Enterprise Value (EV) represents the total value of a company, combining market capitalization, debt, and cash equivalents to provide a comprehensive assessment of its worth. Understanding EV is crucial for comparing companies regardless of capital structure, offering a clearer picture for investment and acquisition decisions. Explore the article to learn how Enterprise Value can impact your financial analysis and business strategy.

Table of Comparison

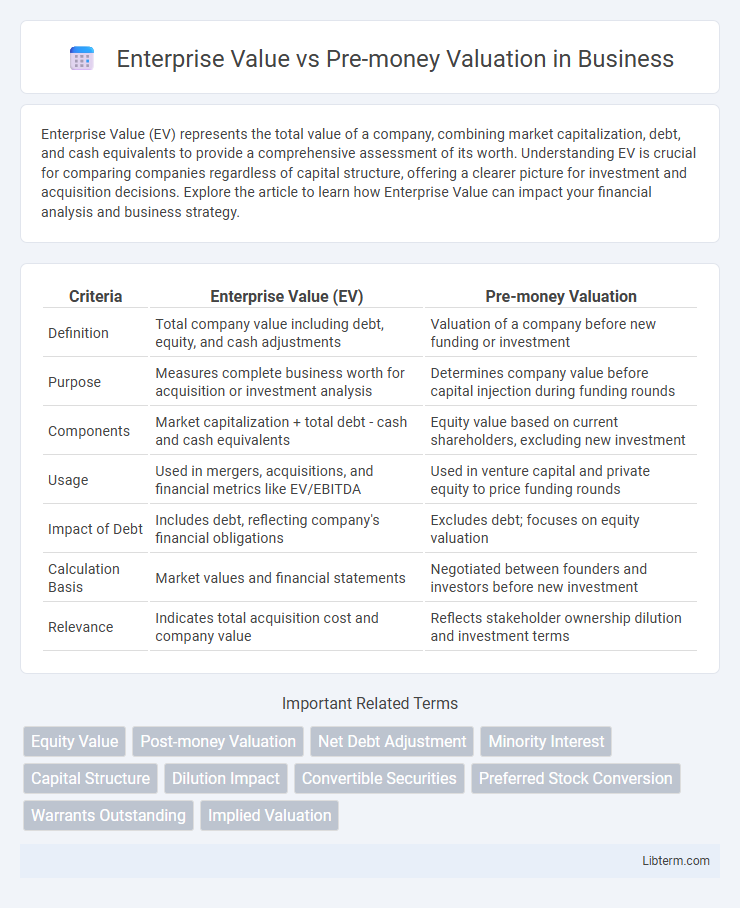

| Criteria | Enterprise Value (EV) | Pre-money Valuation |

|---|---|---|

| Definition | Total company value including debt, equity, and cash adjustments | Valuation of a company before new funding or investment |

| Purpose | Measures complete business worth for acquisition or investment analysis | Determines company value before capital injection during funding rounds |

| Components | Market capitalization + total debt - cash and cash equivalents | Equity value based on current shareholders, excluding new investment |

| Usage | Used in mergers, acquisitions, and financial metrics like EV/EBITDA | Used in venture capital and private equity to price funding rounds |

| Impact of Debt | Includes debt, reflecting company's financial obligations | Excludes debt; focuses on equity valuation |

| Calculation Basis | Market values and financial statements | Negotiated between founders and investors before new investment |

| Relevance | Indicates total acquisition cost and company value | Reflects stakeholder ownership dilution and investment terms |

Introduction to Enterprise Value and Pre-money Valuation

Enterprise Value (EV) represents the total value of a company, including equity, debt, and cash, reflecting the entire cost to acquire the business. Pre-money Valuation refers to a company's estimated value before receiving new external funding or investment, serving as a baseline for equity negotiations. Understanding both metrics is critical for investors and entrepreneurs when assessing company worth and structuring investment deals.

Defining Enterprise Value: Key Components

Enterprise Value (EV) represents a company's total market value, combining market capitalization, total debt, and minority interest while subtracting cash and cash equivalents to reflect true acquisition cost. Key components include equity value (shares outstanding multiplied by share price), net debt (total debt minus cash reserves), and non-controlling interests, providing a comprehensive financial metric beyond just stock market valuation. EV is crucial for investors and analysts to assess a firm's valuation independent of capital structure, enabling accurate comparisons across companies with varied debt levels.

Understanding Pre-money Valuation in Fundraising

Pre-money valuation represents a company's estimated worth before receiving new external funding, serving as a critical benchmark for investors during fundraising rounds. It excludes the value of the incoming capital, allowing both founders and investors to assess ownership dilution and equity stakes accurately. Understanding pre-money valuation is essential for negotiating terms, aligning investor expectations, and ensuring fair equity distribution before the capital injection influences the company's overall enterprise value.

Core Differences Between Enterprise Value and Pre-money Valuation

Enterprise Value (EV) represents a company's total value, including equity, debt, and cash, reflecting the cost to acquire the entire business. Pre-money Valuation refers specifically to the company's equity value before new investment, excluding debt and cash components. The core difference lies in EV encompassing all capital sources, whereas pre-money valuation focuses solely on equity prior to funding.

Calculation Methods for Enterprise Value

Enterprise Value (EV) calculation starts with Market Capitalization, which multiplies the current share price by the total outstanding shares. To this, net debt is added--total debt minus cash and cash equivalents--to reflect the company's true economic value. Preferred equity and minority interest are also included, providing a comprehensive picture of a company's total valuation beyond just equity.

How Pre-money Valuation is Determined

Pre-money valuation is determined by assessing a company's current market value before external funding, considering factors like existing assets, revenue projections, intellectual property, and competitive position. This valuation incorporates analyses such as comparable company valuations, recent funding rounds, and discounted cash flow models to estimate the company's worth. Enterprise value differs as it includes debt, cash, and other financial obligations, representing the total company valuation from an acquisition perspective.

Impact of Debt and Cash on Valuations

Enterprise Value (EV) represents a company's total value, including equity, debt, and cash, providing a comprehensive picture of its worth. Pre-money valuation focuses solely on the equity value before new investment, excluding debt and cash impacts. The presence of significant debt increases Enterprise Value while a large cash balance decreases it, making EV a more complete metric for assessing financial health and acquisition costs compared to pre-money valuation.

Use Cases: When to Apply Each Metric

Enterprise Value is used in mergers and acquisitions to assess the total company worth, including debt and cash, crucial for negotiating buyouts or refinancing. Pre-money Valuation is applied in fundraising rounds to determine company value before new capital infusion, guiding equity distribution among investors. Use Enterprise Value for comprehensive financial analysis, while Pre-money Valuation suits startup funding and investor negotiations.

Implications for Investors and Founders

Enterprise Value (EV) reflects the total value of a company including debt and cash, providing investors a comprehensive view of the firm's worth beyond just equity. Pre-money valuation represents the company's equity value before new investment, critical for founders when negotiating ownership stakes and dilution impacts. Understanding the distinction influences investment decisions by clarifying true cost and potential returns, affecting capital structure strategy and investor confidence.

Choosing the Right Valuation Metric for Your Business

Choosing the right valuation metric depends on your business stage and investment goals; Enterprise Value (EV) offers a comprehensive measure by including debt and cash, reflecting the total company value, while Pre-money Valuation focuses on equity value before new funding rounds. For startups seeking investors, pre-money valuation is crucial as it determines ownership dilution and investment terms, whereas mature companies aiming for acquisitions or capital restructuring rely more on EV to capture overall financial health. Analyzing cash flow, debt structure, and investor expectations helps pinpoint whether EV or pre-money valuation better aligns with your strategic objectives and market position.

Enterprise Value Infographic

libterm.com

libterm.com