Green Bonds and Blue Bonds are specialized financial instruments designed to fund projects with environmental benefits; Green Bonds primarily target climate and sustainability initiatives, while Blue Bonds focus on marine and water conservation. These bonds attract socially responsible investors and support Your commitment to ecological preservation and sustainable development. Explore the rest of the article to understand how these bonds impact global environmental finance and investment strategies.

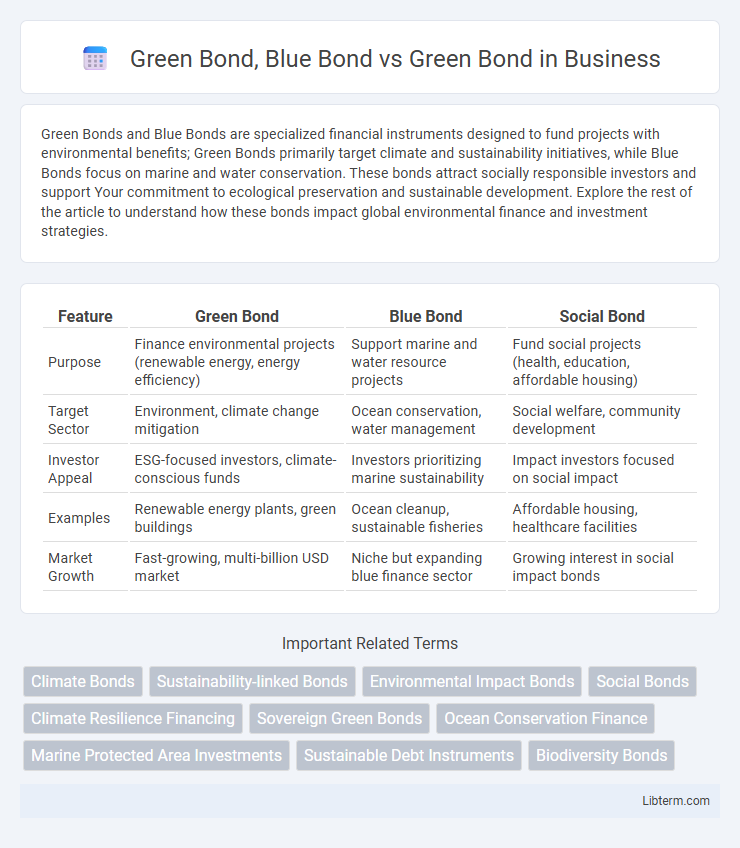

Table of Comparison

| Feature | Green Bond | Blue Bond | Social Bond |

|---|---|---|---|

| Purpose | Finance environmental projects (renewable energy, energy efficiency) | Support marine and water resource projects | Fund social projects (health, education, affordable housing) |

| Target Sector | Environment, climate change mitigation | Ocean conservation, water management | Social welfare, community development |

| Investor Appeal | ESG-focused investors, climate-conscious funds | Investors prioritizing marine sustainability | Impact investors focused on social impact |

| Examples | Renewable energy plants, green buildings | Ocean cleanup, sustainable fisheries | Affordable housing, healthcare facilities |

| Market Growth | Fast-growing, multi-billion USD market | Niche but expanding blue finance sector | Growing interest in social impact bonds |

Introduction to Green Bonds

Green Bonds are fixed-income instruments designed to fund projects with positive environmental impacts, particularly in renewable energy, energy efficiency, and sustainable agriculture. Blue Bonds are a subset focused specifically on financing marine and water-related conservation projects, addressing ocean health and sustainable fisheries. Both bond types enhance sustainable finance but differ in their target ecosystems, with Green Bonds covering broader environmental initiatives compared to the ocean-centric approach of Blue Bonds.

Key Features of Green Bonds

Green Bonds are debt securities issued to finance projects with positive environmental impacts such as renewable energy, energy efficiency, and pollution prevention. Unlike Blue Bonds, which specifically target marine and ocean-related conservation efforts, Green Bonds cover a broader range of environmental projects including clean transportation and sustainable land use. Key features of Green Bonds include transparency in project selection, third-party verification, and adherence to the Green Bond Principles established by the International Capital Market Association (ICMA).

Introduction to Blue Bonds

Blue Bonds specifically finance ocean and marine environment projects, addressing issues like overfishing, pollution, and coastal habitat restoration. Unlike Green Bonds, which cover a broad range of environmental initiatives including renewable energy and clean transportation, Blue Bonds target sustainable marine resource management and protection. The rise of Blue Bonds reflects growing recognition of oceans' critical role in climate stability and biodiversity preservation.

Key Features of Blue Bonds

Blue Bonds specifically fund marine and ocean-based projects, focusing on sustainable fisheries, marine conservation, and climate resilience in coastal areas, distinguishing them from Green Bonds which support a broader range of environmental initiatives such as renewable energy and clean transportation. Key features of Blue Bonds include targeted investments in ocean health, strict environmental performance criteria, and collaboration with marine experts to ensure measurable impact on marine ecosystems. These bonds mobilize capital to address urgent ocean challenges while promoting economic growth in coastal communities.

Green Bond vs Blue Bond: Core Differences

Green Bonds primarily finance projects that reduce carbon emissions, promote renewable energy, and support climate change mitigation on land, while Blue Bonds focus exclusively on marine and ocean-related conservation, sustainable fisheries, and water resource management. The key difference lies in their environmental scope: Green Bonds target broad ecological and climate issues, whereas Blue Bonds concentrate on protecting aquatic ecosystems and enhancing ocean health. Both bonds offer investors opportunities to support environmental sustainability, but Blue Bonds address the unique challenges of marine environments within the broader green finance market.

Environmental Impacts: Green vs Blue Bonds

Green Bonds primarily fund projects that reduce carbon emissions and enhance renewable energy, energy efficiency, and sustainable land use, significantly contributing to climate change mitigation. Blue Bonds specifically target marine and water-related environmental initiatives, such as ocean conservation, sustainable fisheries, and water resource management, directly addressing marine ecosystem preservation and resilience. Both instruments drive environmental impact, but Blue Bonds uniquely focus on protecting aquatic environments, making them critical for coastal communities and global biodiversity.

Market Growth and Trends in Green and Blue Bonds

The green bond market has experienced exponential growth, reaching over $500 billion in issuance by 2023, driven by increased investor demand for climate-aligned assets and regulatory support in regions like the European Union and Asia. Blue bonds, though a nascent segment focused on ocean and marine environment projects, have gained traction with landmark issuances surpassing $3 billion, signaling rising interest in sustainable ocean finance. Market trends indicate diversification in use cases and growing integration of impact measurement frameworks, positioning green and blue bonds as pivotal tools in financing global environmental sustainability.

Regulatory Frameworks for Green and Blue Bonds

Regulatory frameworks for green bonds primarily emphasize environmental sustainability criteria, requiring issuers to comply with standards such as the Green Bond Principles by ICMA, which ensure transparency and impact reporting. Blue bonds, a subset of green bonds, specifically target marine and water-related projects, governed by additional guidelines like the Sustainable Blue Economy Finance Principles, which address ocean health and conservation. Both frameworks aim to enhance investor confidence and market integrity by promoting rigorous disclosure, third-party verification, and compliance with environmental objectives.

Investment Opportunities: Green Bonds vs Blue Bonds

Green Bonds primarily finance projects that promote environmental sustainability, such as renewable energy and energy efficiency, offering investors opportunities aligned with climate action and carbon reduction goals. Blue Bonds specifically target marine and water-related initiatives, including ocean conservation, sustainable fisheries, and water infrastructure, attracting investors interested in preserving aquatic ecosystems and combating water scarcity. Both bond types provide impactful investment avenues, with Green Bonds focusing on terrestrial environmental benefits, while Blue Bonds concentrate on blue economy challenges and marine biodiversity protection.

Future Outlook for Green and Blue Bonds

The future outlook for Green Bonds and Blue Bonds indicates significant growth driven by increasing investor demand for sustainable finance. Green Bonds primarily target environmental projects such as renewable energy and carbon reduction, while Blue Bonds focus on marine and water-related conservation efforts, highlighting a crucial niche within sustainable investments. Market forecasts project expanding capital flows into both bond types, supported by stronger regulatory frameworks and heightened global awareness of climate and ocean health challenges.

Green Bond, Blue Bond Infographic

libterm.com

libterm.com