Severance pay provides financial support to employees after job termination, helping ease the transition period. It often depends on factors like length of service, company policy, and employment contracts. Discover more about how severance pay can protect your financial future and what you need to know by reading the full article.

Table of Comparison

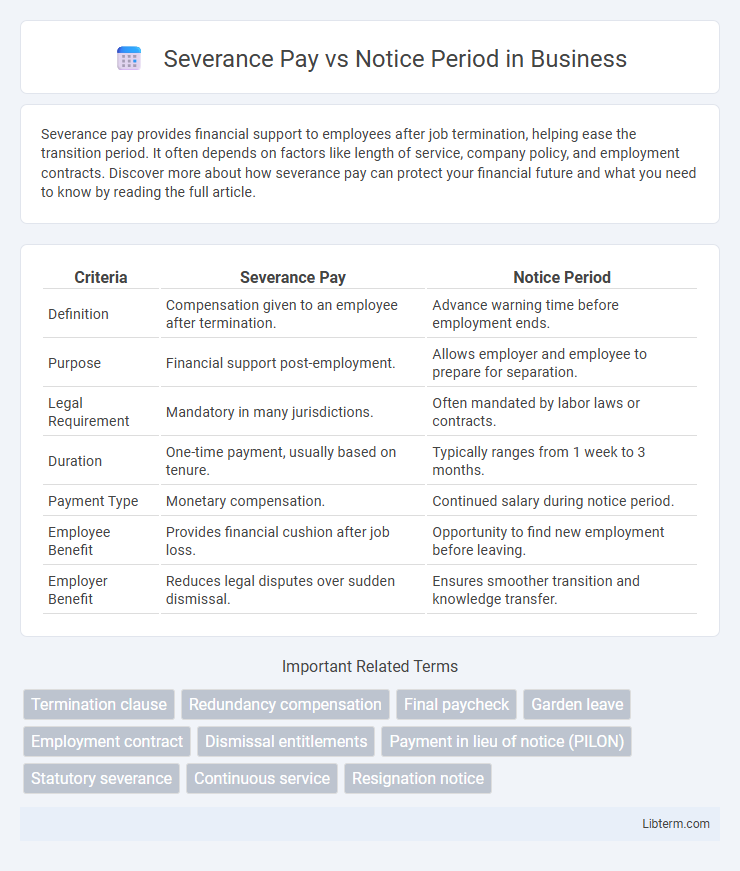

| Criteria | Severance Pay | Notice Period |

|---|---|---|

| Definition | Compensation given to an employee after termination. | Advance warning time before employment ends. |

| Purpose | Financial support post-employment. | Allows employer and employee to prepare for separation. |

| Legal Requirement | Mandatory in many jurisdictions. | Often mandated by labor laws or contracts. |

| Duration | One-time payment, usually based on tenure. | Typically ranges from 1 week to 3 months. |

| Payment Type | Monetary compensation. | Continued salary during notice period. |

| Employee Benefit | Provides financial cushion after job loss. | Opportunity to find new employment before leaving. |

| Employer Benefit | Reduces legal disputes over sudden dismissal. | Ensures smoother transition and knowledge transfer. |

Understanding Severance Pay: Definition and Purpose

Severance pay is a contractual or statutory compensation provided to employees upon termination of their employment, intended to offer financial support during the transition period after job loss. It differs from the notice period, which is the advance warning given before termination, allowing employees time to prepare for departure or secure new employment. Understanding severance pay involves recognizing its role in mitigating the economic impact of involuntary separation and its legal basis in labor laws or company policies.

What is a Notice Period? Key Concepts

A notice period is the designated time frame an employee must work after submitting resignation or receiving termination notice, allowing both parties to prepare for the transition. It balances legal obligations and operational continuity, typically ranging from one week to several months depending on employment contracts and local labor laws. Notice periods ensure employees receive fair warning while enabling employers to manage workload adjustments and recruitment processes efficiently.

Legal Differences Between Severance Pay and Notice Period

Severance pay is a legally mandated financial compensation given to employees upon termination without cause, ensuring income security after job loss, while the notice period is a legally required timeframe an employer must provide before ending the employment contract. Severance pay amounts often depend on factors such as tenure, salary, and local labor laws, whereas the notice period varies according to contract terms and jurisdiction-specific regulations. Employers must comply with both legal provisions separately, as severance pay compensates for immediate job loss, and the notice period allows employees time to transition or seek alternative employment.

Eligibility Criteria for Severance Pay

Severance pay eligibility primarily depends on the duration of employment, with most jurisdictions requiring a minimum tenure, often one year, before qualifying. Employees terminated without cause or due to layoffs are typically entitled to severance pay, contrasting with notice period obligations that apply to both voluntary and involuntary terminations. Specific eligibility criteria may also include factors such as employment contracts, collective bargaining agreements, and local labor laws governing severance provisions.

Requirements and Rules of Notice Period

The notice period is a mandatory duration an employee or employer must provide before termination, as regulated by labor laws or employment contracts, typically ranging from one week to several months depending on tenure and jurisdiction. Employers are required to notify employees explicitly in writing, adhering to statutory timelines to avoid legal disputes and ensure compliance with local regulations. Failure to respect notice period rules can result in penalties or compensation obligations, often making severance pay an alternative remedy if immediate termination occurs.

Calculation Methods: Severance Pay vs. Notice Period

Severance pay calculation typically depends on factors like length of service, employee's wage, and company policy, often equating to a specific number of weeks' or months' salary per year worked. Notice period pay is usually calculated based on the employee's regular salary and benefits during the mandated notice duration, which varies according to employment contracts or labor laws. Understanding these distinct methods helps employers comply with legal obligations and ensures fair compensation during employment termination.

Employee Rights During Severance and Notice Periods

Employee rights during severance and notice periods include entitlement to compensation, job security, and access to benefits as stipulated by labor laws and employment contracts. Severance pay is typically granted when employment is terminated without cause, ensuring financial support based on tenure and salary, while notice periods require employers to inform employees in advance or provide pay in lieu of notice. Understanding these rights helps employees secure fair treatment and legal protection during workforce transitions.

Employer Obligations: Severance Pay vs. Notice Period

Employer obligations differ significantly between severance pay and notice period, impacting financial and legal responsibilities. Severance pay is a lump sum compensation required by law or contract to support employees after termination without cause, calculated based on tenure and salary. Employers must provide notice periods or pay in lieu, ensuring employees have time to secure new employment while complying with employment standards regulations.

Severance Pay and Notice Period in Different Jurisdictions

Severance pay and notice period regulations vary significantly across jurisdictions, reflecting diverse labor laws and employment standards worldwide. In the United States, severance pay is typically negotiable and not mandated by federal law, whereas European countries like Germany and France have statutory severance entitlements based on tenure and reason for termination. Notice period requirements also differ, with countries such as Canada and the UK imposing minimum notice durations correlating to employee service length, ensuring predictable transitions for workers facing job separation.

Choosing the Right Exit Strategy: Severance Pay or Notice Period

Choosing the right exit strategy between severance pay and notice period depends on legal requirements, company policies, and employee preferences. Severance pay provides immediate financial compensation upon termination, ideal for employees seeking quick financial support, while notice periods allow continued work with advance warning, offering time to secure new employment. Evaluating costs, employee morale, and operational impact helps determine whether severance pay or a notice period aligns best with business goals and workforce stability.

Severance Pay Infographic

libterm.com

libterm.com