Solvency II establishes a comprehensive regulatory framework for insurance firms, ensuring they maintain adequate capital to meet their risks and protect policyholders. It enhances risk management through stringent reporting and transparency requirements, promoting financial stability within the insurance sector. Discover how Solvency II impacts your insurance operations and what you need to know by reading the rest of the article.

Table of Comparison

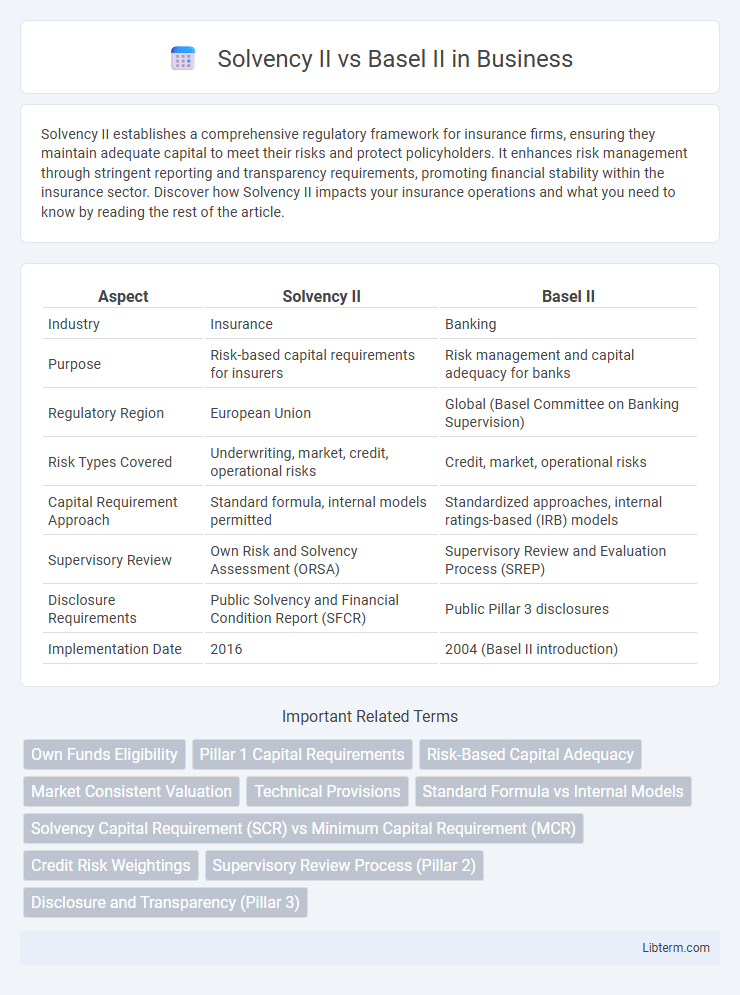

| Aspect | Solvency II | Basel II |

|---|---|---|

| Industry | Insurance | Banking |

| Purpose | Risk-based capital requirements for insurers | Risk management and capital adequacy for banks |

| Regulatory Region | European Union | Global (Basel Committee on Banking Supervision) |

| Risk Types Covered | Underwriting, market, credit, operational risks | Credit, market, operational risks |

| Capital Requirement Approach | Standard formula, internal models permitted | Standardized approaches, internal ratings-based (IRB) models |

| Supervisory Review | Own Risk and Solvency Assessment (ORSA) | Supervisory Review and Evaluation Process (SREP) |

| Disclosure Requirements | Public Solvency and Financial Condition Report (SFCR) | Public Pillar 3 disclosures |

| Implementation Date | 2016 | 2004 (Basel II introduction) |

Overview of Solvency II and Basel II

Solvency II is a comprehensive regulatory framework designed for the insurance industry, emphasizing risk-based capital requirements, governance, and transparency to ensure insurer solvency and policyholder protection. Basel II, targeting the banking sector, focuses on credit risk, operational risk, and market risk with its three pillars: minimum capital requirements, supervisory review, and market discipline. Both frameworks aim to enhance financial stability but address distinct risk profiles and regulatory needs of insurers versus banks.

Key Objectives and Regulatory Focus

Solvency II aims to ensure insurance companies maintain sufficient capital to cover underwriting, market, and credit risks, emphasizing policyholder protection and long-term financial stability. Basel II focuses on banking institutions, targeting credit risk, operational risk, and market risk to promote capital adequacy and reduce systemic risk. Both frameworks use risk-sensitive approaches but differ in regulatory scope, with Solvency II tailored for insurers and Basel II for banks.

Scope of Application: Insurance vs. Banking

Solvency II applies specifically to insurance and reinsurance companies within the European Union, setting risk-based capital requirements to ensure policyholder protection. Basel II targets banking institutions globally, focusing on credit, market, and operational risks to maintain financial stability and protect depositors. The distinct sectoral focus of Solvency II on insurance contrasts with Basel II's emphasis on banking risks and regulatory capital adequacy.

Pillar Structures: Similarities and Differences

Solvency II and Basel II frameworks both feature a three-pillar structure designed to enhance financial stability through risk management, regulatory capital requirements, and supervisory review processes. Pillar 1 in Solvency II emphasizes market-consistent valuation of insurance liabilities and capital adequacy, whereas Basel II's Pillar 1 focuses on credit, market, and operational risk for banking capital calculation. Pillar 2 in both regimes mandates internal risk assessment and supervisory review, but Solvency II places greater emphasis on the Own Risk and Solvency Assessment (ORSA), while Basel II targets bank-specific risk management practices; Pillar 3 in both frameworks promotes transparency through public disclosure, although the scope and specific reporting requirements differ between insurance and banking sectors.

Capital Adequacy Requirements

Solvency II sets a risk-based capital adequacy framework for insurance companies, emphasizing insurance-specific risks such as underwriting, market, credit, and operational risks, whereas Basel II focuses on banks with capital requirements aligned to credit risk, market risk, and operational risk within the banking sector. The Solvency Capital Requirement (SCR) under Solvency II uses a 99.5% Value-at-Risk (VaR) over one year to ensure insurers hold enough capital to withstand extreme losses. Basel II's capital adequacy framework calculates minimum capital ratios based on risk-weighted assets, typically requiring banks to maintain a minimum Tier 1 capital ratio of 4%.

Risk Assessment and Measurement Approaches

Solvency II primarily emphasizes a three-pillar framework focusing on quantitative risk measurement, including market, credit, and operational risks, using a risk-based capital requirement that reflects the insurer's own risk profile. Basel II, targeting banks, employs the Internal Ratings-Based (IRB) approach and standardized methods to evaluate credit risk, operational risk, and market risk, using capital adequacy ratios to ensure financial stability. Both frameworks integrate stress testing and scenario analysis but differ in calibration, with Solvency II tailored to the insurance sector's long-term liabilities and Basel II oriented toward banking activities and short-term credit risk exposures.

Supervisory Review and Reporting Standards

Solvency II and Basel II establish rigorous supervisory review processes to ensure risk assessment accuracy, with Solvency II emphasizing insurance companies' capital adequacy through the Own Risk and Solvency Assessment (ORSA). Basel II focuses on banks' internal risk management and capital requirements, requiring regular supervisory evaluations under the Pillar 2 framework. Reporting standards under Solvency II mandate detailed quantitative and qualitative disclosures in Solvency and Financial Condition Reports (SFCR), while Basel II requires comprehensive risk and capital adequacy reporting through regulatory filings such as the Basel Core Principles Reports.

Impact on Financial Institutions

Solvency II imposes rigorous capital requirements and risk management standards tailored specifically for insurance companies, enhancing their ability to absorb shocks and protect policyholders. Basel II focuses on banks, emphasizing credit risk, operational risk, and market risk, thereby influencing capital adequacy and risk-sensitive lending practices. The divergent regulatory frameworks result in financial institutions adjusting their capital strategies, risk assessments, and reporting processes to comply and maintain stability within their respective sectors.

Implementation Challenges and Solutions

Solvency II and Basel II pose distinct implementation challenges due to their regulatory scope, with Solvency II focusing on insurance risk management and Basel II on banking credit and market risks. Key hurdles include data collection complexity, risk modeling differences, and compliance costs, particularly as Solvency II requires actuarial expertise for sophisticated capital requirement calculations, while Basel II demands advanced credit risk assessment frameworks. Solutions involve investing in integrated data management systems, enhancing cross-disciplinary collaboration between actuarial and risk management teams, and adopting phased implementation strategies supported by regulatory guidance to mitigate compliance burdens.

Future Regulatory Developments and Trends

Future regulatory developments in Solvency II emphasize enhanced risk sensitivity and integration of sustainability factors, aligning with evolving European Insurance and Occupational Pensions Authority (EIOPA) guidelines. Basel II reforms target improved capital adequacy and liquidity coverage in banking, driven by the Basel Committee on Banking Supervision's emphasis on operational risk and stress testing frameworks. Both frameworks are increasingly incorporating digital risk management and climate-related financial disclosures to address emerging systemic risks.

Solvency II Infographic

libterm.com

libterm.com