A joint venture combines strengths from two or more businesses to pursue a specific project or goal, sharing resources, risks, and rewards. This strategic partnership allows your company to enter new markets, access advanced technologies, and enhance competitive advantage efficiently. Discover how forming a joint venture can unlock growth opportunities by reading the rest of the article.

Table of Comparison

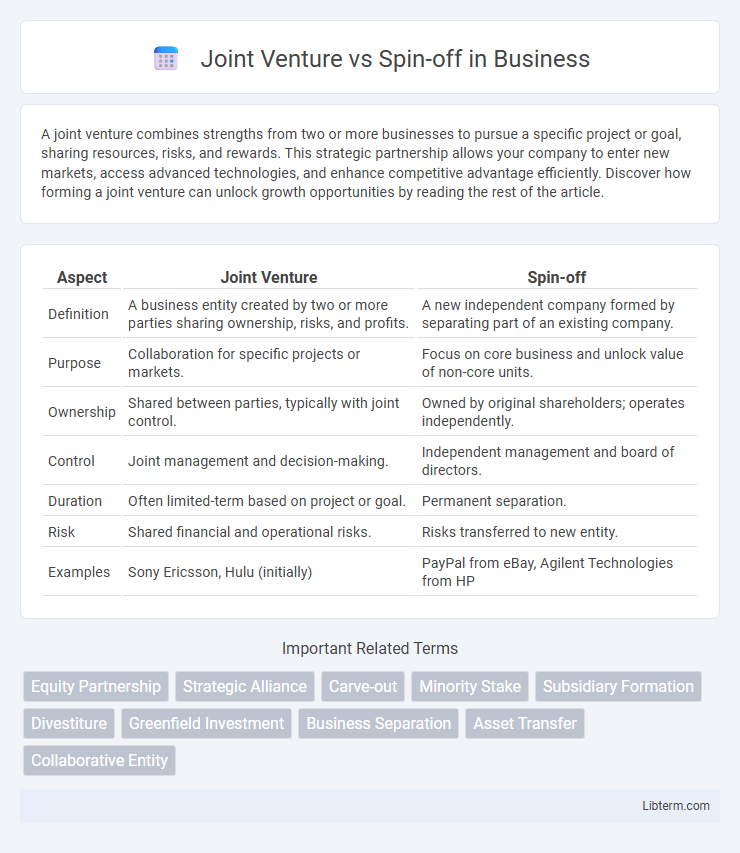

| Aspect | Joint Venture | Spin-off |

|---|---|---|

| Definition | A business entity created by two or more parties sharing ownership, risks, and profits. | A new independent company formed by separating part of an existing company. |

| Purpose | Collaboration for specific projects or markets. | Focus on core business and unlock value of non-core units. |

| Ownership | Shared between parties, typically with joint control. | Owned by original shareholders; operates independently. |

| Control | Joint management and decision-making. | Independent management and board of directors. |

| Duration | Often limited-term based on project or goal. | Permanent separation. |

| Risk | Shared financial and operational risks. | Risks transferred to new entity. |

| Examples | Sony Ericsson, Hulu (initially) | PayPal from eBay, Agilent Technologies from HP |

Introduction to Joint Ventures and Spin-offs

Joint ventures are strategic alliances where two or more companies combine resources to achieve specific business objectives while remaining independent entities. Spin-offs occur when a parent company creates a new, independent company by separating part of its operations or divisions to focus on specialized markets. Both structures aim to enhance growth and innovation but differ in ownership, control, and strategic goals.

Key Definitions: Joint Venture vs Spin-off

A joint venture is a strategic alliance where two or more companies create a new entity to share resources, risks, and profits for a specific business objective. A spin-off occurs when a parent company separates a portion of its operations or assets to form an independent, standalone company, often to enhance focus or unlock shareholder value. Both structures serve different strategic purposes, with joint ventures emphasizing collaboration and spin-offs focusing on organizational restructuring.

Strategic Objectives of Joint Ventures

Joint ventures primarily aim to combine resources and expertise from multiple companies to achieve strategic objectives such as market expansion, risk sharing, and access to new technologies or distribution channels. These partnerships allow firms to leverage complementary strengths while maintaining independent operations and control over their core businesses. Joint ventures often focus on long-term collaboration to enhance competitive advantage and drive innovation in shared markets.

Strategic Objectives of Spin-offs

Spin-offs primarily aim to unlock shareholder value by separating a division or subsidiary into an independent company, allowing focused management and tailored strategic direction. They enhance operational flexibility and enable the parent company to streamline core activities while the new entity pursues growth opportunities with dedicated resources and market positioning. This strategic realignment fosters innovation, attracts targeted investments, and improves competitive agility within distinct market segments.

Legal and Financial Implications

Joint ventures require detailed legal agreements outlining profit sharing, liability, and governance, often involving complex regulatory compliance across jurisdictions. Spin-offs involve creating a new independent entity, transferring assets and liabilities, which may trigger tax consequences and necessitate thorough financial reporting and valuation processes. Both structures impact shareholder equity differently, with joint ventures typically maintaining parent company control, whereas spin-offs provide separate ownership and financial independence.

Advantages of Forming a Joint Venture

Forming a joint venture allows companies to combine resources, expertise, and market access, facilitating rapid entry into new markets and sharing of financial risks. It enhances innovation through collaboration and provides flexibility without full mergers or acquisitions. Companies benefit from pooled strengths while maintaining their independent identities, leading to cost efficiency and improved competitive positioning.

Benefits of Creating a Spin-off

Creating a spin-off allows companies to unlock shareholder value by separating a profitable division into an independent entity, fostering focused management and operational agility. Spin-offs enable better capital allocation and strategic clarity, improving market perception and attracting specialized investors. This structure also promotes innovation and growth by empowering the new entity to pursue tailored business strategies without the constraints of the parent organization.

Potential Risks and Challenges

Joint ventures face potential risks such as cultural clashes, misaligned objectives, and shared liability, which can hinder operational efficiency and decision-making. Spin-offs often encounter challenges including resource constraints, loss of brand recognition, and complexities in establishing independent governance structures. Both entities require careful risk assessment to ensure strategic alignment and mitigate financial and managerial uncertainties.

Case Studies: Successful Examples

Joint ventures such as Sony Ericsson exemplify successful collaboration by combining Sony's electronics expertise with Ericsson's telecommunications technology to dominate the mobile phone market. Spin-offs like PayPal's separation from eBay allowed the company to focus on innovative online payment solutions, leading to significant growth and market leadership. These case studies demonstrate how joint ventures leverage shared resources and spin-offs enable strategic focus to drive business success.

Choosing the Right Strategy for Your Business

Choosing the right strategy between a joint venture and a spin-off depends on your business goals, resource allocation, and market expansion plans. Joint ventures enable collaboration with external partners to share risks and combine expertise while expanding into new markets. Spin-offs concentrate on creating a new independent entity to unlock value, streamline operations, and focus on core competencies without diluting the parent company's control.

Joint Venture Infographic

libterm.com

libterm.com