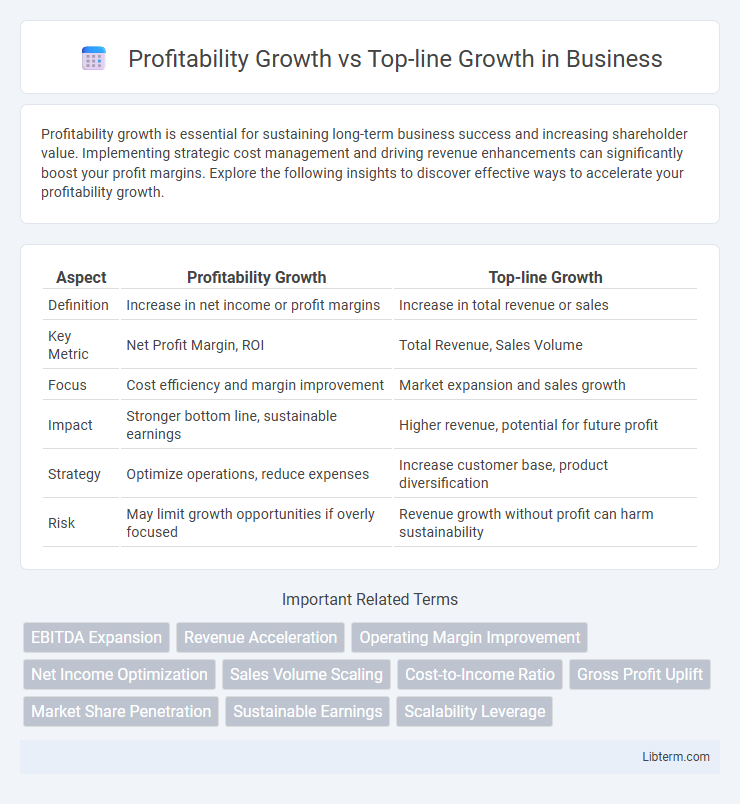

Profitability growth is essential for sustaining long-term business success and increasing shareholder value. Implementing strategic cost management and driving revenue enhancements can significantly boost your profit margins. Explore the following insights to discover effective ways to accelerate your profitability growth.

Table of Comparison

| Aspect | Profitability Growth | Top-line Growth |

|---|---|---|

| Definition | Increase in net income or profit margins | Increase in total revenue or sales |

| Key Metric | Net Profit Margin, ROI | Total Revenue, Sales Volume |

| Focus | Cost efficiency and margin improvement | Market expansion and sales growth |

| Impact | Stronger bottom line, sustainable earnings | Higher revenue, potential for future profit |

| Strategy | Optimize operations, reduce expenses | Increase customer base, product diversification |

| Risk | May limit growth opportunities if overly focused | Revenue growth without profit can harm sustainability |

Understanding Profitability Growth

Profitability growth reflects an increase in net income or profit margins, highlighting a company's efficiency in managing costs and generating returns from revenue. It focuses on improving operational performance, reducing expenses, and optimizing resource allocation rather than just expanding sales volume. Understanding profitability growth helps identify sustainable financial health beyond sheer top-line revenue increases, emphasizing quality over quantity in earnings.

Defining Top-line Growth

Top-line growth refers to the increase in a company's gross sales or revenue, representing its ability to generate higher income from core business activities. It is measured by comparing current period sales figures to previous periods, highlighting expansion in market demand or successful sales strategies. Focusing on top-line growth emphasizes revenue generation before accounting for expenses or profitability metrics.

Key Differences Between Profitability and Top-line Growth

Profitability growth measures the increase in net income after all expenses, highlighting efficient cost management and higher margins, while top-line growth refers to increased revenue generation without directly accounting for expenses. Profitability growth emphasizes sustainable financial health and operational efficiency, whereas top-line growth focuses solely on expanding sales volume or market share. Businesses often balance both metrics to achieve long-term success, but profitability growth provides a clearer indication of true economic performance.

Why Top-line Growth Matters for Businesses

Top-line growth reflects an increase in a company's revenue, signaling expanding market demand and customer base, which is crucial for long-term sustainability. Businesses emphasizing top-line growth attract investors by demonstrating potential for scale, innovation, and competitive advantage. Sustained revenue growth provides the financial foundation to invest in infrastructure, talent, and technological advancements critical for profitability improvement over time.

The Importance of Profitability Growth

Profitability growth indicates a company's ability to increase net income relative to its expenses, reflecting operational efficiency and sustainable financial health. Unlike top-line growth, which measures total revenue increase, profitability growth demonstrates how effectively a business converts sales into actual profit, impacting investor confidence and long-term viability. Prioritizing profitability ensures resource optimization, enabling reinvestment and competitive advantage in the market.

Strategies for Driving Top-line Growth

Implementing targeted marketing campaigns and expanding into new markets are essential strategies for driving top-line growth by increasing sales revenue. Product innovation and diversification enhance customer acquisition and retention, fueling revenue streams and market share expansion. Leveraging digital transformation and data analytics optimizes customer engagement and streamlines sales channels, amplifying revenue growth.

Effective Approaches to Enhance Profitability

Enhancing profitability requires strategies that optimize cost management and improve operational efficiency rather than solely increasing revenue. Implementing targeted pricing strategies, streamlining supply chains, and focusing on high-margin products drive sustainable profit growth. Leveraging data analytics to identify profit leakages and prioritize resource allocation results in more effective profitability enhancement compared to top-line growth alone.

Potential Risks of Focusing Only on Top-line Growth

Focusing solely on top-line growth can lead to increased operational costs, reduced profit margins, and cash flow challenges, posing significant risks to a company's financial health. Rapid revenue expansion without corresponding profitability often results in inefficient resource allocation and unsustainable business practices. Ignoring profitability growth metrics may also mask underlying issues such as high customer acquisition costs and poor product-market fit.

Balancing Profitability and Revenue Expansion

Balancing profitability and top-line growth requires strategic allocation of resources to maximize both revenue expansion and margin improvement. Companies must optimize operational efficiencies while pursuing new markets to sustain scalable growth without eroding profit margins. Effective pricing strategies and cost management play critical roles in aligning revenue growth with long-term profitability goals.

Profitability Growth vs Top-line Growth: Which Drives Long-term Success?

Profitability growth emphasizes improving net income relative to expenses, ensuring sustainable business operations and increased shareholder value over time. Top-line growth focuses on increasing revenue through expanded sales or market share, which may not always translate to higher profits if costs rise disproportionately. Companies prioritizing profitability growth often achieve long-term success by maintaining efficient cost management and generating consistent cash flow, whereas top-line growth alone can lead to unsustainable financial practices.

Profitability Growth Infographic

libterm.com

libterm.com