Liquidation involves selling a company's assets to pay off creditors when the business ceases operations, often leading to the closure of the company. Understanding the different types of liquidation, such as voluntary or compulsory, is crucial for making informed financial decisions and protecting your interests. Explore the rest of the article to learn how liquidation impacts you and the steps involved in the process.

Table of Comparison

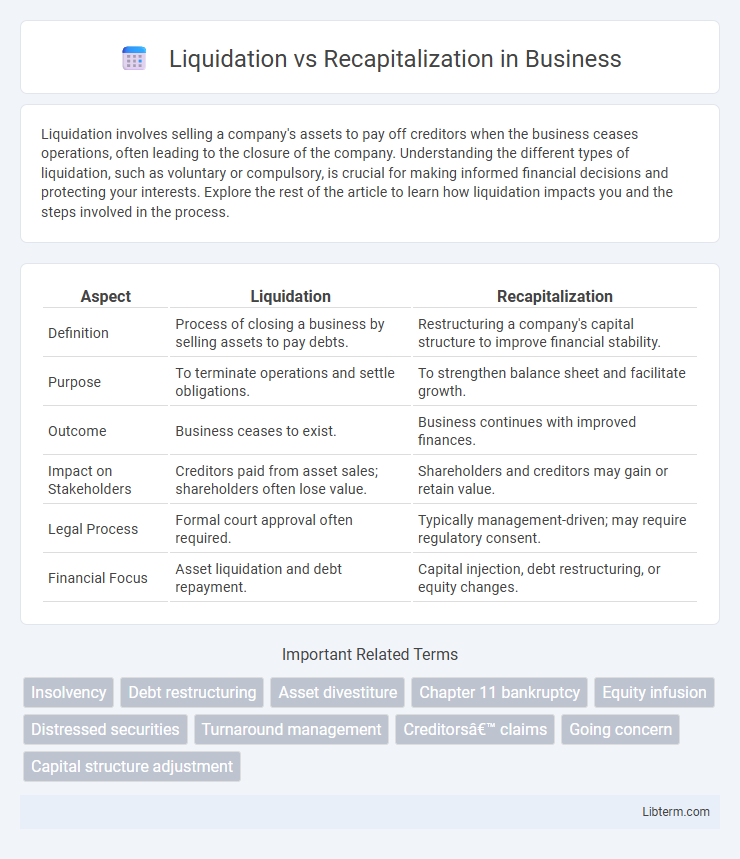

| Aspect | Liquidation | Recapitalization |

|---|---|---|

| Definition | Process of closing a business by selling assets to pay debts. | Restructuring a company's capital structure to improve financial stability. |

| Purpose | To terminate operations and settle obligations. | To strengthen balance sheet and facilitate growth. |

| Outcome | Business ceases to exist. | Business continues with improved finances. |

| Impact on Stakeholders | Creditors paid from asset sales; shareholders often lose value. | Shareholders and creditors may gain or retain value. |

| Legal Process | Formal court approval often required. | Typically management-driven; may require regulatory consent. |

| Financial Focus | Asset liquidation and debt repayment. | Capital injection, debt restructuring, or equity changes. |

Understanding Liquidation: Definition and Key Concepts

Liquidation refers to the process of winding up a company's operations by selling off assets to pay creditors, often resulting in the business ceasing to exist. Key concepts include paying secured creditors first, distributing remaining funds to unsecured creditors and shareholders, and the potential for bankruptcy proceedings if liabilities exceed assets. Understanding liquidation is critical for stakeholders assessing the financial health and exit strategies of distressed companies.

What is Recapitalization? Core Principles Explained

Recapitalization is a financial strategy that restructures a company's capital structure by altering the mix of debt, equity, or hybrid securities to stabilize balance sheets and improve financial health. Core principles include adjusting debt levels to optimize leverage, enhancing liquidity, and aligning capital with strategic growth objectives. This approach contrasts with liquidation, which involves selling assets to pay creditors and typically signals business closure, whereas recapitalization aims to preserve company operations and shareholder value.

Main Reasons for Choosing Liquidation

Companies often choose liquidation due to insolvency, operational unviability, or overwhelming debt burdens that make continued operations unsustainable. Liquidation provides a method to settle creditor claims and distribute remaining assets systematically when recovery or restructuring through recapitalization is impractical. Strategic liquidation also occurs when liquidation value exceeds the estimated value of ongoing business operations or when market conditions render future profitability unlikely.

Advantages and Disadvantages of Recapitalization

Recapitalization offers advantages such as improving a company's capital structure, reducing debt burden, and enhancing financial stability, which can attract new investors and support long-term growth. Disadvantages include potential loss of control for existing shareholders, increased complexity in financial management, and possible signaling of financial distress that may impact market perception. Compared to liquidation, recapitalization allows a business to continue operations and preserve value rather than ceasing activities and selling off assets.

Key Differences Between Liquidation and Recapitalization

Liquidation involves dissolving a company by selling its assets to pay creditors, resulting in the business ceasing operations and distributing remaining funds to shareholders. Recapitalization restructures a company's debt and equity mix to improve financial stability without ending its operations, often by issuing new securities or altering the capital structure. The key differences lie in liquidation ending the company versus recapitalization aiming to preserve and strengthen it financially.

Financial Implications for Stakeholders

Liquidation involves selling a company's assets to pay off creditors, often resulting in significant losses for shareholders due to the dissolution of equity value. Recapitalization restructures a company's debt and equity mix to improve financial stability, potentially preserving shareholder value and providing creditors with improved repayment prospects. Stakeholders must consider the trade-offs between immediate asset recovery in liquidation and longer-term value creation through recapitalization.

Legal and Regulatory Considerations

Liquidation involves the formal legal process of dissolving a company, requiring strict adherence to insolvency laws, creditor rights, and court oversight to ensure equitable asset distribution. Recapitalization demands compliance with securities regulations and corporate governance standards, as it often entails issuing new equity or debt instruments to restructure the company's capital base. Both processes necessitate thorough due diligence and filings with regulatory bodies, such as the SEC or equivalent authorities, to meet transparency and investor protection requirements.

Impact on Employees and Management

Liquidation often results in immediate job losses and the termination of management positions as the company ceases operations and sells its assets. Recapitalization aims to stabilize the business by restructuring its capital, which can preserve jobs and retain key management while improving financial health. Employee morale and leadership continuity are generally better maintained during recapitalization compared to the uncertainty and displacement caused by liquidation.

Industry Examples: Liquidation vs Recapitalization in Practice

In the retail sector, iconic brands like Toys "R" Us opted for liquidation due to overwhelming debt and declining sales, leading to store closures and asset sales. Conversely, General Motors underwent a successful recapitalization during the 2009 financial crisis, restructuring its debt and securing government funding to stabilize operations and return to profitability. These examples illustrate how liquidation results in business dissolution, while recapitalization aims to preserve company value through financial restructuring.

How to Decide: Factors Influencing the Optimal Strategy

Choosing between liquidation and recapitalization depends on factors such as the company's current financial health, future growth potential, and creditor obligations. Businesses facing insurmountable debts and declining market demand may find liquidation the optimal strategy to maximize asset value for creditors. Conversely, companies with viable operations and access to new capital markets often benefit from recapitalization to restructure debt and fund growth initiatives.

Liquidation Infographic

libterm.com

libterm.com