Venture capital fuels innovative startups by providing essential funding and strategic guidance during early growth stages. Understanding how venture capital works can help you navigate investment opportunities and scale your business effectively. Discover more about the venture capital landscape and how it impacts your entrepreneurial journey in the rest of this article.

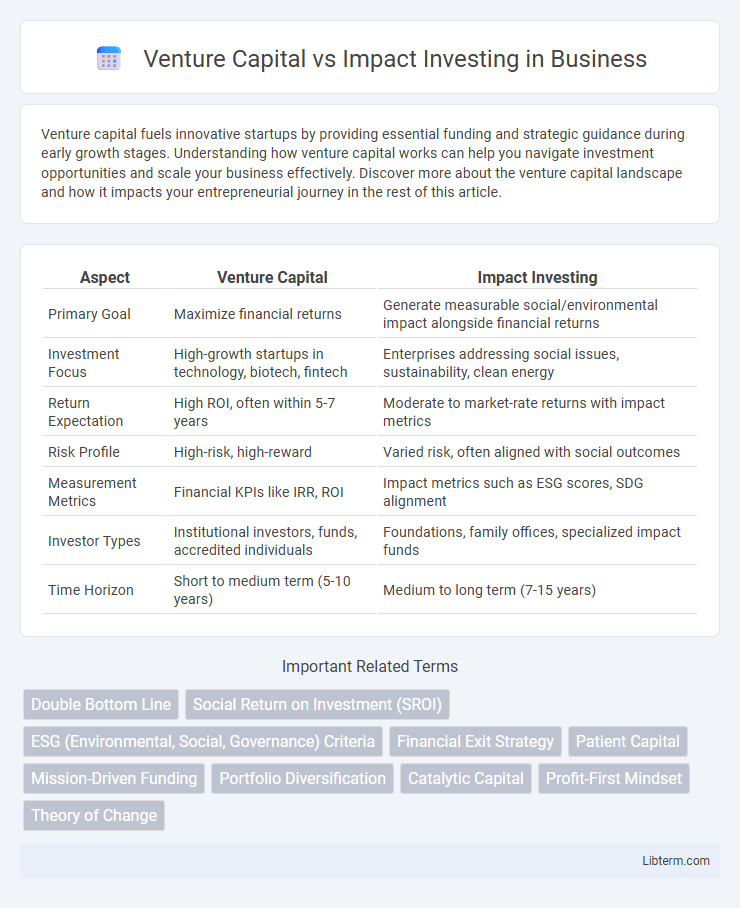

Table of Comparison

| Aspect | Venture Capital | Impact Investing |

|---|---|---|

| Primary Goal | Maximize financial returns | Generate measurable social/environmental impact alongside financial returns |

| Investment Focus | High-growth startups in technology, biotech, fintech | Enterprises addressing social issues, sustainability, clean energy |

| Return Expectation | High ROI, often within 5-7 years | Moderate to market-rate returns with impact metrics |

| Risk Profile | High-risk, high-reward | Varied risk, often aligned with social outcomes |

| Measurement Metrics | Financial KPIs like IRR, ROI | Impact metrics such as ESG scores, SDG alignment |

| Investor Types | Institutional investors, funds, accredited individuals | Foundations, family offices, specialized impact funds |

| Time Horizon | Short to medium term (5-10 years) | Medium to long term (7-15 years) |

Understanding Venture Capital: Key Characteristics

Venture capital involves investing in early-stage startups with high growth potential, emphasizing rapid scalability and significant financial returns. Key characteristics include equity ownership, high risk tolerance, active management involvement, and a focus on market disruption through innovation. Fund managers prioritize businesses capable of generating exponential profits within a defined investment horizon, often seeking industry-transforming technologies and scalable business models.

What is Impact Investing? Core Principles

Impact investing is a strategic approach that targets measurable social and environmental outcomes alongside financial returns, integrating these dual objectives into investment decisions. Core principles include intentionality, where investors prioritize positive societal impact; additionality, ensuring investments create benefits that would not occur otherwise; and measurement, which involves rigorously tracking and reporting impact performance to maintain accountability. This approach differentiates from traditional venture capital by embedding sustainability and ethical considerations into the core investment strategy.

Comparing Investment Goals: Profit vs Purpose

Venture capital primarily seeks high financial returns by investing in innovative startups with rapid growth potential, emphasizing profit maximization. Impact investing balances financial gains with measurable social or environmental benefits, targeting investments in businesses that generate positive change alongside sustainable profits. The fundamental difference lies in venture capital's profit-driven objectives compared to impact investing's dual focus on purpose and financial performance.

Risk and Return Profiles in Venture Capital and Impact Investing

Venture capital typically involves high-risk investments in early-stage startups with the potential for substantial financial returns, often driven by rapid growth and market disruption. Impact investing balances financial returns with measurable social or environmental benefits, generally presenting moderate risk profiles due to diversified portfolios targeting sustainable enterprises. Investors in venture capital accept volatility for outsized gains, while impact investors prioritize stable returns aligned with social impact objectives, reflecting differing risk tolerance and return expectations.

Sectors and Industries Attracting Each Investment Type

Venture capital primarily targets high-growth sectors like technology, biotechnology, and fintech, where innovation and scalability drive significant returns. Impact investing directs capital towards industries such as renewable energy, sustainable agriculture, and affordable healthcare, emphasizing social and environmental benefits alongside financial performance. The distinction lies in venture capital's focus on rapid market disruption versus impact investing's commitment to measurable positive outcomes in underserved or mission-driven markets.

Measuring Success: Financial Returns vs Social Impact Metrics

Venture capital prioritizes financial returns, using metrics such as internal rate of return (IRR), cash-on-cash multiples, and exit valuations to gauge success. Impact investing incorporates both financial performance and social impact metrics, including Environmental, Social, and Governance (ESG) scores, Social Return on Investment (SROI), and impact reporting frameworks like IRIS+. Measuring success in impact investing demands balancing profit with quantifiable social or environmental outcomes to achieve sustainable growth.

Funding Stages and Deal Structures Explained

Venture capital primarily targets early-stage startups with high growth potential, typically engaging in Series A to C funding rounds involving equity stakes and preferred shares. Impact investing spans various stages, from seed to late-stage funding, often incorporating hybrid deal structures like revenue-based financing or convertible notes to balance financial returns with social impact metrics. Both approaches employ due diligence but differ in exit strategies, with venture capital favoring IPOs or acquisitions, while impact investors may prioritize long-term social outcomes alongside financial performance.

Investor Profiles: Who Chooses Venture Capital or Impact Investing?

Venture capital investors typically prioritize high-growth startups with scalable business models, seeking substantial financial returns within a defined timeframe. Impact investors focus on generating measurable social or environmental benefits alongside financial returns, often favoring enterprises aligned with sustainable development goals. The choice between venture capital and impact investing depends on an investor's objectives, risk tolerance, and commitment to social impact.

Trends Shaping the Future of Venture Capital and Impact Investing

Venture capital increasingly integrates environmental, social, and governance (ESG) criteria as impact investing gains momentum, reflecting a shift towards sustainable and responsible investment models. Emerging trends include the rise of blended finance strategies and the proliferation of specialized funds targeting social innovation alongside financial returns. Data from Global Impact Investing Network (GIIN) shows annual impact fund growth rates surpassing traditional venture capital, signaling a transformative convergence in investor priorities shaping the future of capital allocation.

Choosing the Right Path: Which Strategy Fits Your Values and Goals?

Choosing between Venture Capital and Impact Investing hinges on aligning investment strategies with personal values and long-term goals, where Venture Capital emphasizes high-growth startups with financial returns, and Impact Investing targets measurable social or environmental benefits alongside profits. Investors prioritizing rapid scalability and innovation may prefer Venture Capital, while those seeking to drive positive change in areas like sustainability, education, or healthcare often gravitate toward Impact Investing. Assessing risk tolerance, desired impact, and financial objectives helps determine the optimal path to support ventures that resonate with both vision and values.

Venture Capital Infographic

libterm.com

libterm.com