proof of a company's legal existence and registration status. This document enables corporations to operate as separate legal entities, offering limited liability protection to shareholders.

Key Differences Between Partnership Agreement and Certificate of Incorporation

A Partnership Agreement is a legal document outlining the roles, responsibilities, profit sharing, and dispute resolution mechanisms among business partners, primarily governing operational aspects within a partnership structure. In contrast, a Certificate of Incorporation is an official government-issued document that legally establishes a company as a separate legal entity, providing it with corporate status, rights, and obligations. While the Partnership Agreement focuses on internal management details, the Certificate of Incorporation validates the company's existence and compliance with regulatory requirements.

Formation Process: Partnership vs Incorporation

The formation process of a partnership involves drafting and signing a partnership agreement that outlines the roles, responsibilities, profit-sharing, and management structure agreed upon by the partners. In contrast, incorporation requires filing a Certificate of Incorporation with the state or relevant government authority, which legally establishes the company as a separate corporate entity. While partnerships rely on contractual agreements between individuals, incorporation creates a distinct legal identity through formal registration and compliance with statutory requirements.

Legal Status and Liability Comparison

A Partnership Agreement outlines the legal relationship and obligations between business partners, with each partner typically bearing unlimited personal liability for the firm's debts and obligations. In contrast, a Certificate of Incorporation formally establishes a corporation as a separate legal entity, providing shareholders limited liability protection where personal assets are generally shielded from business debts. The legal status under a Certificate of Incorporation enables the business to enter contracts, sue or be sued independent of its owners, whereas a partnership lacks this separate legal identity.

Management Structure: Partnership vs Incorporated Entity

A Partnership Agreement outlines the management structure by defining roles, responsibilities, and decision-making powers among individual partners, allowing for direct control and flexible operational arrangements. In contrast, a Certificate of Incorporation establishes a corporation as a separate legal entity with a formalized management hierarchy that includes a board of directors and appointed officers who govern the company according to corporate bylaws. This distinction results in partnerships having shared management accountability, while incorporated entities operate under structured governance with legally defined roles and fiduciary duties.

Documentation and Regulatory Requirements

A Partnership Agreement outlines the roles, responsibilities, and profit-sharing ratios among partners, serving as a private contract with no mandatory filing requirements, while a Certificate of Incorporation is an official legal document filed with the state that establishes a company as a separate legal entity. The Partnership Agreement does not require registration but must comply with state laws governing partnerships; the Certificate of Incorporation demands strict adherence to statutory formalities, including the submission of articles of incorporation and payment of state fees. Regulatory bodies use the Certificate of Incorporation to verify a corporation's legitimacy, while a Partnership Agreement primarily governs internal operations and disputes among partners.

Tax Implications and Compliance

A Partnership Agreement outlines profit-sharing and tax responsibilities, with income typically passing through to partners who report earnings on personal tax returns, avoiding corporate taxation but requiring compliance with self-employment taxes. A Certificate of Incorporation establishes a corporation as a separate legal entity subject to corporate income tax, requires filing annual tax returns, and mandates adherence to regulatory compliance such as issuing stock and holding board meetings. Understanding these distinctions is crucial for optimizing tax strategy and meeting the specific reporting and regulatory obligations of each business structure.

Choosing the Right Structure for Your Business

Selecting the appropriate business structure depends on factors such as liability, tax implications, and ownership flexibility. A Partnership Agreement outlines roles, profit sharing, and responsibilities among partners, ideal for collaborative ventures without limited liability protection. In contrast, a Certificate of Incorporation establishes a corporation, offering limited liability, ease of raising capital, and formalized governance, making it suitable for businesses seeking growth and legal protection.

Partnership Agreement Infographic

libterm.com

libterm.com