A surety bond is a legally binding agreement that involves three parties: the principal, the obligee, and the surety, ensuring the principal fulfills their contractual obligations. This financial instrument protects the obligee from losses if the principal fails to meet specified terms, providing peace of mind and security. Discover how surety bonds work and why they are essential for your business by reading the rest of the article.

Table of Comparison

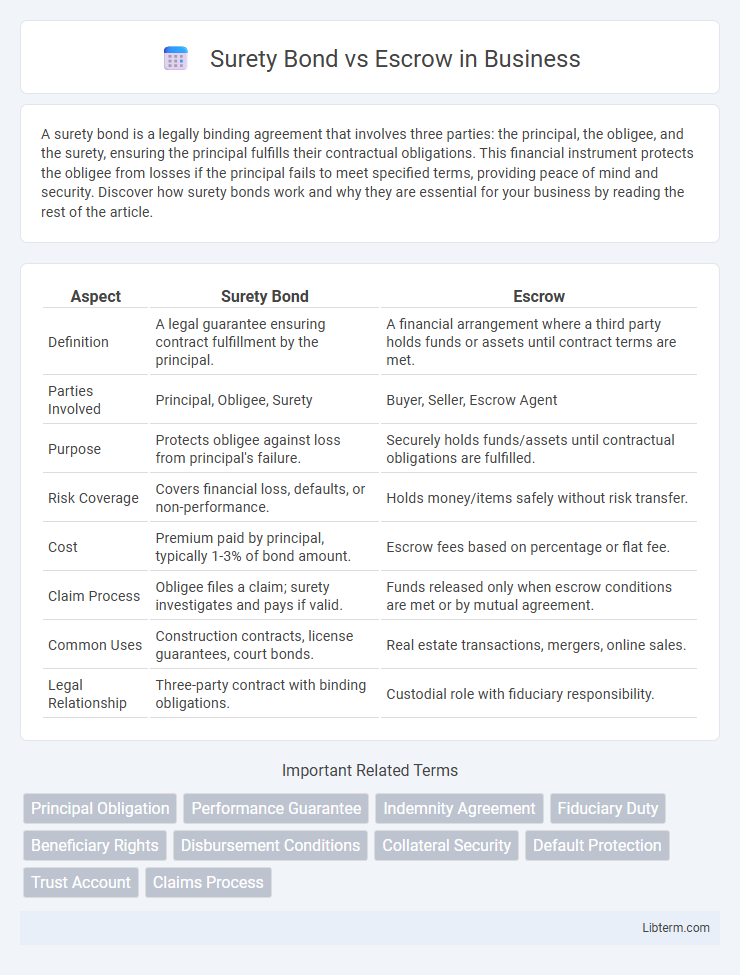

| Aspect | Surety Bond | Escrow |

|---|---|---|

| Definition | A legal guarantee ensuring contract fulfillment by the principal. | A financial arrangement where a third party holds funds or assets until contract terms are met. |

| Parties Involved | Principal, Obligee, Surety | Buyer, Seller, Escrow Agent |

| Purpose | Protects obligee against loss from principal's failure. | Securely holds funds/assets until contractual obligations are fulfilled. |

| Risk Coverage | Covers financial loss, defaults, or non-performance. | Holds money/items safely without risk transfer. |

| Cost | Premium paid by principal, typically 1-3% of bond amount. | Escrow fees based on percentage or flat fee. |

| Claim Process | Obligee files a claim; surety investigates and pays if valid. | Funds released only when escrow conditions are met or by mutual agreement. |

| Common Uses | Construction contracts, license guarantees, court bonds. | Real estate transactions, mergers, online sales. |

| Legal Relationship | Three-party contract with binding obligations. | Custodial role with fiduciary responsibility. |

Surety Bond vs Escrow: Key Differences

Surety bonds involve three parties--the principal, obligee, and surety--where the surety guarantees the principal's obligation to the obligee, while escrow accounts hold funds or assets managed by a neutral third party until contract conditions are met. Surety bonds provide financial protection against non-performance or default without transferring funds upfront, whereas escrow requires depositing funds that are released upon agreement fulfillment. The key difference lies in risk allocation: surety bonds shift risk to the surety company, whereas escrow arrangements mitigate risk by holding actual assets during the transaction process.

What Is a Surety Bond?

A surety bond is a legally binding contract involving three parties: the principal, the obligee, and the surety company, which guarantees the principal's obligation will be fulfilled according to the contract terms. It provides financial protection to the obligee by ensuring compensation if the principal fails to perform duties such as completing a construction project or paying taxes. This risk mitigation tool differs from escrow accounts, which hold funds during transactions but do not guarantee performance or indemnify losses.

What Is Escrow?

Escrow is a financial arrangement where a neutral third party holds funds or assets until specified conditions are met, ensuring secure transactions between buyers and sellers. Commonly used in real estate and online sales, escrow mitigates risks by protecting both parties from potential fraud or non-performance. Unlike surety bonds, which provide a guarantee of obligation fulfillment, escrow directly manages and disburses funds based on contract terms.

How Surety Bonds Work

Surety bonds involve a three-party agreement among the principal, obligee, and surety company, where the surety guarantees the principal's performance or payment to the obligee. If the principal fails to fulfill their obligations, the surety compensates the obligee up to the bond amount and seeks reimbursement from the principal. This risk transfer mechanism ensures financial protection and compliance in contracts, distinguishing surety bonds from escrow arrangements where funds are held rather than guaranteed.

How Escrow Accounts Function

Escrow accounts function as neutral third-party holding accounts where funds are securely stored until contractual obligations are met, ensuring trust between buyers and sellers. These accounts are commonly used in real estate transactions to manage deposits, property taxes, and insurance payments, guaranteeing that disbursements occur only when agreed conditions are satisfied. Unlike surety bonds, escrow accounts involve actual funds being held, providing tangible financial security to all parties involved.

Pros and Cons of Surety Bonds

Surety bonds offer the benefit of guaranteeing project completion or financial obligations without tying up the principal's capital, allowing for greater liquidity and flexibility compared to escrow accounts. They provide a legal assurance backed by a surety company, but the principal remains liable for repayment if a claim is made, unlike escrow funds which are held independently and non-recourse. A key disadvantage of surety bonds is the underwriting process, which can be stringent and time-consuming, potentially limiting access for businesses with poor credit or financial instability.

Pros and Cons of Escrow

Escrow provides a secure method for managing funds during transactions, ensuring that both parties meet their obligations before money is released, which reduces risk and increases trust. However, escrow services can incur fees that add to transaction costs, and the process may cause delays due to the need for verification and approval at multiple stages. Unlike surety bonds, escrow does not guarantee performance or repayment but strictly holds funds, making it advantageous for payment security but less effective in covering potential losses or liabilities.

When to Use a Surety Bond

A surety bond is ideal when a third party requires a financial guarantee that contractual obligations will be fulfilled, particularly in construction projects, licensing, or court proceedings. It protects the obligee by holding the principal accountable without tying up large sums of money, unlike escrow accounts which hold funds upfront. Surety bonds are used when performance assurance and risk mitigation are essential without immediate cash transfer.

When to Choose Escrow

Choose escrow when managing transactions that require neutral third-party custody of funds or assets to ensure contract fulfillment and safeguard buyer and seller interests. Escrow is ideal for real estate deals, online sales, and large project payments where conditional release of funds depends on meeting predefined terms. This method reduces risk and provides transparency by holding funds securely until all parties satisfy their contractual obligations.

Surety Bond or Escrow: Which Is Right for You?

Choosing between a surety bond and an escrow depends on your financial responsibility and risk management needs. Surety bonds provide a guarantee from a third party ensuring contract completion or compliance, often used in construction and licensing. Escrow accounts hold funds securely until contract terms are met, ideal for real estate transactions and ensuring payment protection between buyers and sellers.

Surety Bond Infographic

libterm.com

libterm.com