Partly paid shares require shareholders to pay only a portion of the share value upfront, with the remaining amount due at a later date as called by the company. This allows companies to raise capital incrementally, reducing immediate financial burden on investors while maintaining the option to collect additional funds in the future. Explore the rest of the article to understand how partly paid shares impact your investment strategy and shareholder rights.

Table of Comparison

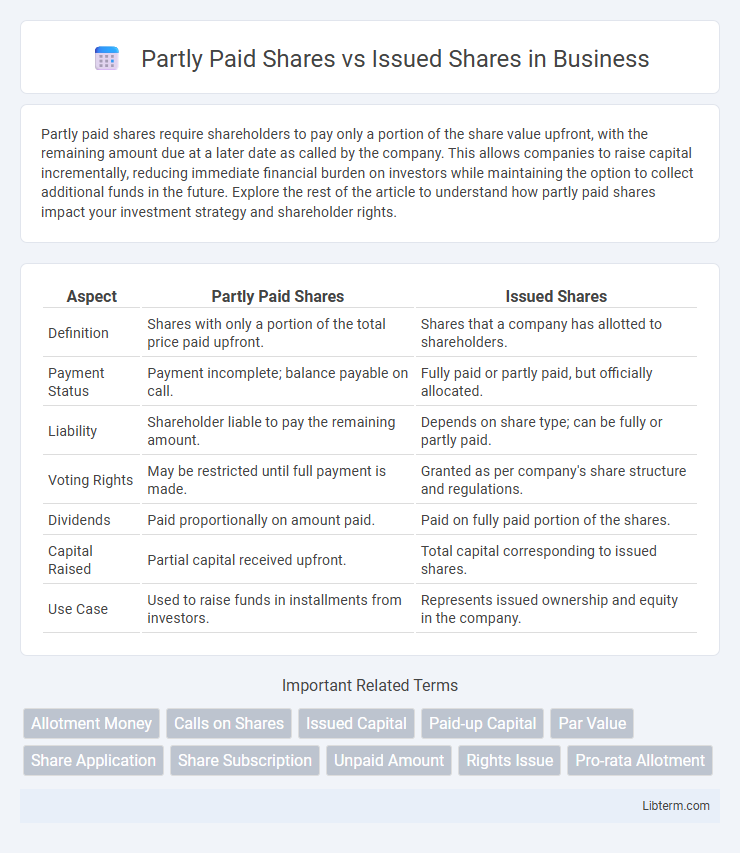

| Aspect | Partly Paid Shares | Issued Shares |

|---|---|---|

| Definition | Shares with only a portion of the total price paid upfront. | Shares that a company has allotted to shareholders. |

| Payment Status | Payment incomplete; balance payable on call. | Fully paid or partly paid, but officially allocated. |

| Liability | Shareholder liable to pay the remaining amount. | Depends on share type; can be fully or partly paid. |

| Voting Rights | May be restricted until full payment is made. | Granted as per company's share structure and regulations. |

| Dividends | Paid proportionally on amount paid. | Paid on fully paid portion of the shares. |

| Capital Raised | Partial capital received upfront. | Total capital corresponding to issued shares. |

| Use Case | Used to raise funds in installments from investors. | Represents issued ownership and equity in the company. |

Introduction to Partly Paid Shares and Issued Shares

Partly paid shares represent equity for which shareholders have paid only a portion of the nominal value, with the remaining balance payable on demand by the company. Issued shares refer to the total number of shares a company has distributed to shareholders, encompassing fully paid, partly paid, and sometimes treasury shares. Understanding the distinctions influences corporate financing strategies and shareholder obligations in equity capital management.

Definition of Partly Paid Shares

Partly paid shares are equity shares on which the shareholder has paid only a portion of the total face value, with the remaining amount payable on demand by the company. These shares provide flexibility for both the company and investors, as the company can call for the balance payment as needed, while investors initially commit less capital. Issued shares, in contrast, refer to the total number of shares that a company has allotted to shareholders, regardless of whether they are fully paid or partly paid.

Definition of Issued Shares

Issued shares represent the total number of shares a company has authorized and sold to shareholders, including both fully paid and partly paid shares. These shares grant ownership rights and typically entitle shareholders to dividends and voting rights, depending on the company's share structure. Partly paid shares differ as shareholders have only paid a portion of the share price, with remaining amounts due in the future.

Key Differences Between Partly Paid and Issued Shares

Partly paid shares refer to shares issued by a company where the shareholder has only paid a portion of the total nominal value, creating an outstanding liability for the remaining amount. Issued shares encompass the total number of shares a company has allocated and sold to shareholders, regardless of whether they are fully or partly paid. The key difference lies in the payment status: issued shares represent total ownership stakes granted, while partly paid shares indicate incomplete capital contribution from shareholders.

Process of Allotment for Partly Paid Shares

The process of allotment for partly paid shares involves offering shares to investors who pay a portion of the total share value initially, with the balance to be paid in future installments as called by the company. Companies issue partly paid shares to raise capital while giving shareholders flexibility in payment schedules, subject to the terms outlined in the share subscription agreement and company's Articles of Association. The allotment is recorded officially, and shareholders become part-owners with a pro-rated voting right and dividend entitlement based on the paid-up capital.

Rights and Obligations of Holders

Partly paid shares require shareholders to pay only a portion of the share value upfront, with the obligation to pay the remaining balance when called by the company, creating contingent liabilities for holders. Issued shares represent the total shares allocated to shareholders, who have full ownership rights, including voting rights and dividends proportional to their holding. Holders of partly paid shares have limited rights until full payment is made, whereas holders of fully paid issued shares enjoy complete equity rights without further payment obligations.

Payment Schedules and Calls

Partly paid shares allow investors to pay the share price in installments according to a predetermined payment schedule, often triggered by calls from the issuing company. Issued shares represent the total number of shares that have been allocated to shareholders, regardless of whether full payment has been made. Payment schedules and calls are critical in managing cash flow for companies and ensuring shareholders meet their financial obligations on partly paid shares.

Legal Implications and Compliance

Partly paid shares carry legal implications as shareholders are liable to pay the remaining amount on these shares when called upon, affecting compliance with company statutes and shareholder agreements. Issued shares represent actual shares allocated to shareholders, and companies must ensure accurate reporting and adherence to regulatory requirements for issuance and payments. Failure to comply with the obligations linked to partly paid shares or incorrect issuance can result in penalties, legal disputes, and challenges in corporate governance.

Advantages and Disadvantages

Partly paid shares allow companies to receive initial capital while deferring full payment, improving cash flow flexibility and reducing immediate shareholder burden, but they carry the risk of payment defaults and complicate equity valuation. Issued shares represent the total shares allotted to shareholders, providing clear ownership structure and full capital receipt, yet they limit future capital raising options unless new shares are issued and may dilute existing shareholder value. Choosing between partly paid and issued shares depends on balancing capital needs, shareholder commitment, and ownership clarity.

Conclusion: Choosing the Right Share Structure

Selecting the appropriate share structure between partly paid shares and issued shares depends on a company's capital requirements and shareholder obligations. Partly paid shares offer flexibility in capital calls without immediate full payment, aiding cash flow management and phased investment. Issued shares, fully paid at issuance, provide clearer ownership and straightforward dividend rights, suitable for companies seeking immediate full capital mobilization.

Partly Paid Shares Infographic

libterm.com

libterm.com