Traditional venture capital focuses on investing in early-stage startups with high growth potential, often providing both funding and strategic support. This model typically involves venture capital firms pooling resources from limited partners to back innovative companies in exchange for equity. Explore the rest of the article to understand how traditional venture capital can impact your startup journey and investment strategies.

Table of Comparison

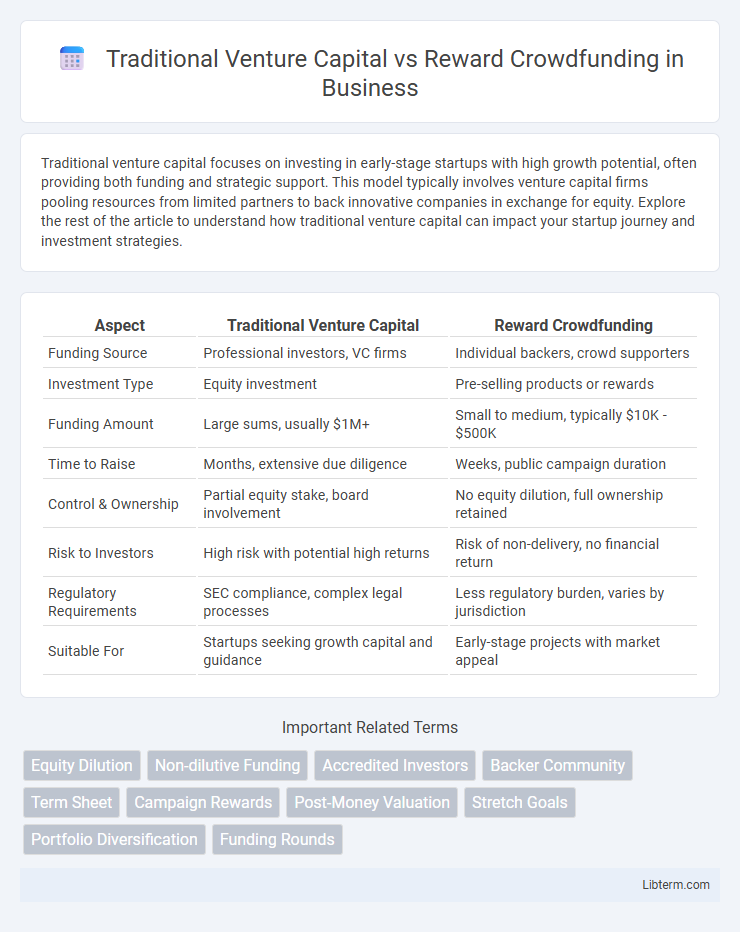

| Aspect | Traditional Venture Capital | Reward Crowdfunding |

|---|---|---|

| Funding Source | Professional investors, VC firms | Individual backers, crowd supporters |

| Investment Type | Equity investment | Pre-selling products or rewards |

| Funding Amount | Large sums, usually $1M+ | Small to medium, typically $10K - $500K |

| Time to Raise | Months, extensive due diligence | Weeks, public campaign duration |

| Control & Ownership | Partial equity stake, board involvement | No equity dilution, full ownership retained |

| Risk to Investors | High risk with potential high returns | Risk of non-delivery, no financial return |

| Regulatory Requirements | SEC compliance, complex legal processes | Less regulatory burden, varies by jurisdiction |

| Suitable For | Startups seeking growth capital and guidance | Early-stage projects with market appeal |

Introduction to Startup Financing Methods

Traditional venture capital involves raising funds through institutional investors who acquire equity stakes and often seek significant control and high returns, typically during later startup stages. Reward crowdfunding enables startups to secure capital by offering non-monetary incentives or early product access to a broad base of backers, making it suitable for early-stage ventures with consumer-facing innovations. Both methods provide crucial financial resources, but they differ in investor involvement, scalability, and risk distribution for startup founders.

Overview of Traditional Venture Capital

Traditional venture capital involves institutional investors providing substantial funding to startups in exchange for equity, typically during early-stage growth phases. This method requires rigorous due diligence, offering not only capital but also strategic guidance, industry connections, and governance oversight. Venture capital firms seek high-growth potential companies with scalable business models, aiming for significant returns through eventual exits such as IPOs or acquisitions.

Understanding Reward Crowdfunding

Reward crowdfunding enables startups to raise capital by offering non-financial incentives such as products or services in exchange for contributions, fostering direct engagement with backers. Unlike traditional venture capital, which requires equity stakes and stringent vetting processes, reward crowdfunding provides accessible funding without ownership dilution or complex negotiations. This model leverages social validation and marketing benefits, making it a strategic choice for creative projects and early-stage businesses seeking community support.

Key Differences Between Venture Capital and Reward Crowdfunding

Traditional venture capital involves investors providing equity funding to startups in exchange for ownership stakes, focusing on long-term financial returns and active involvement in business decisions. Reward crowdfunding allows entrepreneurs to raise capital from a large number of backers by offering non-financial incentives or products, without giving up equity or control. The key differences between venture capital and reward crowdfunding include the nature of funding (equity vs. pre-sales), investor involvement, risk levels, and the scalability of capital raised.

Investment Requirements and Access

Traditional venture capital requires startups to meet rigorous criteria, including proven traction, scalable business models, and often substantial equity offerings to attract high-net-worth investors or institutional funds. Reward crowdfunding provides easier access to capital by enabling entrepreneurs to raise smaller amounts from a broad base of backers without relinquishing equity, appealing to early-stage projects or consumer-focused innovations. Investment requirements for reward crowdfunding are minimal, often centered on creating compelling pitch campaigns, while traditional venture capital demands detailed financial projections and due diligence documentation.

Risk and Return Profiles

Traditional venture capital involves high risk but offers the potential for substantial returns through equity stakes in startups, with investors often actively participating in company growth. Reward crowdfunding presents lower financial risk as backers receive non-monetary rewards instead of equity, resulting in limited or no financial return. While venture capital targets exponential gains from successful exits, reward crowdfunding primarily supports early-stage product funding with minimal financial upside.

Control and Equity Considerations

Traditional venture capital involves exchanging significant equity stakes for substantial control and strategic decision-making authority in a startup, often leading to diluted ownership for founders. Reward crowdfunding allows entrepreneurs to raise funds without giving up equity or control, appealing to those seeking capital while maintaining full ownership and operational independence. Equity considerations differ as venture capitalists seek financial returns through equity appreciation, whereas reward crowdfunding contributors receive non-financial rewards, minimizing founder dilution and control loss.

Impact on Startup Growth and Development

Traditional venture capital provides startups with significant funding and strategic guidance, enabling accelerated growth and scalability through experienced networks and resources. Reward crowdfunding offers access to early customer validation and market feedback, fostering product development and brand awareness without diluting equity. While venture capital drives rapid expansion and operational maturity, crowdfunding empowers startups to build community engagement and incremental development.

Suitability for Different Business Models

Traditional venture capital suits high-growth startups with scalable business models, substantial funding needs, and a clear exit strategy, typically in technology or biotech sectors. Reward crowdfunding fits creative projects, early-stage consumer products, or community-driven initiatives that benefit from market validation and customer engagement without giving up equity. Each funding model aligns differently with business goals, risk tolerance, and industry characteristics, making the choice critical for sustainable growth.

Future Trends in Startup Funding

Future trends in startup funding indicate a growing shift from traditional venture capital, which relies on significant equity stakes and stringent due diligence, toward reward crowdfunding that leverages community engagement and early customer validation. Emerging technologies and platforms are enhancing transparency, allowing startups to access diverse funding sources while reducing reliance on a few major investors. The increasing adoption of decentralized finance (DeFi) and blockchain technology is expected to integrate with reward crowdfunding, creating more secure and efficient funding mechanisms for startups worldwide.

Traditional Venture Capital Infographic

libterm.com

libterm.com