A finance lease allows businesses to use assets while spreading the cost over time, combining elements of ownership and rental agreements. This arrangement helps manage cash flow effectively without the immediate need for large capital outlays. Explore the rest of the article to understand how a finance lease can benefit your financial strategy.

Table of Comparison

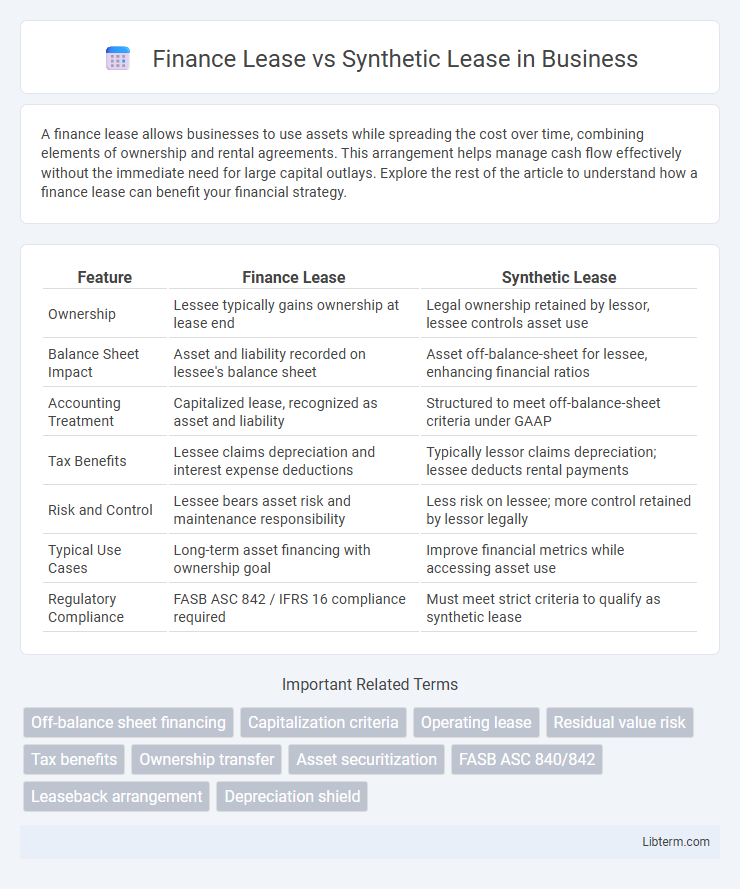

| Feature | Finance Lease | Synthetic Lease |

|---|---|---|

| Ownership | Lessee typically gains ownership at lease end | Legal ownership retained by lessor, lessee controls asset use |

| Balance Sheet Impact | Asset and liability recorded on lessee's balance sheet | Asset off-balance-sheet for lessee, enhancing financial ratios |

| Accounting Treatment | Capitalized lease, recognized as asset and liability | Structured to meet off-balance-sheet criteria under GAAP |

| Tax Benefits | Lessee claims depreciation and interest expense deductions | Typically lessor claims depreciation; lessee deducts rental payments |

| Risk and Control | Lessee bears asset risk and maintenance responsibility | Less risk on lessee; more control retained by lessor legally |

| Typical Use Cases | Long-term asset financing with ownership goal | Improve financial metrics while accessing asset use |

| Regulatory Compliance | FASB ASC 842 / IFRS 16 compliance required | Must meet strict criteria to qualify as synthetic lease |

Understanding Finance Lease: Key Concepts

Finance leases, also known as capital leases, involve the lessee acquiring substantial ownership risks and rewards of the asset, reflected as both an asset and liability on the balance sheet. Key concepts include the lease term covering the majority of the asset's useful life, an option to purchase the asset at a bargain price, and lease payments equating to the asset's fair value. This type of lease provides tax benefits through depreciation and interest expense deductions, impacting financial statements significantly.

Defining Synthetic Lease: An Overview

A synthetic lease is a financing structure that allows a company to retain operational control of an asset while classifying it as an off-balance-sheet item for accounting purposes. Unlike a traditional finance lease, which records the asset and liability on the lessee's balance sheet, a synthetic lease is typically established through a special purpose entity (SPE) to achieve favorable reporting and tax treatment. This hybrid arrangement combines the benefits of ownership and leasing, providing flexibility in asset management and financial statement presentation.

Key Differences Between Finance Lease and Synthetic Lease

Finance leases involve the lessee recognizing both the leased asset and liability on their balance sheet, reflecting ownership-like risks and rewards, whereas synthetic leases enable off-balance-sheet financing by structuring the lease as an operating lease for accounting purposes while retaining tax benefits of ownership. Finance leases typically have fixed lease terms matching the asset's economic life, whereas synthetic leases offer more flexible terms tailored to meet specific tax and financial reporting objectives. The key difference lies in reporting treatment: finance leases increase reported assets and liabilities, impacting debt ratios, while synthetic leases keep liabilities off the balance sheet, improving financial metrics but requiring compliance with stricter tax regulations.

Accounting Treatment: Finance Lease vs Synthetic Lease

Finance leases are recorded on the balance sheet, recognizing both an asset and a corresponding liability, with depreciation and interest expense reflected in the income statement. Synthetic leases, while structured to appear off-balance sheet for accounting purposes, typically require disclosure of lease obligations in the notes, delaying asset recognition but maintaining economic substance. The accounting treatment of finance leases aligns with IFRS 16 and ASC 842 standards, whereas synthetic leases often leverage SPEs (Special Purpose Entities) to achieve off-balance-sheet financing under specific regulatory criteria.

Balance Sheet Impact: Financial Reporting Comparison

A finance lease results in both the asset and corresponding liability being recorded on the balance sheet, increasing total assets and liabilities, which affects financial ratios such as debt-to-equity and return on assets. In contrast, a synthetic lease allows the lessee to keep the leased asset and related liability off the balance sheet by structuring the arrangement as an operating lease for financial reporting purposes, improving key financial metrics. Companies often use synthetic leases to achieve off-balance-sheet financing benefits while maintaining control of the asset.

Tax Implications of Finance and Synthetic Leases

Finance leases are treated as asset ownership for tax purposes, allowing lessees to claim depreciation and interest deductions, which can reduce taxable income significantly. Synthetic leases provide off-balance-sheet financing by structuring as operating leases for accounting while being treated as owned assets for tax purposes, enabling lessees to benefit from tax deductions like depreciation without reflecting the lease as a liability on financial statements. The choice between finance and synthetic leases impacts tax strategies, with finance leases offering straightforward tax benefits, whereas synthetic leases require careful compliance with IRS rules to maintain tax advantages and off-balance-sheet treatment.

Risk and Ownership Considerations

Finance leases transfer significant ownership risks and rewards to the lessee, including asset depreciation and obsolescence, reflecting on the lessee's balance sheet and creditworthiness. Synthetic leases structure off-balance-sheet financing, maintaining legal ownership with the lessor while the lessee assumes operational control and associated risks, thereby minimizing financial statement impact. The key difference lies in risk allocation: finance leases embed asset ownership risks with the lessee, whereas synthetic leases distribute risks to preserve lessee financial ratios and off-balance-sheet treatment.

Suitable Scenarios for Finance Lease

Finance leases are ideal for companies seeking long-term asset ownership with predictable cash flow and full balance sheet recognition. This leasing option suits businesses aiming to acquire high-value equipment or real estate while leveraging tax benefits such as depreciation and interest deductions. Firms with strong credit profiles looking to improve financial ratios without off-balance-sheet exposure typically prefer finance leases.

When to Choose a Synthetic Lease

Choose a synthetic lease when a company seeks off-balance-sheet financing to maintain favorable financial ratios and improve debt capacity while still controlling the leased asset. This structure is ideal for businesses aiming to leverage tax benefits of ownership without reflecting the lease liability on their balance sheet under GAAP. Companies with strong credit profiles and a need for flexible asset management often favor synthetic leases over traditional finance leases to optimize financial reporting and operational control.

Finance Lease vs Synthetic Lease: Pros and Cons

Finance leases provide lessees with ownership benefits, including asset depreciation and predictable payments, but they increase balance sheet liabilities and reduce financial flexibility. Synthetic leases offer off-balance-sheet financing, preserving company credit metrics and providing tax advantages, yet they carry complex accounting requirements and potential risk if lease terms don't align with regulatory standards. Choosing between finance leases and synthetic leases depends on the business's need for asset control versus financial reporting strategies and risk tolerance.

Finance Lease Infographic

libterm.com

libterm.com