Excess working capital occurs when a company holds more current assets than necessary to meet its short-term obligations and operating expenses, which can lead to inefficient use of resources and lower returns on investment. Proper management of working capital ensures that your business maintains enough liquidity to operate smoothly while avoiding tying up funds in idle assets. Explore the rest of this article to learn how to identify, manage, and optimize your working capital effectively.

Table of Comparison

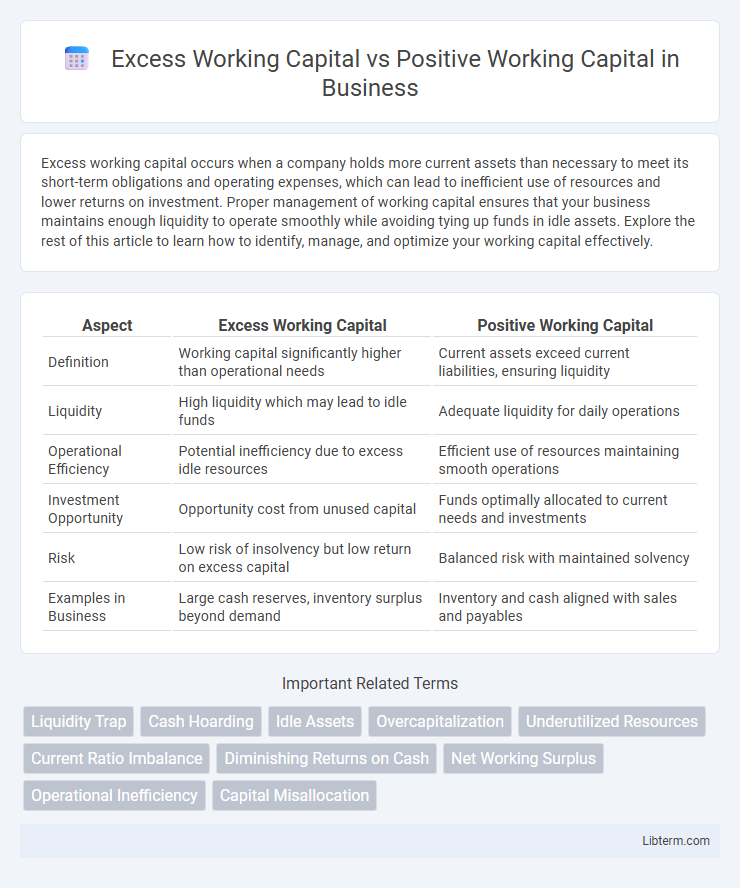

| Aspect | Excess Working Capital | Positive Working Capital |

|---|---|---|

| Definition | Working capital significantly higher than operational needs | Current assets exceed current liabilities, ensuring liquidity |

| Liquidity | High liquidity which may lead to idle funds | Adequate liquidity for daily operations |

| Operational Efficiency | Potential inefficiency due to excess idle resources | Efficient use of resources maintaining smooth operations |

| Investment Opportunity | Opportunity cost from unused capital | Funds optimally allocated to current needs and investments |

| Risk | Low risk of insolvency but low return on excess capital | Balanced risk with maintained solvency |

| Examples in Business | Large cash reserves, inventory surplus beyond demand | Inventory and cash aligned with sales and payables |

Understanding Working Capital: An Overview

Excess working capital occurs when a company holds more short-term assets than necessary to cover its current liabilities, potentially leading to inefficient use of resources. Positive working capital indicates that a company has sufficient assets to meet its short-term obligations, reflecting financial stability and operational efficiency. Understanding the balance between excess and positive working capital is crucial for optimizing liquidity, supporting growth, and minimizing the risk of cash flow problems.

What Is Positive Working Capital?

Positive working capital occurs when a company's current assets exceed its current liabilities, indicating sufficient short-term liquidity to cover operational expenses and debt obligations. This financial state enables businesses to invest in growth opportunities, manage unexpected costs, and maintain smooth day-to-day operations. Conversely, excess working capital may signify inefficient asset use, where surplus funds are not optimally deployed to generate higher returns or fuel expansion efforts.

Defining Excess Working Capital

Excess working capital refers to the surplus current assets exceeding the optimal level needed for day-to-day operations, which can lead to inefficiencies and reduced return on investment. Positive working capital, by contrast, indicates that a company has sufficient current assets to cover its short-term liabilities, ensuring liquidity and operational stability. Managing excess working capital involves balancing cash, receivables, and inventory to avoid tying up funds that could be better deployed for growth or debt reduction.

Key Differences: Excess vs Positive Working Capital

Excess working capital occurs when a company holds more current assets than necessary to cover its short-term liabilities, potentially indicating inefficient use of resources or excessive inventory. Positive working capital means current assets exceed current liabilities, ensuring smooth day-to-day operations and financial stability without tying up surplus funds unnecessarily. The key difference lies in excess working capital representing an overabundance beyond operational needs, whereas positive working capital reflects an optimal balance supporting liquidity and operational efficiency.

Causes of Excess Working Capital

Excess working capital occurs when a company holds significantly more current assets than current liabilities, often caused by overstocked inventory, delayed receivables collection, or excessive cash reserves. Positive working capital indicates a healthy liquidity position, but excess working capital can signal inefficient asset management and poor cash flow optimization. Causes of excess working capital typically include inefficient inventory management, extended payment terms to customers, and conservative cash management policies.

Advantages of Maintaining Positive Working Capital

Maintaining positive working capital ensures a company has sufficient short-term assets to cover its liabilities, enhancing liquidity and operational stability. It enables businesses to meet supplier payments on time, invest in growth opportunities, and absorb financial shocks without requiring additional financing. Positive working capital also strengthens creditworthiness, facilitating better borrowing terms and fostering long-term financial health.

Risks Associated with Excess Working Capital

Excess working capital ties up valuable resources that could otherwise be invested in growth opportunities, leading to inefficient asset utilization and reduced profitability. Holding too much cash or inventory increases risks of obsolescence, higher carrying costs, and lower return on assets. Companies with excessive working capital may also face increased opportunity costs and pressure from shareholders demanding better capital efficiency.

Impact on Business Performance

Excess working capital ties up funds in non-productive assets, reducing liquidity and limiting investment opportunities, which can hinder business growth and operational efficiency. Positive working capital indicates a company's ability to cover short-term liabilities with current assets, enhancing financial stability and enabling smooth day-to-day operations. Maintaining an optimal balance improves cash flow management and supports strategic initiatives, directly influencing profitability and competitive advantage.

Strategies to Optimize Working Capital Levels

Excess working capital ties up funds that could be invested in growth opportunities, while positive working capital ensures smooth operational liquidity without overcapitalization. Strategies to optimize working capital levels include improving inventory turnover through just-in-time management, accelerating accounts receivable collections with efficient credit policies, and negotiating better payment terms with suppliers to extend accounts payable. Implementing cash flow forecasting tools and adopting technology-driven financial analytics also aids in maintaining an optimal balance that supports both operational efficiency and financial flexibility.

Best Practices for Managing Working Capital Efficiently

Excess working capital can indicate inefficient asset utilization, while positive working capital ensures sufficient liquidity to meet short-term obligations. Best practices for managing working capital efficiently include optimizing inventory levels, accelerating receivables through effective credit policies, and extending payables without damaging supplier relationships. Implementing cash flow forecasting and real-time monitoring tools improves decision-making and maintains an optimal balance between liquidity and profitability.

Excess Working Capital Infographic

libterm.com

libterm.com