Brokered agreements involve a third party facilitating negotiations between two or more parties to reach a mutually beneficial deal. This process ensures smoother communication, reduces conflicts, and often results in more favorable terms for all involved. Explore this article to learn how brokered solutions can enhance your negotiation outcomes.

Table of Comparison

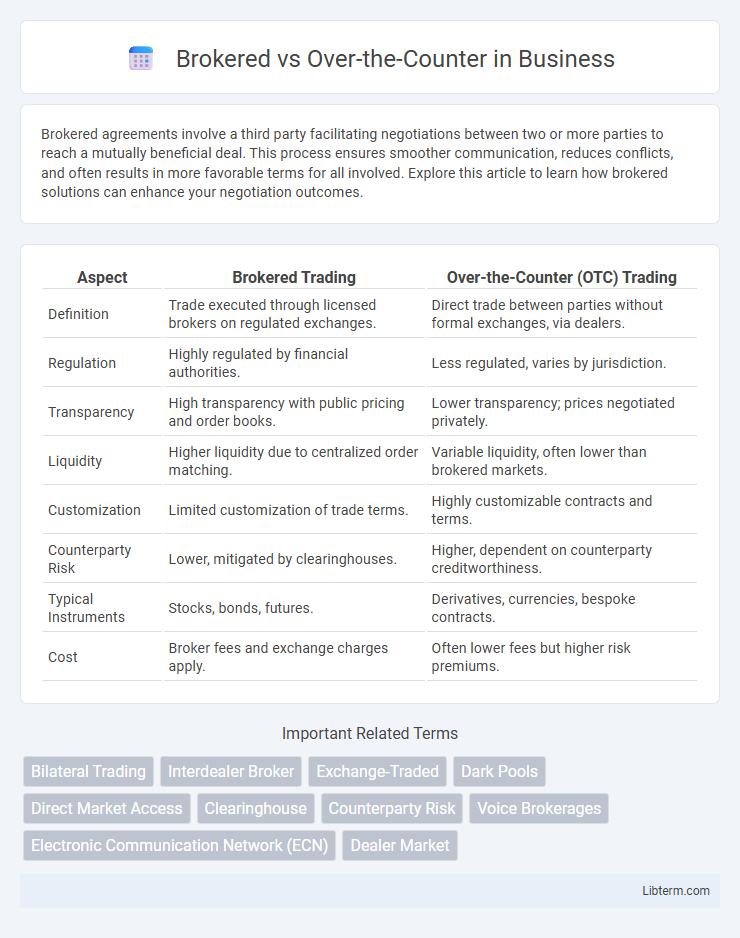

| Aspect | Brokered Trading | Over-the-Counter (OTC) Trading |

|---|---|---|

| Definition | Trade executed through licensed brokers on regulated exchanges. | Direct trade between parties without formal exchanges, via dealers. |

| Regulation | Highly regulated by financial authorities. | Less regulated, varies by jurisdiction. |

| Transparency | High transparency with public pricing and order books. | Lower transparency; prices negotiated privately. |

| Liquidity | Higher liquidity due to centralized order matching. | Variable liquidity, often lower than brokered markets. |

| Customization | Limited customization of trade terms. | Highly customizable contracts and terms. |

| Counterparty Risk | Lower, mitigated by clearinghouses. | Higher, dependent on counterparty creditworthiness. |

| Typical Instruments | Stocks, bonds, futures. | Derivatives, currencies, bespoke contracts. |

| Cost | Broker fees and exchange charges apply. | Often lower fees but higher risk premiums. |

Introduction to Brokered and Over-the-Counter Transactions

Brokered transactions involve intermediaries who facilitate the buying and selling of securities, ensuring liquidity and price discovery in financial markets. Over-the-counter (OTC) transactions occur directly between two parties without a centralized exchange, often involving customized contracts and less regulatory oversight. Both methods play crucial roles in market dynamics, with brokered trades providing structure and OTC deals offering flexibility in asset negotiation.

Defining Brokered Markets

Brokered markets are defined by the involvement of intermediaries who facilitate transactions between buyers and sellers, ensuring liquidity and price discovery. Unlike over-the-counter (OTC) markets where trades occur directly between parties without intermediaries, brokered markets depend on brokers to match orders efficiently. This structure supports transparent pricing and reduces information asymmetry in financial markets such as real estate, securities, and commodities.

What is Over-the-Counter (OTC) Trading?

Over-the-Counter (OTC) trading involves the direct exchange of financial instruments between two parties without the supervision of an exchange. This decentralized market facilitates the trading of stocks, bonds, derivatives, and currencies that are not listed on formal exchanges, often accommodating less liquid or customized products. OTC trading offers flexibility and privacy but may carry higher counterparty risk compared to brokered or exchange-traded transactions.

Key Differences Between Brokered and OTC Systems

Brokered systems involve intermediaries who facilitate trades by matching buyers and sellers, ensuring price transparency and regulatory oversight. Over-the-Counter (OTC) systems operate directly between two parties without intermediaries, often resulting in less transparency but greater flexibility in transaction terms. The key differences lie in the presence of brokers, level of transparency, regulatory frameworks, and the customization of trades.

Advantages of Brokered Transactions

Brokered transactions provide the advantage of access to a wider range of buyers and sellers, enhancing liquidity and price discovery in financial markets. Brokers offer expert negotiation skills and market insights, reducing transaction costs and risks for clients. These services ensure regulatory compliance and transparency, fostering trust and efficiency in complex trade executions.

Benefits of OTC Trading

Over-the-counter (OTC) trading offers greater flexibility compared to brokered trades by enabling direct transactions between parties without centralized exchange constraints. This method provides access to a wider variety of financial instruments, including less liquid securities and customized contracts, which are often unavailable through brokers. OTC trading also typically results in lower transaction costs and faster execution times, benefiting traders with tailored investment strategies.

Risks and Challenges in Brokered vs OTC Markets

Brokered markets face risks such as reduced transparency and higher fees due to intermediary involvement, potentially leading to conflicts of interest and slower transaction times. Over-the-counter (OTC) markets carry challenges including lower regulatory oversight, increased counterparty risk, and price volatility from less standardized contracts. Both market types demand careful risk assessment and due diligence to mitigate issues related to liquidity, pricing accuracy, and settlement reliability.

Regulatory Considerations for Brokered and OTC Trades

Brokered trades are typically subject to stricter regulatory oversight by authorities such as the SEC and FINRA, ensuring compliance with reporting requirements and trade execution standards. Over-the-counter (OTC) trades often involve less transparency and fewer regulatory safeguards, increasing counterparty risk and necessitating careful due diligence. Regulatory frameworks aim to protect market integrity by imposing detailed record-keeping, disclosure mandates, and fair dealing rules on brokered transactions, while OTC markets may operate under lighter regulatory regimes depending on jurisdiction and asset class.

Industry Examples: Brokered vs OTC in Practice

In the financial industry, brokered transactions often occur on regulated exchanges like the New York Stock Exchange, where brokers facilitate trades between buyers and sellers ensuring transparency and compliance. Over-the-Counter (OTC) trades dominate markets such as foreign exchange and derivatives, where deals happen directly between parties without centralized exchange oversight, exemplified by the Forex OTC market. In pharmaceutical distribution, brokered sales involve intermediaries connecting manufacturers and pharmacies, while OTC products refer to medications sold directly to consumers without prescriptions, highlighting distinct operational frameworks.

Choosing the Right Method: Factors to Consider

Selecting between brokered and over-the-counter (OTC) transaction methods hinges on factors such as trade size, market liquidity, and the need for price transparency. Brokered trades often suit substantial orders requiring market expertise and negotiation to minimize price impact. OTC transactions benefit those prioritizing privacy and customized terms, especially in less liquid or highly specialized asset classes.

Brokered Infographic

libterm.com

libterm.com