Investment banking plays a crucial role in helping companies raise capital, manage mergers and acquisitions, and provide strategic financial advisory services. Experts in this field use extensive market knowledge and analytical skills to maximize value for clients while navigating complex regulatory environments. Discover how investment banking can impact Your financial goals by reading the rest of the article.

Table of Comparison

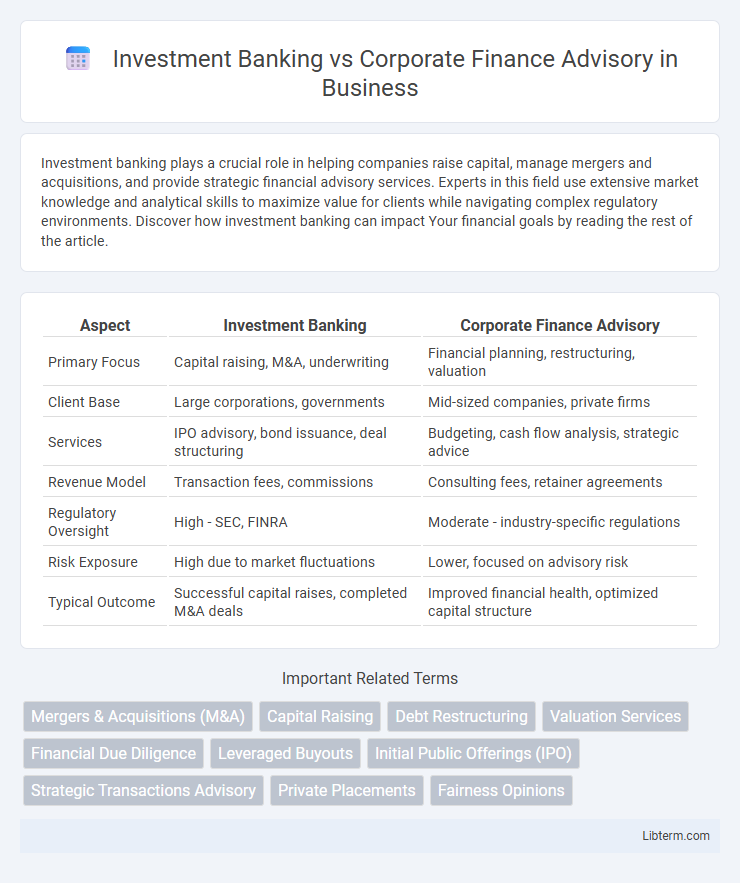

| Aspect | Investment Banking | Corporate Finance Advisory |

|---|---|---|

| Primary Focus | Capital raising, M&A, underwriting | Financial planning, restructuring, valuation |

| Client Base | Large corporations, governments | Mid-sized companies, private firms |

| Services | IPO advisory, bond issuance, deal structuring | Budgeting, cash flow analysis, strategic advice |

| Revenue Model | Transaction fees, commissions | Consulting fees, retainer agreements |

| Regulatory Oversight | High - SEC, FINRA | Moderate - industry-specific regulations |

| Risk Exposure | High due to market fluctuations | Lower, focused on advisory risk |

| Typical Outcome | Successful capital raises, completed M&A deals | Improved financial health, optimized capital structure |

Introduction to Investment Banking and Corporate Finance Advisory

Investment banking primarily focuses on capital raising, mergers and acquisitions, and providing strategic financial advice to corporations, governments, and institutions. Corporate finance advisory centers on optimizing a company's financial structure, managing risks, and guiding strategic decisions like capital allocation and funding strategies. Both fields emphasize financial analysis and transaction expertise but differ in scope, with investment banking targeting external market activities and corporate finance advisory concentrating on internal financial planning and strategy.

Key Definitions and Core Functions

Investment banking involves underwriting, capital raising, mergers and acquisitions, and providing market-making services for clients, focusing on large-scale transactions in public and private markets. Corporate finance advisory centers on advising companies on capital structure optimization, financial planning, budgeting, and strategic investment decisions to enhance shareholder value. Both disciplines require expertise in financial modeling, valuation, and regulatory compliance but differ in scope, with investment banking emphasizing transaction execution and corporate finance advisory prioritizing long-term financial strategy.

Services Provided: A Comparative Overview

Investment banking primarily offers services such as underwriting securities, facilitating mergers and acquisitions, and providing capital raising solutions for corporations. Corporate finance advisory focuses on strategic financial planning, valuation analysis, restructuring advice, and optimizing capital structures to enhance business performance. Both sectors provide critical financial guidance, but investment banking emphasizes market transactions, while corporate finance advisory centers on internal financial strategy and long-term value creation.

Typical Clients and Market Focus

Investment banking primarily serves large corporations, institutional investors, and governments, focusing on capital raising, mergers and acquisitions, and underwriting securities in global markets. Corporate finance advisory targets mid-sized to large companies seeking strategic financial guidance, restructuring, and optimization of capital structures within specific industries or regional markets. Both sectors emphasize delivering tailored financial solutions but differ in client scale and market scope, with investment banking operating on a broader, often international level.

Organizational Structure and Team Dynamics

Investment banking teams typically feature a hierarchical structure with analysts, associates, vice presidents, and managing directors focused on deal execution and client acquisition. Corporate finance advisory groups often operate with a flatter organizational model emphasizing collaborative project teams that integrate cross-functional expertise for strategic planning and financial restructuring. Team dynamics in investment banking prioritize rapid decision-making and high-pressure deal environments, while corporate finance advisory fosters consultative relationships and long-term client partnership development.

Revenue Models and Fee Structures

Investment banking primarily generates revenue through underwriting fees, advisory fees from mergers and acquisitions, and trading commissions, often structured as a percentage of transaction value or fixed retainer fees. Corporate finance advisory firms typically earn fees based on project scope, including hourly rates, fixed fees for specific deliverables, or success-based fees tied to financial restructuring or capital raising outcomes. Both models incorporate performance incentives, but investment banking fees are more transaction-driven, whereas corporate finance advisory emphasizes ongoing consulting and strategic advisory retainers.

Required Skills and Qualifications

Investment banking requires strong financial modeling, valuation, and deal execution skills, with a focus on mergers and acquisitions, capital raising, and underwriting. Corporate finance advisory demands expertise in financial analysis, strategic planning, and risk management to support long-term business growth and capital structuring. Both fields prefer candidates with degrees in finance, economics, or business, alongside proficiency in Excel, PowerPoint, and relevant certifications like CFA or CPA.

Career Pathways and Professional Development

Investment banking offers career pathways emphasizing mergers and acquisitions, capital raising, and market transactions, fostering skills in deal structuring and financial modeling. Corporate finance advisory focuses on strategic financial planning, valuation, and internal decision support, enhancing expertise in budgeting, forecasting, and risk analysis. Both fields provide robust professional development through rigorous client engagement and exposure to complex financial scenarios, with investment banking typically demanding faster-paced, transaction-driven experience, while corporate finance advisory prioritizes long-term strategic insight.

Industry Trends and Future Outlook

Investment banking continues to evolve with increased emphasis on digital transformation, mergers and acquisitions, and cross-border transactions driven by globalization and regulatory shifts. Corporate finance advisory is witnessing growing demand for strategic financial planning, capital raising, and sustainability-focused investments as companies prioritize ESG criteria and long-term value creation. Future outlook indicates integration of AI and data analytics will enhance deal structuring and risk assessment across both sectors, while market volatility necessitates adaptive advisory solutions.

Choosing Between Investment Banking and Corporate Finance Advisory

Choosing between investment banking and corporate finance advisory depends on career goals and skillsets; investment banking involves capital markets, mergers and acquisitions, and high-pressure deal execution, while corporate finance advisory focuses on strategic financial planning, valuation, and long-term corporate growth strategies. Professionals seeking dynamic, transaction-driven environments may prefer investment banking, whereas those interested in consultative roles and client relationship management might lean towards corporate finance advisory. Understanding the differences in work-life balance, compensation structures, and skill applications is crucial for making an informed decision.

Investment Banking Infographic

libterm.com

libterm.com