Short selling involves borrowing shares to sell them at the current price, aiming to buy them back later at a lower price for a profit. This strategy carries significant risk, as losses can be unlimited if the stock price rises instead of falls. Explore the rest of the article to understand how short selling works and whether it fits Your investment goals.

Table of Comparison

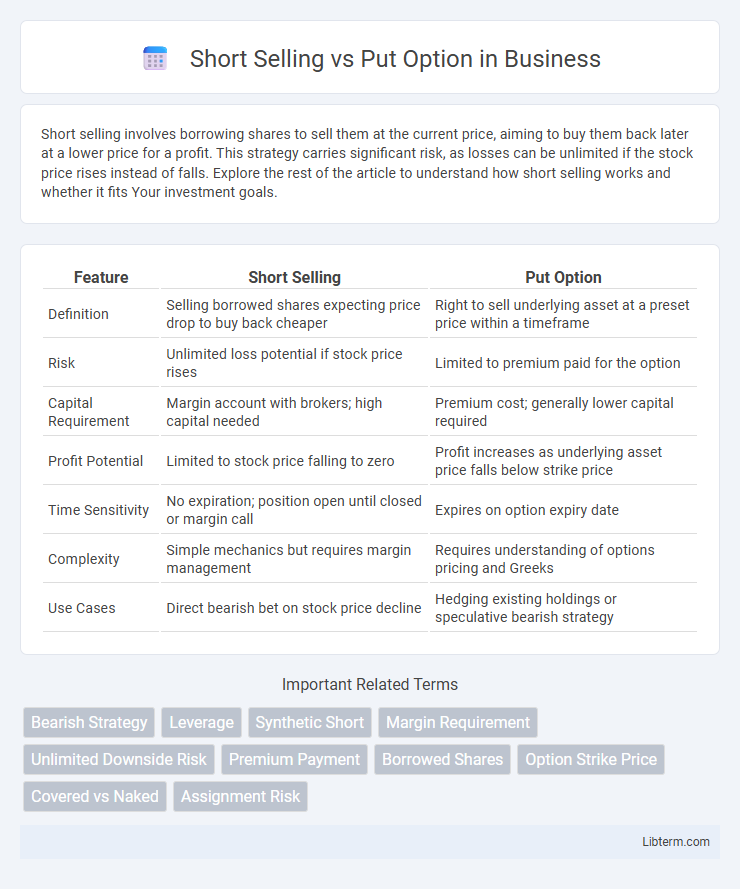

| Feature | Short Selling | Put Option |

|---|---|---|

| Definition | Selling borrowed shares expecting price drop to buy back cheaper | Right to sell underlying asset at a preset price within a timeframe |

| Risk | Unlimited loss potential if stock price rises | Limited to premium paid for the option |

| Capital Requirement | Margin account with brokers; high capital needed | Premium cost; generally lower capital required |

| Profit Potential | Limited to stock price falling to zero | Profit increases as underlying asset price falls below strike price |

| Time Sensitivity | No expiration; position open until closed or margin call | Expires on option expiry date |

| Complexity | Simple mechanics but requires margin management | Requires understanding of options pricing and Greeks |

| Use Cases | Direct bearish bet on stock price decline | Hedging existing holdings or speculative bearish strategy |

Introduction to Short Selling and Put Options

Short selling involves borrowing shares to sell them at the current market price with the intention of buying them back later at a lower price, profiting from a decline in the stock's value. Put options grant the buyer the right, but not the obligation, to sell an underlying asset at a predetermined strike price before the option's expiration date, offering a way to hedge or speculate on downward price movements. Both strategies aim to capitalize on declining stock prices but differ in risk profiles and capital requirements.

How Short Selling Works

Short selling involves borrowing shares from a broker and selling them at the current market price with the obligation to buy them back later, ideally at a lower price, to return to the lender. Traders profit when the stock price declines, as repurchasing shares cheaper than the initial sale price results in a net gain. This strategy requires margin accounts and carries risks, including unlimited losses if the stock price rises significantly.

Understanding Put Options

Put options grant the holder the right to sell an underlying asset at a predetermined price before expiration, allowing investors to hedge or profit from anticipated declines in asset value. Unlike short selling, which involves borrowing and selling the asset directly, put options limit potential losses to the premium paid while offering leveraged downside exposure. Understanding these key distinctions helps investors manage risk and capitalize on bearish market movements effectively.

Key Differences Between Short Selling and Put Options

Short selling involves borrowing shares to sell them at the current market price with the expectation of repurchasing them later at a lower price, exposing the investor to unlimited loss potential if the stock rises. Put options grant the right, but not the obligation, to sell a stock at a predetermined strike price before expiration, limiting the maximum loss to the premium paid. Unlike short selling, put options provide leveraged downside protection and allow risk management without requiring the borrowing of shares.

Risk Factors in Short Selling vs Put Options

Short selling involves unlimited risk as the stock price can rise indefinitely, leading to potentially infinite losses, whereas put options have limited risk confined to the premium paid for the option. Margin calls and liquidity issues can amplify short selling risks, while put options provide leveraged downside protection with defined maximum loss. Understanding market volatility and timing is critical in both strategies, but short sellers face the added burden of borrowing costs and regulatory restrictions absent in put option trading.

Profit Potential: Short Selling vs Buying Puts

Short selling involves borrowing shares to sell at the current price, aiming to buy them back at a lower price for profit, with theoretically unlimited risk if the stock price rises. Buying put options offers defined risk limited to the premium paid, while providing leverage to profit from a decline in the underlying asset's price. Put options can multiply gains with a smaller initial investment compared to short selling, but expire worthless if the stock price does not fall below the strike price within the option period.

Margin Requirements and Capital Needed

Short selling requires borrowing shares with margin requirements typically set at 150% of the short sale value, demanding an initial margin of approximately 50% plus the full value of the borrowed stock as collateral. In contrast, purchasing put options requires paying the option premium upfront, often representing a significantly lower capital outlay with no margin calls, as the maximum loss is limited to the premium paid. Margin requirements for put options are minimal since buyers are not exposed to unlimited risk, whereas short sellers face higher capital demands due to potential unlimited losses and maintenance margin adjustments.

Tax Implications of Short Selling and Put Options

Short selling generates taxable capital gains upon closing the position, with interest expenses on borrowed securities potentially deductible, but dividends paid to lenders are not deductible. Put options create taxable events when exercised or sold, with losses deductible only against capital gains, following specific holding period rules to determine short-term or long-term capital gains treatment. Understanding IRS regulations and timing of transactions is crucial to optimize tax liabilities related to short selling and put options strategies.

Common Strategies Using Shorts and Puts

Short selling involves borrowing shares to sell at the current price, aiming to repurchase them later at a lower price for profit, commonly used in bearish market strategies. Put options grant the right to sell an asset at a predetermined price, often utilized for hedging or speculative purposes to capitalize on expected price declines. Traders frequently combine short selling with put options to enhance downside protection and leverage bearish market positions.

Which Approach is Right for You?

Short selling involves borrowing shares to sell them at a high price, aiming to buy them back lower, and requires margin accounts with higher risk and potential unlimited losses. Put options grant the right to sell shares at a specific price within a set timeframe, offering limited risk equal to the premium paid while providing leverage and flexibility. Choosing the right strategy depends on your risk tolerance, market outlook, and investment objectives, with put options favored by traders seeking defined risk and short selling suitable for experienced investors confident in downward trends.

Short Selling Infographic

libterm.com

libterm.com