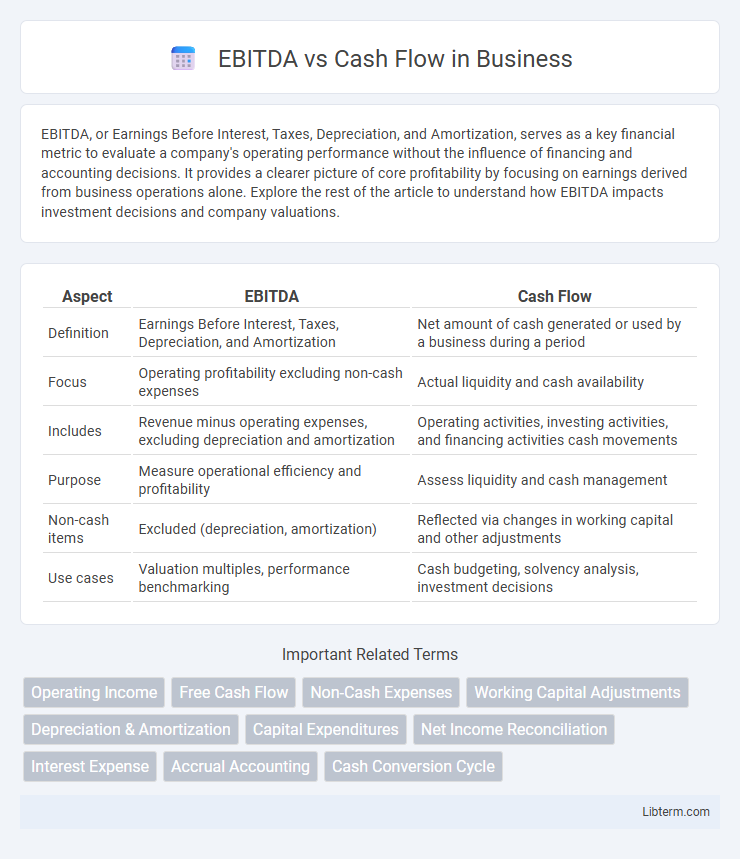

EBITDA, or Earnings Before Interest, Taxes, Depreciation, and Amortization, serves as a key financial metric to evaluate a company's operating performance without the influence of financing and accounting decisions. It provides a clearer picture of core profitability by focusing on earnings derived from business operations alone. Explore the rest of the article to understand how EBITDA impacts investment decisions and company valuations.

Table of Comparison

| Aspect | EBITDA | Cash Flow |

|---|---|---|

| Definition | Earnings Before Interest, Taxes, Depreciation, and Amortization | Net amount of cash generated or used by a business during a period |

| Focus | Operating profitability excluding non-cash expenses | Actual liquidity and cash availability |

| Includes | Revenue minus operating expenses, excluding depreciation and amortization | Operating activities, investing activities, and financing activities cash movements |

| Purpose | Measure operational efficiency and profitability | Assess liquidity and cash management |

| Non-cash items | Excluded (depreciation, amortization) | Reflected via changes in working capital and other adjustments |

| Use cases | Valuation multiples, performance benchmarking | Cash budgeting, solvency analysis, investment decisions |

Introduction to EBITDA and Cash Flow

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) measures a company's operational profitability by excluding non-operational expenses. Cash flow represents the actual inflow and outflow of cash, reflecting a company's liquidity and ability to cover immediate expenses. Understanding both EBITDA and cash flow is crucial for assessing financial health and operational efficiency.

Defining EBITDA: Key Components

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) measures a company's operational profitability by excluding non-operational expenses like interest and tax, as well as non-cash charges such as depreciation and amortization. It highlights core business performance before accounting for financing and accounting decisions, providing insight into cash earnings derived from operations. Understanding EBITDA components helps investors evaluate company efficiency and compare firms with different capital structures.

Understanding Cash Flow: Core Elements

Cash flow represents the actual liquidity generated and used by a business, highlighting operational efficiency through cash inflows and outflows from core activities, investing, and financing. Key components include operating cash flow, which measures cash generated from day-to-day operations, investing cash flow reflecting purchases and sales of assets, and financing cash flow capturing debt and equity transactions. Understanding these core elements provides a clearer picture of a company's financial health beyond accounting metrics like EBITDA, which excludes capital expenditures and working capital changes.

Major Differences Between EBITDA and Cash Flow

EBITDA measures a company's operating performance by excluding interest, taxes, depreciation, and amortization, providing insight into core profitability. Cash flow accounts for actual cash inflows and outflows, reflecting liquidity available for operations, investments, and financing activities. The major differences lie in EBITDA's non-cash expenses exclusion versus cash flow's inclusion of working capital changes and capital expenditures, impacting financial analysis and decision-making.

Importance in Financial Analysis

EBITDA provides insight into a company's operating profitability by excluding non-cash expenses, making it essential for comparing operational efficiency across industries. Cash flow reflects the actual liquidity position by capturing all cash inflows and outflows, which is critical for assessing a company's ability to meet short-term obligations and invest in growth. Analyzing both EBITDA and cash flow together offers a comprehensive view of financial health, balancing profitability with real cash availability.

Common Misconceptions Explained

EBITDA often gets mistaken for cash flow because both measure financial performance, but EBITDA excludes changes in working capital, capital expenditures, and debt servicing costs, which are accounted for in cash flow. A common misconception is that EBITDA reflects actual liquidity, yet it omits crucial cash inflows and outflows that impact a company's ability to meet financial obligations. Understanding these differences clarifies that cash flow provides a more accurate picture of operational cash generation and financial health than EBITDA alone.

When to Use EBITDA vs Cash Flow

Use EBITDA to evaluate a company's operational profitability by excluding non-cash expenses like depreciation and amortization, making it ideal for comparing performance across firms and industries. Cash flow is essential for assessing liquidity, showing the actual amount of cash generated or used during a period, which reflects the company's ability to meet short-term obligations and capital expenditures. Investors and analysts rely on EBITDA for earnings analysis while prioritizing cash flow for understanding financial health and sustainability.

Real-World Examples and Case Studies

EBITDA and cash flow often diverge in real-world scenarios, as seen in companies like Tesla, where high EBITDA contrasts with volatile cash flow due to capital expenditures and working capital changes. Case studies from Amazon reveal robust EBITDA growth while free cash flow fluctuates with investments in infrastructure and inventory. These examples highlight the importance of analyzing both metrics to assess operational performance and financial health accurately.

Pros and Cons of EBITDA and Cash Flow

EBITDA highlights a company's operating profitability by excluding non-cash expenses and capital structure effects, offering a clear view of core business performance but potentially overstating cash availability due to ignoring working capital changes and capital expenditures. Cash flow provides a comprehensive measure of actual liquidity by capturing inflows and outflows from operations, investing, and financing activities, making it crucial for assessing a company's ability to meet obligations, though it can be more volatile and influenced by one-time cash events. Investors should weigh EBITDA's comparability and focus on operational efficiency against cash flow's accuracy in reflecting financial health and sustainability.

Conclusion: Choosing the Right Metric

Selecting between EBITDA and cash flow hinges on the specific financial insight required: EBITDA emphasizes operational profitability by excluding non-cash expenses and financing costs, making it ideal for comparing companies within the same industry. Cash flow delivers a comprehensive view of actual liquidity by accounting for working capital changes, capital expenditures, and financing activities, essential for understanding a company's ability to meet short-term obligations. Investors and analysts must align metric choice with their evaluation goals, balancing operational performance against true cash availability.

EBITDA Infographic

libterm.com

libterm.com