Liquidation value represents the estimated amount a company could realize if its assets were sold off quickly, often at a price lower than market value due to the urgent nature of the sale. This metric is crucial for investors and creditors to assess potential recovery during financial distress or bankruptcy proceedings. Discover how understanding liquidation value can impact your financial decisions by exploring the rest of the article.

Table of Comparison

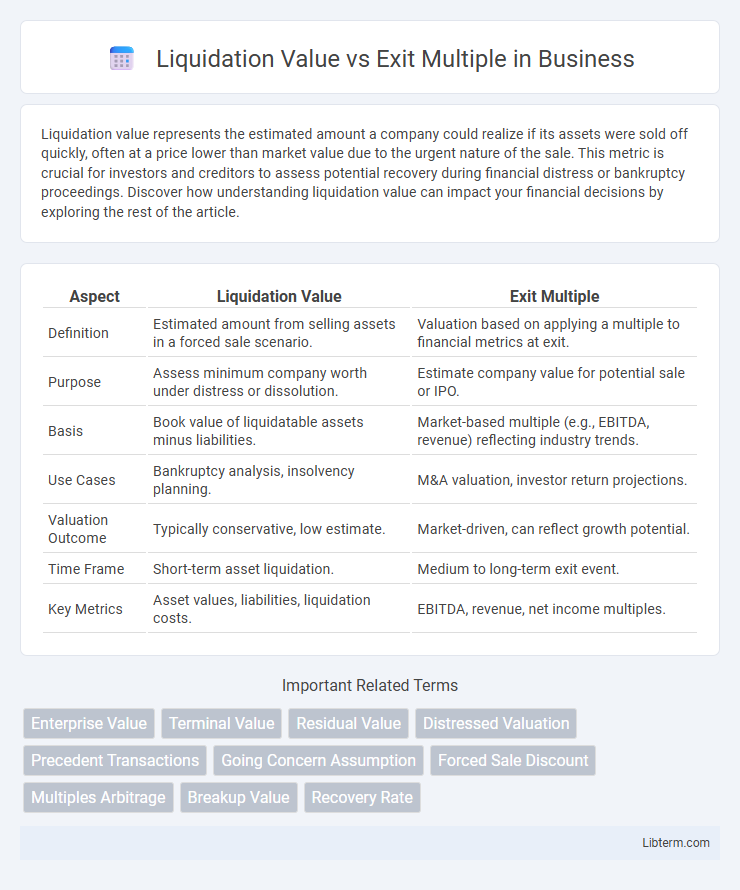

| Aspect | Liquidation Value | Exit Multiple |

|---|---|---|

| Definition | Estimated amount from selling assets in a forced sale scenario. | Valuation based on applying a multiple to financial metrics at exit. |

| Purpose | Assess minimum company worth under distress or dissolution. | Estimate company value for potential sale or IPO. |

| Basis | Book value of liquidatable assets minus liabilities. | Market-based multiple (e.g., EBITDA, revenue) reflecting industry trends. |

| Use Cases | Bankruptcy analysis, insolvency planning. | M&A valuation, investor return projections. |

| Valuation Outcome | Typically conservative, low estimate. | Market-driven, can reflect growth potential. |

| Time Frame | Short-term asset liquidation. | Medium to long-term exit event. |

| Key Metrics | Asset values, liabilities, liquidation costs. | EBITDA, revenue, net income multiples. |

Introduction to Liquidation Value and Exit Multiple

Liquidation value represents the estimated amount a company's assets would generate if sold off quickly during a forced sale or bankruptcy, reflecting a conservative valuation approach. Exit multiple, commonly used in private equity and venture capital, calculates a company's value based on a projected earnings metric such as EBITDA multiplied by an industry-standard multiple, representing potential resale or exit price. Understanding liquidation value provides a floor valuation, while exit multiples offer market-based growth projections, crucial for investment and financial decision-making.

Definition of Liquidation Value

Liquidation value is the estimated amount a company can realize if its assets are sold off quickly, typically during bankruptcy or forced sale scenarios, reflecting net recoverable value after settling liabilities. Unlike exit multiple valuation, which projects business worth based on earnings multiples and future growth assumptions, liquidation value focuses purely on tangible asset recoveries without considering operational profitability. This valuation metric is crucial for risk assessment and creditor decision-making during insolvency or distressed asset disposition.

Understanding Exit Multiple

Exit multiple is a key valuation metric used in private equity and mergers and acquisitions to estimate a business's value based on a projected financial metric, such as EBITDA. It reflects the expected selling price as a multiple of earnings, providing insight into market expectations for similar companies in the same industry. Understanding exit multiple helps investors gauge potential returns and assess risks by comparing anticipated sale values against liquidation value, which represents the net asset value if the business is sold off piecemeal.

Key Differences Between Liquidation Value and Exit Multiple

Liquidation value represents the net amount a company can realize if its assets are sold off in a forced sale, reflecting a pessimistic valuation based on distressed asset disposition. Exit multiple, typically derived from comparable company analysis, estimates a business's value by applying a multiple to financial metrics like EBITDA, assuming a going-concern and market-driven sale. The key difference lies in liquidation value's focus on immediate asset conversion under distress, whereas the exit multiple reflects anticipated market value under normal operational conditions.

Importance in Business Valuation

Liquidation value provides a conservative estimate reflecting the net cash achievable if assets are sold quickly, crucial for assessing downside risk in business valuation. Exit multiple valuation estimates a company's worth based on expected future earnings or revenue multiples, offering insight into market-driven growth potential. Comparing these valuation methods helps investors and stakeholders balance risk and reward, ensuring more informed decision-making in financing, acquisition, and strategic planning.

When to Use Liquidation Value

Liquidation value is ideal for assessing the worth of distressed companies or assets expected to be sold quickly under unfavorable conditions. It provides a conservative estimate based on the net cash realizable from asset sales, crucial during bankruptcy or liquidation scenarios. Exit multiple valuation suits growth-stage companies anticipating a strategic sale or IPO, emphasizing future earnings rather than immediate asset liquidation.

When to Apply Exit Multiple

Exit multiple valuation is most effective when estimating a business's future sale price based on comparable market transactions, making it ideal during growth phases or for established companies with predictable earnings. It utilizes industry-specific multiples, such as EV/EBITDA or P/E ratios, to project enterprise value, reflecting potential investor returns upon exit. This method is preferred over liquidation value when assessing going-concern businesses intended to continue operations rather than undergoing asset liquidation.

Factors Influencing Liquidation Value and Exit Multiple

Factors influencing liquidation value include the condition and marketability of assets, the urgency of sale, and current market demand, which often result in a lower valuation due to forced asset disposal. Exit multiple depends heavily on industry growth prospects, comparable company valuations, and anticipated profitability, reflecting the expected future earnings potential. Market volatility and economic conditions also play critical roles in determining both liquidation value and exit multiple.

Impact on Investment Decisions

Liquidation value provides a conservative estimate by calculating the net cash if assets were sold in a distress scenario, influencing investors to assess downside risk and prioritize capital preservation. Exit multiple estimates future firm value based on comparable company transactions or earnings multiples, guiding investors to forecast potential returns and shape growth expectations. The choice between liquidation value and exit multiple significantly impacts investment decisions by balancing risk tolerance with growth projections and exit strategy planning.

Conclusion: Choosing the Right Valuation Approach

Choosing the right valuation approach depends on the company's financial condition and business context; liquidation value suits distressed or asset-heavy companies while exit multiples suit growing, profitable firms with predictable cash flows. Exit multiples capture market sentiment and future growth potential, whereas liquidation value reflects the minimum recoverable amount under forced sale conditions. A balanced valuation often involves comparing both approaches to ensure realistic and contextually relevant investment decisions.

Liquidation Value Infographic

libterm.com

libterm.com