Right of First Refusal grants you the opportunity to match any offer made by a third party before the property or asset can be sold. This contractual right protects your interests by ensuring you have priority in purchasing, which can be crucial in competitive markets. Explore the rest of the article to understand how this right can benefit your negotiations and investment decisions.

Table of Comparison

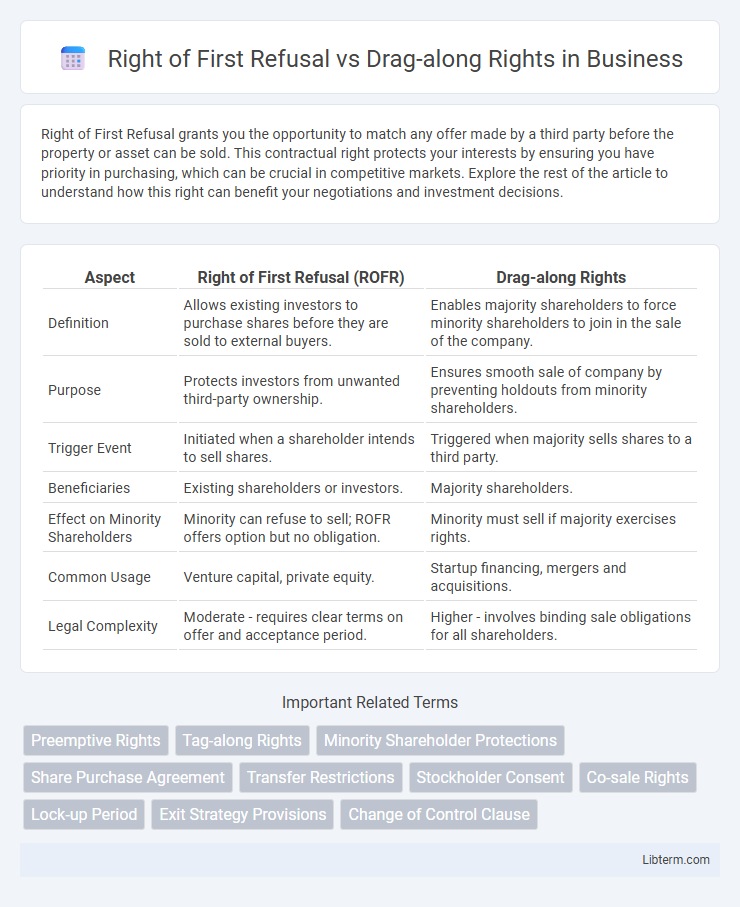

| Aspect | Right of First Refusal (ROFR) | Drag-along Rights |

|---|---|---|

| Definition | Allows existing investors to purchase shares before they are sold to external buyers. | Enables majority shareholders to force minority shareholders to join in the sale of the company. |

| Purpose | Protects investors from unwanted third-party ownership. | Ensures smooth sale of company by preventing holdouts from minority shareholders. |

| Trigger Event | Initiated when a shareholder intends to sell shares. | Triggered when majority sells shares to a third party. |

| Beneficiaries | Existing shareholders or investors. | Majority shareholders. |

| Effect on Minority Shareholders | Minority can refuse to sell; ROFR offers option but no obligation. | Minority must sell if majority exercises rights. |

| Common Usage | Venture capital, private equity. | Startup financing, mergers and acquisitions. |

| Legal Complexity | Moderate - requires clear terms on offer and acceptance period. | Higher - involves binding sale obligations for all shareholders. |

Introduction to Right of First Refusal and Drag-along Rights

The Right of First Refusal (ROFR) grants existing shareholders or investors the opportunity to purchase shares before the owner sells them to a third party, providing a key protective mechanism in equity transactions. Drag-along rights compel minority shareholders to join in the sale of a company if the majority shareholders decide to sell their stakes, ensuring smoother exit strategies and deal executions. Both rights play critical roles in maintaining control dynamics and facilitating investment liquidity within shareholder agreements.

Defining the Right of First Refusal

The Right of First Refusal (ROFR) grants existing shareholders the priority to purchase shares before the seller offers them to outside parties, ensuring control over ownership changes. This right protects shareholders from unwanted dilution and maintains the current ownership structure by allowing them to match any third-party offer. Unlike drag-along rights, which compel minority shareholders to join in a sale, ROFR empowers shareholders with preemptive purchase options over new equity transfers.

Understanding Drag-along Rights

Drag-along rights allow majority shareholders to compel minority shareholders to join in the sale of a company, ensuring a smooth transaction by obligating all shareholders to sell their shares under the same terms. These rights protect majority owners by preventing minority shareholders from blocking or delaying the sale of the business. Understanding drag-along rights is crucial for investors and founders to align exit strategies and minimize disputes during acquisition or merger processes.

Key Differences Between ROFR and Drag-along Rights

Right of First Refusal (ROFR) grants existing shareholders the priority to purchase shares before outsiders, ensuring control over ownership changes and preventing unwanted third-party involvement. Drag-along rights enable majority shareholders to compel minority shareholders to join in the sale of the company, facilitating a unified exit strategy and maximizing sale value. Key differences lie in ROFR providing purchase priority, while drag-along rights enforce collective selling, impacting shareholder autonomy and exit flexibility.

Legal Framework Governing ROFR and Drag-along Clauses

The legal framework governing Right of First Refusal (ROFR) and Drag-along Rights is primarily established through contract law, corporate governance statutes, and specific provisions within shareholder agreements. ROFR clauses grant existing shareholders the option to purchase shares before third parties, ensuring control over ownership changes, while Drag-along Rights enable majority shareholders to compel minority holders to join in the sale of the company under agreed terms. Courts typically interpret these clauses strictly based on the contract language, emphasizing clear definitions of triggering events, notice requirements, and procedural compliance to enforce or invalidate claims.

Advantages of the Right of First Refusal for Shareholders

The Right of First Refusal (ROFR) provides shareholders with a strategic advantage by allowing them to control the transfer of shares and prevent unwanted third-party ownership, thus preserving their equity position and influence in the company. It enhances shareholder protection by offering the opportunity to purchase shares before they are available to external investors, reducing the risk of dilution and maintaining the company's ownership balance. ROFR fosters a more stable shareholder structure, promoting long-term investment security and aligning with shareholder interests.

Benefits of Drag-along Rights for Majority Owners

Drag-along rights empower majority owners to compel minority shareholders to join in the sale of a company, ensuring smoother, more efficient transactions and maximizing sale value by avoiding holdouts. These rights protect majority stakeholders by facilitating full transfer of ownership to strategic buyers, which can attract higher bids and reduce negotiation complexities. The ability to enforce drag-along rights ensures majority owners maintain control over exit strategies, enhancing liquidity and investment returns.

Potential Risks and Drawbacks of Each Agreement

The Right of First Refusal (ROFR) may limit a shareholder's ability to sell shares freely, potentially reducing market liquidity and leading to valuation challenges if the right is exercised at below-market prices. Drag-along rights can compel minority shareholders to sell their stakes under terms approved by the majority, risking forced exit at unfavorable valuations and diminished negotiation power. Both agreements pose risks of conflicted interests and can create obstacles in future financing or exit strategies due to their restrictive mechanisms.

Common Scenarios for Using ROFR vs Drag-along Rights

Right of First Refusal (ROFR) is commonly used in shareholder agreements to give existing shareholders the priority to purchase shares before they are offered to external parties, preventing unwanted third-party ownership. Drag-along rights are typical in venture capital deals, enabling majority shareholders to compel minority shareholders to join in the sale of the company to attract strategic buyers by ensuring full ownership transfer. ROFR is frequently exercised in early-stage companies to maintain control within the founding group, whereas drag-along rights are invoked during exit events to streamline the sale process and maximize transaction value.

Best Practices When Negotiating Shareholder Agreements

Best practices when negotiating shareholder agreements include clearly defining the scope and trigger events for Right of First Refusal (ROFR) to prevent misunderstandings and ensure smooth share transfers within existing shareholders. For Drag-along Rights, specify the conditions under which minority shareholders can be compelled to sell their shares alongside majority shareholders, protecting majority interests during acquisition deals. Detailed, unambiguous drafting combined with alignment of parties' incentives helps balance control and protection, reducing legal disputes and fostering long-term shareholder cooperation.

Right of First Refusal Infographic

libterm.com

libterm.com