The asking price is the initial amount a seller expects to receive for an item or property, serving as a starting point for negotiations. Understanding factors influencing asking prices can help you make informed decisions and avoid overpaying. Explore the rest of the article to learn how to evaluate and negotiate asking prices effectively.

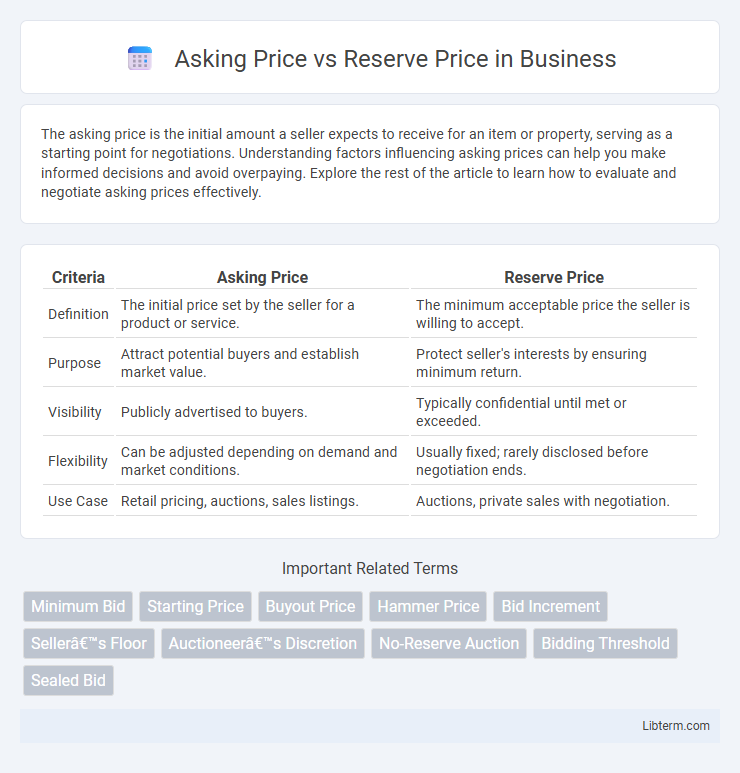

Table of Comparison

| Criteria | Asking Price | Reserve Price |

|---|---|---|

| Definition | The initial price set by the seller for a product or service. | The minimum acceptable price the seller is willing to accept. |

| Purpose | Attract potential buyers and establish market value. | Protect seller's interests by ensuring minimum return. |

| Visibility | Publicly advertised to buyers. | Typically confidential until met or exceeded. |

| Flexibility | Can be adjusted depending on demand and market conditions. | Usually fixed; rarely disclosed before negotiation ends. |

| Use Case | Retail pricing, auctions, sales listings. | Auctions, private sales with negotiation. |

Understanding Asking Price: Definition and Purpose

The asking price is the initial amount a seller sets to attract potential buyers and gauge market interest for an asset or property. This figure serves as a benchmark in negotiations, reflecting the seller's expectations while providing flexibility for offer adjustments. Understanding the asking price helps buyers assess value and strategize their bids in competitive markets.

What Is Reserve Price? Key Differences

Reserve price is the minimum amount a seller is willing to accept in an auction, set secretly to ensure the item is not sold below value. The asking price is the publicly stated amount or starting bid meant to attract potential buyers, often higher than or equal to the reserve price. Key differences include transparency--asking price is visible to bidders, while reserve price remains confidential until met, influencing bidding dynamics and final sale outcomes.

How Asking Price Influences Buyer Perception

The asking price significantly shapes buyer perception by setting initial expectations of value and quality, often positioning the item within a specific market segment. A perceived high asking price may signal premium quality or exclusivity, attracting buyers willing to pay more, while a lower asking price can create urgency or a bargain appeal. Understanding this dynamic helps sellers strategically price items to influence interest and negotiation outcomes without revealing the underlying reserve price.

The Strategic Role of Reserve Price in Auctions

The reserve price in auctions acts as a critical threshold that safeguards the seller's minimum acceptable value, preventing the item from selling below a predetermined price. Unlike the asking price, which serves as an initial benchmark to attract bidders, the reserve price strategically influences bidder behavior by signaling the seller's valuation and maintaining market confidence. Setting an optimal reserve price balances the risk of no sale against achieving a fair market value, ultimately maximizing the auction's revenue potential.

Negotiation Dynamics: Asking Price vs Reserve Price

The negotiation dynamics between asking price and reserve price significantly influence buyer-seller interactions during a sale. Buyers often start negotiations near the asking price, aiming to approach or surpass the seller's hidden reserve price, which represents the minimum acceptable value. Understanding the gap between these two prices helps both parties strategize effectively, balancing market expectations with negotiation flexibility to close deals successfully.

Setting the Right Asking Price: Tips and Strategies

Setting the right asking price involves researching comparable market values and understanding current demand trends to attract serious buyers and avoid undervaluation. Employing strategies like pricing slightly below the market average can generate competitive bidding, while ensuring the reserve price remains realistic protects seller interests by setting a minimum acceptable sale amount. Utilizing data-driven analysis and consulting real estate professionals enhances price accuracy, maximizing the likelihood of a successful, profitable transaction.

Risks and Benefits of Using a Reserve Price

Using a reserve price in auctions protects sellers from accepting bids below the item's true value, reducing the risk of significant financial loss while maintaining control over the final sale price. However, setting the reserve price too high may deter potential buyers, leading to fewer bids and a higher chance of the item remaining unsold. Balancing the reserve price optimizes seller benefits by securing adequate returns while fostering competitive bidding that can drive the sale price upward.

Common Misconceptions About Reserve and Asking Prices

Many sellers confuse the asking price with the reserve price, assuming they are the same, but the asking price is the initial amount listed publicly while the reserve price is the minimum acceptable sale price kept confidential. Buyers often believe bidding below the asking price is invalid, overlooking that sellers may accept offers above the reserve price, even if below the asking price. Understanding this distinction is crucial to navigating auctions or negotiations effectively and avoiding common pitfalls in pricing strategies.

Impact on Sales Outcome: Reserve Price vs Asking Price

The reserve price sets the minimum amount a seller is willing to accept, directly influencing the likelihood of a sale, while the asking price serves as the initial value presented to potential buyers and shapes their interest. If the reserve price is significantly higher than the asking price, it may deter bids, reducing the chances of a successful sale. A well-calibrated reserve price aligned closely with the asking price optimizes buyer engagement and increases the probability of achieving or exceeding the desired sale value.

Choosing the Best Pricing Strategy for Sellers

Choosing the best pricing strategy involves understanding the distinction between asking price and reserve price; the asking price is the initial amount a seller hopes to achieve, while the reserve price is the minimum acceptable value below which the item will not be sold. Sellers who set a competitive asking price can attract more potential buyers and create bidding excitement, whereas a well-defined reserve price protects them from selling valuable items below their worth. Balancing these prices effectively can maximize final sale value and ensure a successful transaction in auctions or listings.

Asking Price Infographic

libterm.com

libterm.com