Venture capital fuels innovation by providing startups with crucial funding and strategic guidance to accelerate growth and market expansion. This investment approach focuses on high-potential companies in technology, healthcare, and other emerging industries, often taking equity stakes to drive long-term success. Explore the rest of the article to understand how venture capital can impact your business journey and investment opportunities.

Table of Comparison

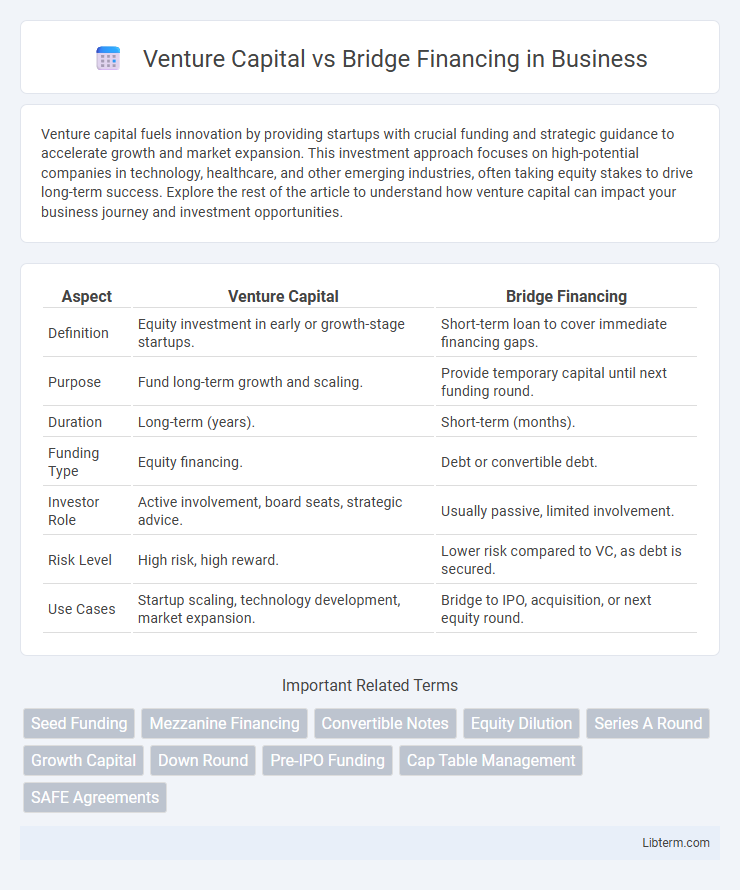

| Aspect | Venture Capital | Bridge Financing |

|---|---|---|

| Definition | Equity investment in early or growth-stage startups. | Short-term loan to cover immediate financing gaps. |

| Purpose | Fund long-term growth and scaling. | Provide temporary capital until next funding round. |

| Duration | Long-term (years). | Short-term (months). |

| Funding Type | Equity financing. | Debt or convertible debt. |

| Investor Role | Active involvement, board seats, strategic advice. | Usually passive, limited involvement. |

| Risk Level | High risk, high reward. | Lower risk compared to VC, as debt is secured. |

| Use Cases | Startup scaling, technology development, market expansion. | Bridge to IPO, acquisition, or next equity round. |

Understanding Venture Capital and Bridge Financing

Venture capital involves investing significant equity in startups or early-stage companies with high growth potential, providing not just funds but also mentorship and strategic support. Bridge financing is a short-term loan or equity infusion designed to cover temporary capital needs, ensuring companies maintain operations while awaiting a larger funding round or liquidity event. Understanding these distinct financing methods helps entrepreneurs strategically manage cash flow and growth milestones.

Key Differences Between Venture Capital and Bridge Financing

Venture capital involves long-term equity investment aimed at fueling startup growth and scaling operations, often including active investor involvement and strategic guidance. Bridge financing is a short-term loan or funding solution designed to provide temporary liquidity until a company secures permanent financing or reaches the next funding milestone. The key difference lies in venture capital providing equity with growth expectations, whereas bridge financing offers debt or convertible notes as a stopgap measure without relinquishing ownership stakes.

When to Choose Venture Capital

Choose venture capital when your startup requires substantial funding to scale rapidly and enter competitive markets, especially during early or growth stages. Venture capital offers not only capital infusion but also strategic support, industry connections, and credibility essential for high-growth potential companies. Opt for venture capital if you aim to fuel innovation, expand operations, or accelerate product development with investors expecting equity stakes and long-term returns.

When Bridge Financing Makes Sense

Bridge financing makes sense when startups need temporary capital to cover operational expenses or reach a milestone before a larger equity round. This short-term loan helps maintain business continuity without immediate dilution, especially ideal for companies nearing a significant funding event or acquisition. Venture capital typically follows bridge financing, providing substantial growth capital once key objectives are achieved.

Typical Terms and Conditions

Venture capital typically involves equity investment with terms including preferred shares, anti-dilution protections, voting rights, and board representation to align investor and company interests. Bridge financing often takes the form of short-term debt or convertible notes, featuring higher interest rates, maturity dates within 6 to 12 months, and conversion options triggered by subsequent financing rounds. Both instruments require detailed term sheets outlining valuation caps, liquidation preferences, and covenants to mitigate risk and incentivize growth.

Stages of Funding: VC vs Bridge Loans

Venture capital typically occurs during early to late stages of a startup's growth, providing substantial equity funding aimed at scaling operations and market expansion. Bridge financing serves as a short-term funding solution, usually positioned between funding rounds or before a major liquidity event, helping to cover immediate expenses and maintain runway without diluting ownership significantly. While venture capital investments involve rigorous valuation and due diligence processes, bridge loans offer faster access to capital with higher interest rates or convertible debt features.

Pros and Cons of Venture Capital

Venture capital offers significant advantages such as large capital infusion, expertise from seasoned investors, and access to extensive networks that can accelerate startup growth. However, it often involves relinquishing substantial equity and control, with intense pressure for rapid scaling and exit strategies. The high expectations and rigorous due diligence process can also be challenging for early-stage companies seeking flexibility.

Pros and Cons of Bridge Financing

Bridge financing offers a quick infusion of capital to cover short-term needs before a larger funding round, enabling companies to maintain operations and meet milestones without diluting equity immediately. However, it often comes with higher interest rates and the risk of repayment demands if the anticipated funding round does not materialize, potentially straining the startup's financial health. Despite its flexibility and speed, bridge financing may increase financial uncertainty and pressure compared to long-term venture capital investments.

Impact on Company Ownership and Control

Venture capital typically involves exchanging equity for funding, which dilutes existing ownership and shifts some control to investors through board seats or voting rights. Bridge financing, often structured as short-term debt or convertible notes, temporarily preserves ownership but can convert to equity under certain conditions, potentially diluting control later. Founders should carefully evaluate these impacts on ownership percentages and decision-making authority when choosing between venture capital and bridge financing.

How to Decide: Venture Capital or Bridge Financing?

Choosing between venture capital and bridge financing depends on a startup's growth stage and immediate capital needs. Venture capital suits companies seeking significant funds for expansion and long-term support from experienced investors, while bridge financing works best as a short-term solution to cover operational costs before a larger funding round. Evaluating cash flow requirements, investor expectations, and dilution impact helps determine the optimal financing strategy.

Venture Capital Infographic

libterm.com

libterm.com