Tax accounting focuses on preparing financial statements and reports in compliance with tax laws and regulations, ensuring accurate calculation of taxable income. It involves understanding tax codes, deductions, credits, and filing requirements to optimize your tax position and avoid penalties. Discover more about effective tax accounting strategies and how they can benefit your financial planning in the rest of this article.

Table of Comparison

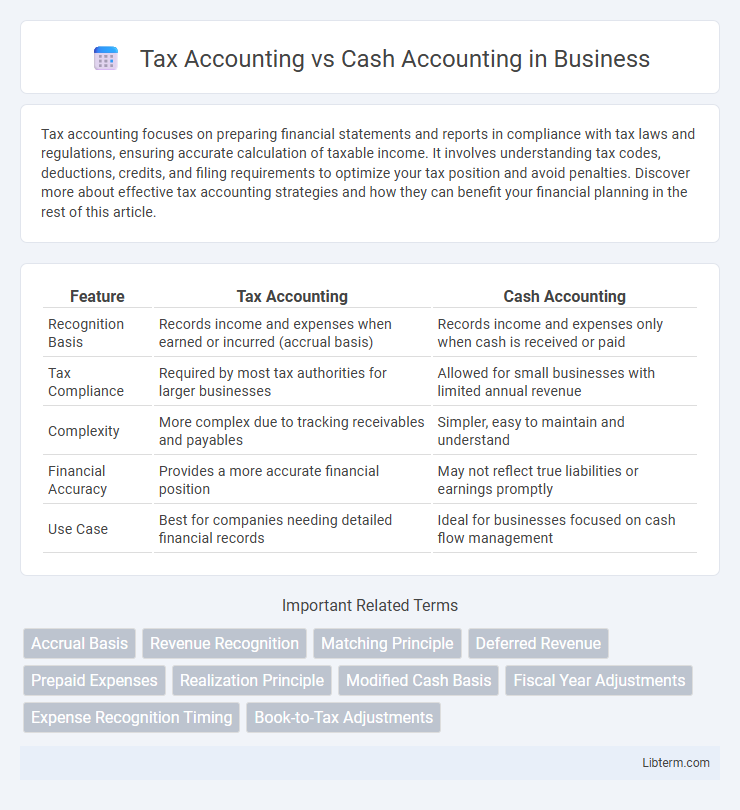

| Feature | Tax Accounting | Cash Accounting |

|---|---|---|

| Recognition Basis | Records income and expenses when earned or incurred (accrual basis) | Records income and expenses only when cash is received or paid |

| Tax Compliance | Required by most tax authorities for larger businesses | Allowed for small businesses with limited annual revenue |

| Complexity | More complex due to tracking receivables and payables | Simpler, easy to maintain and understand |

| Financial Accuracy | Provides a more accurate financial position | May not reflect true liabilities or earnings promptly |

| Use Case | Best for companies needing detailed financial records | Ideal for businesses focused on cash flow management |

Introduction to Tax and Cash Accounting

Tax accounting focuses on reporting income and expenses according to IRS regulations and tax laws, ensuring compliance and minimizing tax liability, while cash accounting records revenues and expenses only when cash transactions occur, providing a straightforward view of cash flow. Businesses using tax accounting must adhere to specific rules regarding income recognition and deductions, often leading to differences in reported profits compared to cash accounting. Cash accounting suits small businesses with simple transactions, whereas tax accounting is essential for larger entities requiring accurate tax reporting and planning.

Defining Tax Accounting

Tax accounting involves recording and reporting financial transactions specifically to comply with tax laws and regulations, focusing on taxable income and allowable deductions. It follows guidelines set by tax authorities, such as the IRS in the United States, ensuring accurate calculation of tax liabilities based on tax codes. Unlike cash accounting, tax accounting may use accrual methods or special rules to align financial reporting with tax compliance requirements.

Understanding Cash Accounting

Cash accounting records transactions only when cash changes hands, providing a straightforward view of income and expenses based on actual cash flow. This method benefits small businesses by simplifying tax preparation and highlighting available funds without tracking receivables or payables. Understanding cash accounting allows better management of short-term cash flow and reduces complexity in tax reporting for businesses with limited inventory or credit transactions.

Key Differences Between Tax and Cash Accounting

Tax accounting follows regulations set by tax authorities to determine taxable income, often incorporating accrual methods and recognizing income and expenses when earned or incurred. Cash accounting recognizes income and expenses only when cash is actually received or paid, providing a straightforward view of cash flow. Key differences include timing of income recognition, treatment of accounts receivable and payable, and compliance requirements, which affect financial reporting and tax liabilities.

Advantages of Tax Accounting

Tax accounting provides a precise framework for complying with IRS regulations and maximizing deductions, which reduces taxable income effectively. It offers a detailed record of income and expenses based on when transactions are legally recognized, aiding in accurate financial reporting and tax planning. Businesses benefit from tax accounting's alignment with tax laws, enabling better forecasting of tax liabilities and improved decision-making.

Benefits of Cash Accounting

Cash accounting offers simplified financial tracking by recording transactions only when cash changes hands, providing a clear and immediate view of cash flow. Small businesses particularly benefit from cash accounting as it helps maintain accurate liquidity management and reduces complexity in bookkeeping. This method also defers tax liabilities by recognizing income and expenses in the period they are actually received or paid, potentially improving tax planning and cash management.

Disadvantages of Tax and Cash Accounting

Tax accounting often faces complexity due to adherence to strict IRS rules and regulations, which can result in increased time and costs for compliance. Cash accounting may lead to misleading financial statements as it recognizes revenue and expenses only when cash is exchanged, ignoring outstanding receivables and payables. Both methods can create challenges in accurately matching income with expenses, impacting business decision-making and financial analysis.

Choosing the Right Accounting Method for Your Business

Choosing the right accounting method for your business hinges on evaluating cash flow patterns, tax obligations, and regulatory compliance. Tax accounting focuses on adhering to IRS rules and maximizing tax benefits, often using accrual or cash methods based on the business structure, while cash accounting records income and expenses only when transactions occur, offering simplicity and real-time financial clarity. Small businesses with straightforward finances often prefer cash accounting for its ease, whereas larger or inventory-heavy businesses may benefit from tax accounting's structured approach to optimize tax reporting and financial accuracy.

Tax Implications of Accounting Methods

Tax accounting and cash accounting differ significantly in their tax implications, as tax accounting follows IRS rules to recognize income and expenses when earned or incurred, while cash accounting records transactions only when cash changes hands. Businesses using tax accounting may face higher taxable income during periods of unpaid invoices, resulting in increased tax liabilities, whereas cash accounting can defer tax payments by recognizing income upon receipt of payment. Understanding these differences is crucial for optimizing tax strategies and ensuring compliance with IRS regulations.

Frequently Asked Questions about Tax and Cash Accounting

Tax accounting focuses on preparing financial records according to tax laws and IRS regulations, ensuring compliance for accurate tax reporting and liability calculation. Cash accounting records revenue and expenses only when cash is actually received or paid, offering a straightforward approach primarily used by small businesses and individuals. Frequently asked questions often address which method minimizes tax liability, how each impacts cash flow, and eligibility criteria for choosing between tax and cash accounting methods.

Tax Accounting Infographic

libterm.com

libterm.com