Syndicate expenses encompass the costs incurred during the management and operation of a group investment or insurance syndicate, including administrative fees, legal costs, and claims handling expenses. Understanding these expenses helps you evaluate the syndicate's financial efficiency and impact on returns. Explore the detailed breakdown of syndicate expenses and how they affect your investment outcomes in the following article.

Table of Comparison

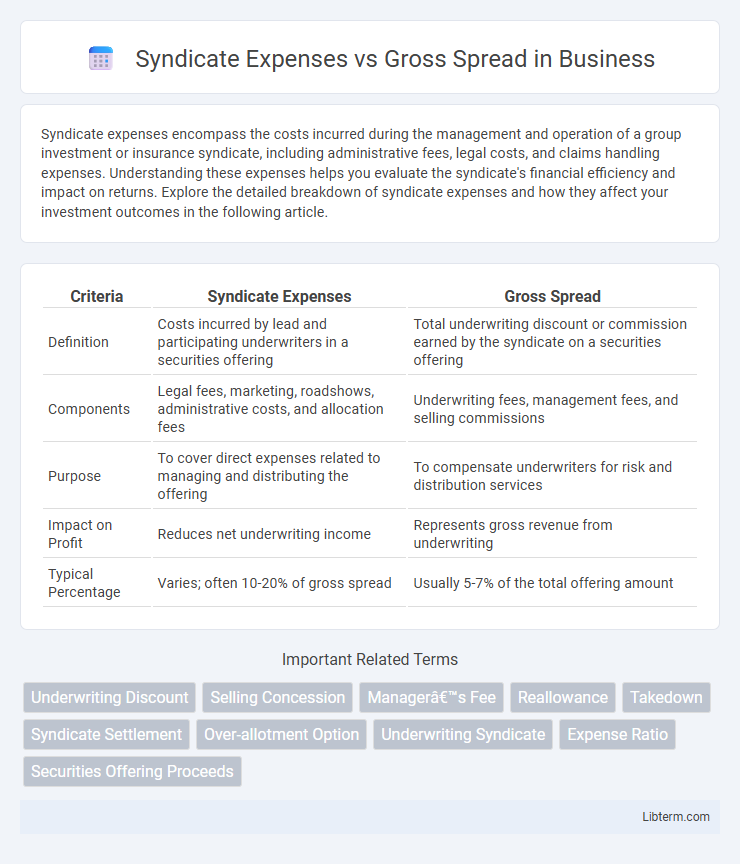

| Criteria | Syndicate Expenses | Gross Spread |

|---|---|---|

| Definition | Costs incurred by lead and participating underwriters in a securities offering | Total underwriting discount or commission earned by the syndicate on a securities offering |

| Components | Legal fees, marketing, roadshows, administrative costs, and allocation fees | Underwriting fees, management fees, and selling commissions |

| Purpose | To cover direct expenses related to managing and distributing the offering | To compensate underwriters for risk and distribution services |

| Impact on Profit | Reduces net underwriting income | Represents gross revenue from underwriting |

| Typical Percentage | Varies; often 10-20% of gross spread | Usually 5-7% of the total offering amount |

Understanding Syndicate Expenses

Syndicate expenses refer to the costs incurred by underwriters during the distribution of a new securities offering, including legal fees, marketing, and administrative expenses, which directly impact the net proceeds to the issuer. These expenses are deducted from the gross spread, the difference between the underwriters' purchase price and the public offering price, representing the total compensation for underwriting services. Understanding syndicate expenses is crucial for issuers to accurately assess the net capital raised and investors to evaluate the true cost structure of the offering.

What Is Gross Spread?

Gross spread refers to the total underwriting fees and expenses that underwriters receive from an issuance of securities, typically expressed as a percentage of the gross proceeds. It includes syndicate expenses such as selling concessions, underwriting fees, and management fees, covering costs related to marketing and distributing the securities. Understanding gross spread is crucial for issuers and investors as it directly impacts the net proceeds from the offering and the overall cost of capital.

Key Differences Between Syndicate Expenses and Gross Spread

Syndicate expenses consist of the costs incurred by underwriters for marketing and distributing a new securities issue, including legal fees, printing, and administrative charges, whereas gross spread refers to the difference between the public offering price and the price paid by underwriters to the issuer, representing the underwriters' total compensation. Key differences lie in the nature of gross spread as the revenue margin for underwriters, while syndicate expenses are out-of-pocket costs deducted before calculating net proceeds to the issuer. Understanding this distinction is crucial for analyzing underwriting profitability and the actual financial impact on the issuer.

Components of Syndicate Expenses

Syndicate expenses primarily include management fees, underwriter counsel fees, account fees, and miscellaneous expenses such as marketing and printing costs, all deducted from the gross spread. These expenses are integral components that reduce the underwriters' net proceeds from the gross spread, which itself is the difference between the offering price and the price paid to the issuer. Understanding the breakdown and allocation of these syndicate expenses is crucial for assessing the effective cost structure in syndicated underwriting transactions.

How Gross Spread Is Calculated

Gross spread is calculated as the percentage difference between the amount a company raises in an offering and the total proceeds received by the underwriters after fees and expenses. This spread represents the underwriting syndicate's compensation, typically including management fees, underwriting fees, and selling concessions. Syndicate expenses, which cover marketing, legal, printing, and other transaction costs, are deducted from the gross spread to determine the net proceeds for the underwriters.

Impact on Issuer’s Net Proceeds

Syndicate expenses and gross spread directly reduce the issuer's net proceeds from a securities offering, with the gross spread typically comprising the largest portion paid to underwriters. Higher syndicate expenses, including underwriting fees, legal costs, and marketing fees, decrease the capital available to the issuer, impacting financing efficiency. Careful management of these costs is essential for optimizing net proceeds and maximizing issuer value in public offerings.

Industry Standards for Syndicate Expenses

Syndicate expenses typically range from 10% to 20% of the gross spread in underwriting transactions, reflecting industry standards that balance cost recovery with competitive pricing. These expenses cover due diligence, legal fees, and marketing costs borne by syndicate members during initial public offerings or bond issuances. Maintaining syndicate expenses within this range ensures efficient allocation of underwriting costs while preserving profitability for participating banks.

Factors Influencing Gross Spread

Gross spread is primarily influenced by the size and complexity of the offering, where larger or riskier deals typically command higher spreads to compensate underwriters for increased underwriting risk and marketing efforts. Syndicate expenses, including legal fees, printing costs, and distribution expenses, are deducted from the gross spread, affecting net proceeds to the issuer. Market conditions, investor demand, and competitive factors within underwriting syndicates also play critical roles in determining the final gross spread percentage.

Transparency and Disclosure Requirements

Syndicate expenses represent the costs underwriters incur during a securities offering, while the gross spread is the total underwriting discount deducted from the public offering price. Transparency in syndicate expenses requires clear disclosure to investors to ensure they understand the allocation of fees within the gross spread. Regulatory bodies mandate detailed reporting of these expenses to promote accountability and prevent hidden underwriting costs.

Best Practices for Managing Offering Costs

Effective management of syndicate expenses and gross spread is crucial for optimizing offering costs in capital markets. Firms should conduct thorough due diligence to benchmark typical gross spreads by deal type and market conditions, ensuring syndicate fees and allocations align with best practices and regulatory standards. Leveraging transparent fee structures and periodic expense audits can minimize unnecessary costs while maintaining syndicate motivation and investor confidence.

Syndicate Expenses Infographic

libterm.com

libterm.com