Encumbrance refers to a claim, lien, or liability attached to property that may affect its transfer or reduce its value. Understanding different types of encumbrances, such as mortgages, easements, and leases, is crucial for property owners and buyers to avoid legal complications. Explore the rest of this article to learn how encumbrances can impact your property rights and transactions.

Table of Comparison

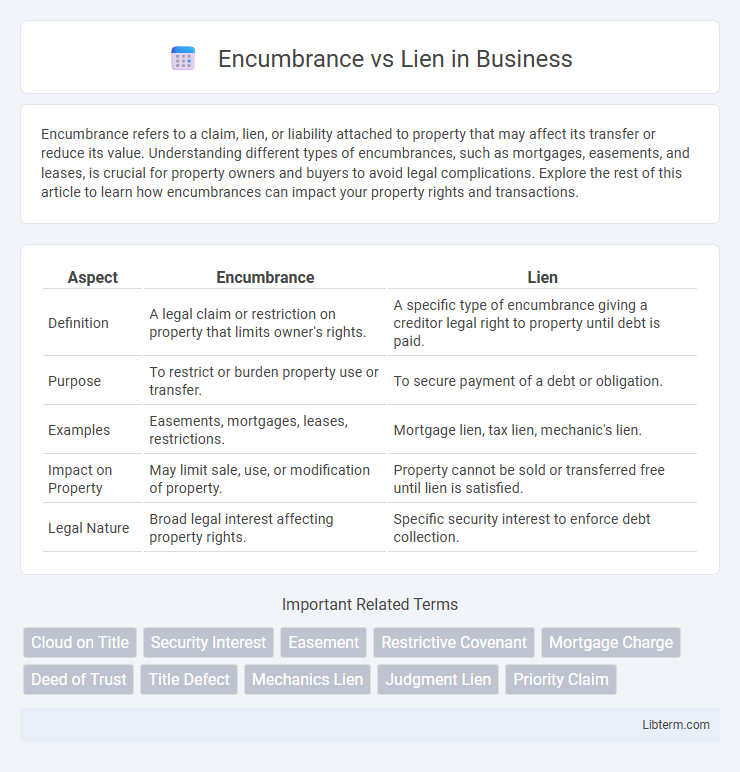

| Aspect | Encumbrance | Lien |

|---|---|---|

| Definition | A legal claim or restriction on property that limits owner's rights. | A specific type of encumbrance giving a creditor legal right to property until debt is paid. |

| Purpose | To restrict or burden property use or transfer. | To secure payment of a debt or obligation. |

| Examples | Easements, mortgages, leases, restrictions. | Mortgage lien, tax lien, mechanic's lien. |

| Impact on Property | May limit sale, use, or modification of property. | Property cannot be sold or transferred free until lien is satisfied. |

| Legal Nature | Broad legal interest affecting property rights. | Specific security interest to enforce debt collection. |

Understanding Encumbrance: Definition and Scope

Encumbrance refers to any claim, lien, charge, or liability attached to a property that may diminish its value or restrict its use, encompassing mortgages, easements, leases, and restrictions. Unlike liens, which specifically denote a legal right or interest in the property as security for a debt or obligation, encumbrances include a broader range of limitations affecting ownership or title. Understanding the scope of encumbrance is crucial for property owners and buyers to assess potential legal and financial impacts before completing real estate transactions.

What Is a Lien? Types and Legal Implications

A lien is a legal claim or right against a property, typically used as security for a debt or obligation, allowing the creditor to take possession or force sale if the debtor defaults. Common types of liens include mortgage liens, tax liens, and mechanic's liens, each with specific legal requirements and enforcement procedures governed by state laws. Liens impact property ownership by restricting the owner's ability to sell or transfer clear title until the lien is satisfied or released.

Key Differences Between Encumbrance and Lien

Encumbrance refers to any claim or liability attached to a property that may affect its value or use, such as easements, restrictions, or mortgages, whereas a lien is a specific legal right or interest that a creditor has on a property until a debt is satisfied. Encumbrances can be voluntary or involuntary and include both financial and non-financial claims, while liens primarily represent a security interest arising from unpaid debts or obligations. The key difference lies in that all liens are encumbrances, but not all encumbrances qualify as liens, as liens strictly ensure creditor rights for debt recovery.

How Encumbrances Affect Property Ownership

Encumbrances affect property ownership by limiting the owner's ability to use, transfer, or fully enjoy the property, as they represent claims, restrictions, or liabilities attached to the real estate. Unlike liens, which specifically secure a debt or obligation against the property, encumbrances include easements, covenants, and encroachments that impose conditions or usage constraints. Property owners must disclose encumbrances during sales transactions, as these burdens can impact market value and transferability.

Common Types of Encumbrances Beyond Liens

Common types of encumbrances beyond liens include easements, which grant others the right to use a portion of the property for specific purposes such as utilities or access roads. Restrictive covenants limit property use, often imposed by homeowners' associations or local governments to maintain neighborhood standards. Encroachments occur when a structure or improvement intrudes onto neighboring property, potentially affecting property value and transferability.

The Impact of Liens on Real Estate Transactions

Liens significantly affect real estate transactions by creating a legal claim against a property, often restricting the owner's ability to sell or refinance until the debt is cleared. Unlike general encumbrances that may include non-financial claims, liens specifically represent financial obligations such as mortgages, tax debts, or mechanic's liens. Clearing these liens is crucial to ensure clear title transfer and avoid potential legal disputes during property transactions.

legal Procedures for Removing Encumbrances and Liens

Removing encumbrances and liens typically involves a legal process such as filing a release or satisfaction document with the county recorder's office or court, proving debt repayment or resolving the underlying obligation. Property owners must obtain a lien release or lien discharge from the creditor, followed by recording the document to clear the public record and restore clear title. In certain cases, court action may be required to challenge invalid liens or negotiate settlements before obtaining formal removal.

Buyer’s Guide: Conducting Title Searches for Encumbrances

Title searches for encumbrances are crucial in real estate transactions to identify any claims, liens, or restrictions that may affect property ownership. Buyers should focus on uncovering encumbrances such as mortgages, easements, or unpaid taxes that could limit property use or transferability. Understanding the difference between encumbrances, which include all claims on a property, and liens, which are specific legal claims for debt repayment, helps buyers make informed decisions and avoid future legal disputes.

Protecting Your Property from Unwanted Liens

Encumbrances are broad claims or restrictions on property, while liens specifically represent a legal right to keep possession until a debt is paid, often posing greater risks to property owners. Protecting your property from unwanted liens involves proactively monitoring title records, contesting inaccurate claims, and maintaining clear records of all financial obligations secured by the property. Employing title insurance and working closely with legal professionals ensures effective management and prevention of liens that could compromise ownership rights.

Encumbrance vs Lien: Which Has a Greater Effect on Property Value?

Encumbrances and liens both impact property value by restricting ownership rights, but liens typically have a greater effect due to their direct claim on the property's equity, often leading to forced sale if unpaid. Encumbrances, such as easements or restrictions, may limit use but do not inherently threaten ownership or saleability, making their impact less severe. Therefore, liens generally result in a more significant reduction in property marketability and value compared to other types of encumbrances.

Encumbrance Infographic

libterm.com

libterm.com