Equity stake represents your ownership interest in a company, typically measured by the percentage of shares you hold. It directly influences your voting rights and entitlement to dividends, tying your financial growth to the company's success. Discover how understanding equity stakes can empower your investment decisions by reading the rest of this article.

Table of Comparison

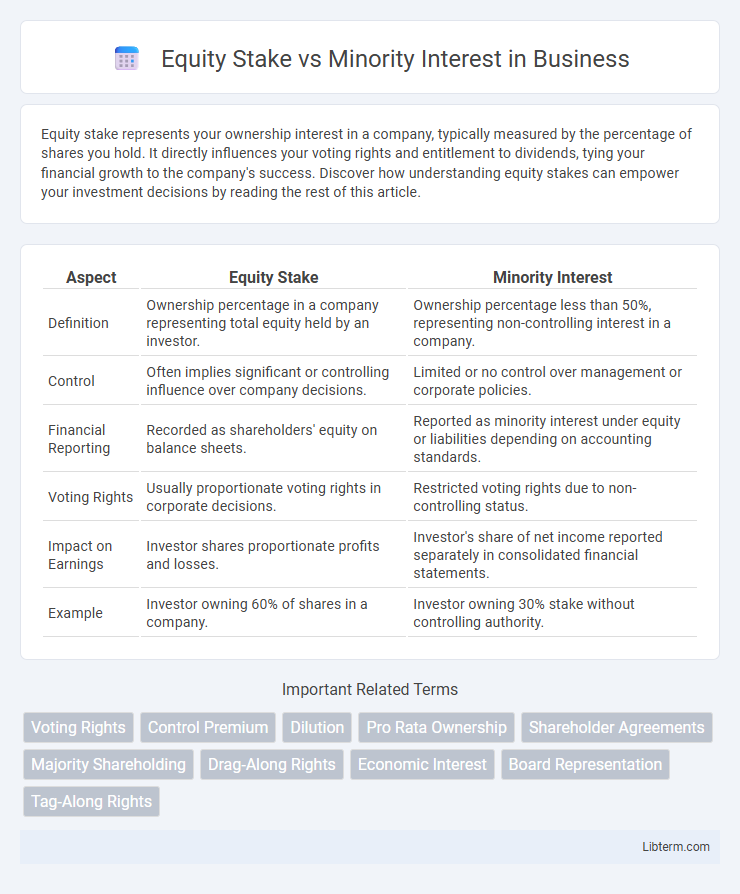

| Aspect | Equity Stake | Minority Interest |

|---|---|---|

| Definition | Ownership percentage in a company representing total equity held by an investor. | Ownership percentage less than 50%, representing non-controlling interest in a company. |

| Control | Often implies significant or controlling influence over company decisions. | Limited or no control over management or corporate policies. |

| Financial Reporting | Recorded as shareholders' equity on balance sheets. | Reported as minority interest under equity or liabilities depending on accounting standards. |

| Voting Rights | Usually proportionate voting rights in corporate decisions. | Restricted voting rights due to non-controlling status. |

| Impact on Earnings | Investor shares proportionate profits and losses. | Investor's share of net income reported separately in consolidated financial statements. |

| Example | Investor owning 60% of shares in a company. | Investor owning 30% stake without controlling authority. |

Understanding Equity Stake and Minority Interest

Equity stake refers to the ownership percentage an individual or entity holds in a company, representing their proportional claim on assets and earnings. Minority interest specifically denotes the portion of equity in a subsidiary not owned by the parent company, reflecting non-controlling shareholder rights. Understanding the distinction is crucial for accurate financial reporting and investment analysis, as equity stake encompasses both controlling and non-controlling interests, whereas minority interest highlights only the non-controlling share.

Key Differences Between Equity Stake and Minority Interest

Equity stake refers to the total ownership percentage an investor holds in a company, including both majority and minority holdings, while minority interest specifically denotes a less than 50% ownership share without control over business decisions. Key differences include control rights, where equity stake holders may have significant influence or majority control, and minority interest holders typically lack such authority. Financial reporting distinguishes these by showing minority interest as a non-controlling interest in consolidated financial statements, reflecting the portion of subsidiary equity not owned by the parent company.

Defining Equity Stake: Scope and Implications

Equity stake refers to the ownership percentage an investor or entity holds in a company, representing a claim on its assets and earnings proportional to the shares owned. It encompasses both majority and minority positions, influencing control rights, dividend entitlements, and voting power within the organization. Understanding equity stake is crucial for assessing investment value, governance influence, and potential returns in corporate finance.

What Constitutes a Minority Interest?

Minority interest constitutes the ownership stake in a company held by shareholders who possess less than 50% of the voting shares, resulting in limited control over corporate decisions. This stake is reflected on the consolidated balance sheet of the parent company as a non-controlling interest, representing the portion of equity not attributable to the parent. Understanding minority interest is essential for accurate financial reporting, valuation, and analysis of a company's equity distribution.

Legal Rights: Equity Stakeholders vs Minority Shareholders

Equity stakeholders possess legal rights that typically include voting power, dividend claims, and influence over corporate decisions proportional to their ownership percentage. Minority shareholders hold equity stakes but face limited legal rights, often lacking control over major corporate actions and being vulnerable to decisions by majority stakeholders. Legal protections for minority shareholders, such as anti-oppression remedies and disclosure requirements, vary by jurisdiction and aim to prevent abuse by controlling equity stakeholders.

Control and Influence in Equity Stakes vs Minority Interests

Equity stake represents ownership in a company, often accompanied by significant control and voting rights that influence major business decisions. Minority interest refers to a smaller ownership share, typically lacking control over company management but still providing influence proportional to the equity held. The distinction impacts governance, as equity stakeholders can direct strategy, while minority interest holders primarily benefit from financial returns with limited decision-making power.

Financial Reporting and Valuation Differences

Equity stake represents total ownership percentage in a company, directly influencing control and consolidated financial reporting, while minority interest reflects the portion of equity held by non-controlling shareholders reported separately in consolidated statements. Minority interest is presented in the equity section but requires adjustments in valuation to account for lack of control and marketability discounts. Financial analysts must differentiate these terms to accurately assess ownership structure, control premiums, and the fair value of investments in valuation models.

Risks and Benefits: Equity Stakes Compared to Minority Interests

An equity stake grants investors ownership and voting rights proportional to their shares, enabling strategic influence and potential dividends, but it exposes them to market volatility and business risks. Minority interests, representing less than 50% ownership, offer limited control and reduced risk exposure, yet restrict decision-making power and influence on company policies. Both equity stakes and minority interests carry financial opportunity and risk, but equity stakes usually involve greater engagement and responsibility in the firm's success or failure.

Strategic Considerations for Investors

Equity stake represents the total ownership percentage an investor holds in a company, providing direct control and influence over strategic decisions, while minority interest typically denotes a smaller ownership share with limited control but potential for significant financial returns through growth and dividends. Investors prioritize equity stakes in scenarios requiring active governance and operational input, whereas minority interests appeal when seeking portfolio diversification, reduced risk, and passive income streams. Strategic considerations include evaluating voting rights, potential for board representation, impact on financial reporting, and alignment with long-term investment goals.

Real-World Examples: Equity Stake vs Minority Interest

Equity stake represents ownership in a company and can range from a small share to a controlling interest, while minority interest refers specifically to a stake of less than 50% that does not grant control over the company. For example, Berkshire Hathaway's minority interest in companies like The Coca-Cola Company highlights strategic investment without control, whereas Tencent's equity stake in multiple startups often entails significant influence but not outright ownership. Real-world cases demonstrate that minority interest is often reflected in consolidated financial statements to show non-controlling shareholders' claims, while equity stakes can dictate voting power and management decisions.

Equity Stake Infographic

libterm.com

libterm.com