Private placement offers a streamlined method for companies to raise capital by selling securities directly to a select group of investors, bypassing public market regulations. This approach can provide faster access to funds, tailored investment terms, and reduced costs compared to public offerings. Explore the rest of the article to understand how private placement can benefit your financing strategy.

Table of Comparison

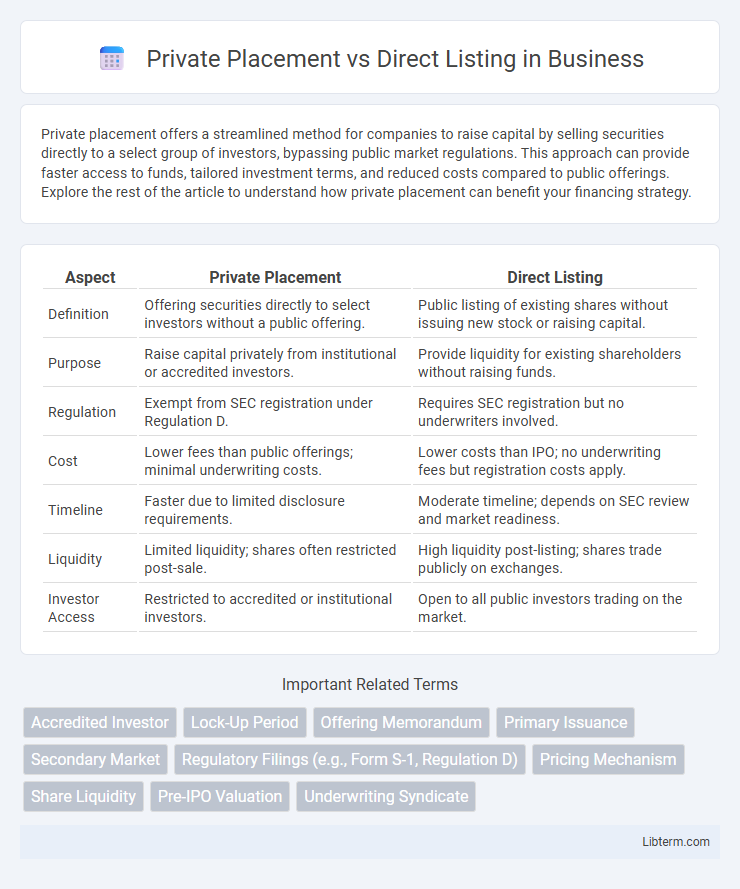

| Aspect | Private Placement | Direct Listing |

|---|---|---|

| Definition | Offering securities directly to select investors without a public offering. | Public listing of existing shares without issuing new stock or raising capital. |

| Purpose | Raise capital privately from institutional or accredited investors. | Provide liquidity for existing shareholders without raising funds. |

| Regulation | Exempt from SEC registration under Regulation D. | Requires SEC registration but no underwriters involved. |

| Cost | Lower fees than public offerings; minimal underwriting costs. | Lower costs than IPO; no underwriting fees but registration costs apply. |

| Timeline | Faster due to limited disclosure requirements. | Moderate timeline; depends on SEC review and market readiness. |

| Liquidity | Limited liquidity; shares often restricted post-sale. | High liquidity post-listing; shares trade publicly on exchanges. |

| Investor Access | Restricted to accredited or institutional investors. | Open to all public investors trading on the market. |

Introduction to Private Placement and Direct Listing

Private placement involves the sale of securities to a limited number of sophisticated investors, bypassing public market exchanges and regulatory requirements typical of initial public offerings (IPOs). Direct listing allows companies to list existing shares on a public stock exchange without issuing new shares or raising capital, providing liquidity for current shareholders without underwriters. Both methods offer alternatives to traditional IPOs, each with distinct regulatory, financial, and operational implications.

Key Differences Between Private Placement and Direct Listing

Private placement involves selling securities directly to a select group of investors, often institutional or accredited, without public offering, whereas direct listing allows a company to list its existing shares on a public exchange without issuing new shares. Private placements typically provide faster capital raising with less regulatory scrutiny, while direct listings focus on liquidity and market-driven share pricing without diluting ownership. Key differences include investor access, regulatory requirements, capital infusion, and market exposure.

Overview: What is Private Placement?

Private placement is a method of raising capital where securities are sold directly to a select group of institutional or accredited investors, bypassing public markets. This approach allows companies to secure funding quickly with fewer regulatory requirements compared to public offerings. Private placements offer flexibility in structuring deals and maintaining confidentiality during the fundraising process.

Overview: What is Direct Listing?

Direct listing is a method for companies to go public without issuing new shares or raising capital, enabling existing shareholders to sell their shares directly on the stock exchange. Unlike private placement, which involves selling securities privately to select investors, direct listing provides immediate liquidity and market-driven pricing with no lock-up periods. This approach benefits companies seeking transparency and cost efficiency by avoiding underwriter fees and minimizing dilution of ownership.

Advantages of Private Placement

Private placement offers companies the ability to raise capital quickly from a select group of investors without the regulatory burdens of a public offering, providing greater confidentiality and flexibility in deal structuring. This method typically results in lower costs and fewer disclosure requirements, preserving competitive advantages and sensitive business information. Investors benefit from negotiating terms directly, often receiving shares at favorable prices or with preferential rights compared to public market offerings.

Advantages of Direct Listing

Direct listing offers companies cost savings by bypassing underwriter fees and enables immediate liquidity for existing shareholders without the constraints of lock-up periods. It provides greater market-driven price discovery, allowing the stock to trade freely based on supply and demand dynamics from the first day. Transparency and equal access to shares promote fair valuation and broaden investor participation compared to the restricted nature of private placements.

Disadvantages and Risks of Private Placement

Private placements carry significant risks such as limited liquidity, as shares are not traded on public exchanges, making it difficult for investors to sell their holdings quickly. The lack of regulatory oversight compared to public offerings can result in less transparency, raising concerns about valuation accuracy and potential fraud. High minimum investment requirements and restricted investor access further limit the diversification potential and increase exposure to concentrated risks.

Disadvantages and Risks of Direct Listing

Direct listings carry the risk of high price volatility due to the absence of underwriters stabilizing the share price, potentially leading to significant market fluctuations. The lack of capital raising in a direct listing limits immediate liquidity and funding opportunities for the company compared to private placements. Furthermore, minimal investor protections and less structured investor engagement increase the likelihood of asymmetric information impacting stock performance.

Factors to Consider When Choosing Between Private Placement and Direct Listing

Evaluating factors such as capital requirements, investor access, and regulatory complexity is crucial when choosing between private placement and direct listing. Private placements offer targeted fundraising with limited disclosure obligations, whereas direct listings provide broader market access but entail stringent regulatory compliance and higher visibility. Companies must also consider liquidity needs, control retention, and long-term strategic goals to determine the optimal route for equity offering.

Conclusion: Which Route is Right for Your Company?

Choosing between a private placement and a direct listing depends on your company's capital needs, shareholder goals, and market readiness. Private placements offer a faster, less public method to raise funds from selected investors, while direct listings provide liquidity and market visibility without diluting ownership through new shares. Assessing factors like cost, control, and long-term strategy will determine the most beneficial route for your company's growth and financial objectives.

Private Placement Infographic

libterm.com

libterm.com