Cost accounting provides detailed insights into a company's production costs, helping to identify areas where expenses can be reduced and efficiency improved. By analyzing direct and indirect costs, businesses can make informed decisions to optimize pricing strategies and enhance profitability. Discover how mastering cost accounting can empower your financial management by reading the rest of the article.

Table of Comparison

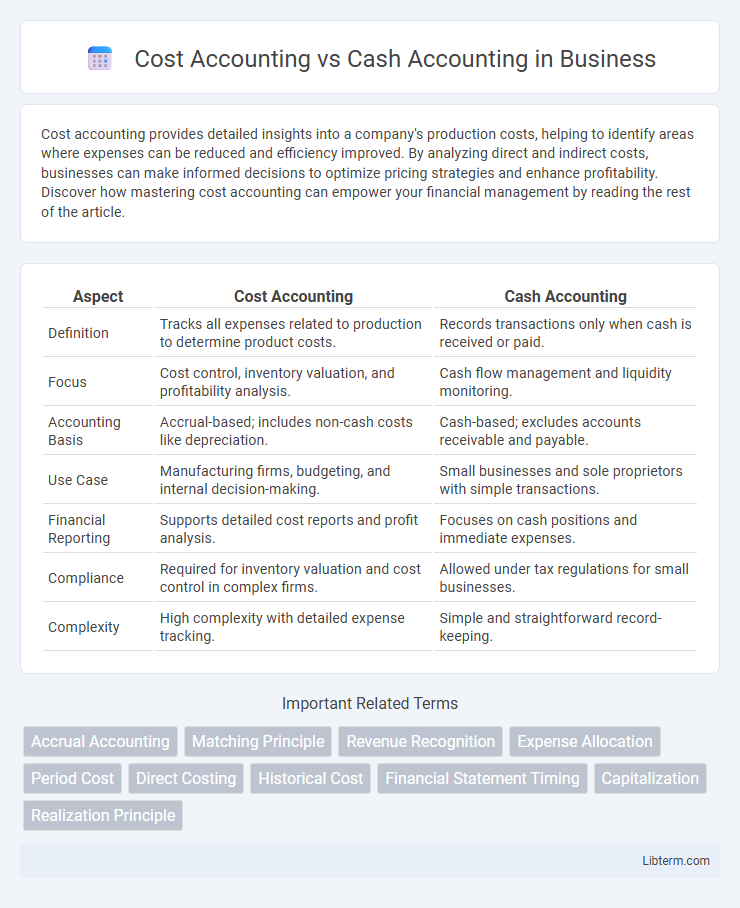

| Aspect | Cost Accounting | Cash Accounting |

|---|---|---|

| Definition | Tracks all expenses related to production to determine product costs. | Records transactions only when cash is received or paid. |

| Focus | Cost control, inventory valuation, and profitability analysis. | Cash flow management and liquidity monitoring. |

| Accounting Basis | Accrual-based; includes non-cash costs like depreciation. | Cash-based; excludes accounts receivable and payable. |

| Use Case | Manufacturing firms, budgeting, and internal decision-making. | Small businesses and sole proprietors with simple transactions. |

| Financial Reporting | Supports detailed cost reports and profit analysis. | Focuses on cash positions and immediate expenses. |

| Compliance | Required for inventory valuation and cost control in complex firms. | Allowed under tax regulations for small businesses. |

| Complexity | High complexity with detailed expense tracking. | Simple and straightforward record-keeping. |

Introduction to Cost Accounting and Cash Accounting

Cost accounting tracks all costs associated with production, including fixed and variable expenses, to help businesses analyze profitability and control operations. Cash accounting records financial transactions only when cash changes hands, providing a straightforward view of cash flow but lacking insight into accrued expenses and revenues. Understanding the differences between cost accounting and cash accounting allows businesses to choose appropriate methods for financial planning, budgeting, and decision-making.

Key Definitions and Concepts

Cost accounting tracks and analyzes all costs involved in producing goods or services to help businesses control expenses and set pricing strategies. Cash accounting records revenues and expenses only when cash transactions occur, providing a straightforward view of cash flow but not reflecting accrued income or liabilities. Understanding the distinction between accumulated costs in cost accounting and actual cash movements in cash accounting is crucial for accurate financial analysis and decision-making.

Core Principles of Cost Accounting

Cost accounting emphasizes the systematic recording, analysis, and allocation of production costs, focusing on direct materials, labor, and overhead to determine the cost of goods manufactured. It supports managerial decision-making by providing detailed insights into cost behavior, budgeting, and performance evaluation. Unlike cash accounting, which records transactions based on cash flow timing, cost accounting centers on accurate cost measurement regardless of payment dates, enabling precise cost control and profitability analysis.

Core Principles of Cash Accounting

Cash accounting records transactions only when cash is exchanged, emphasizing actual cash flow and simplicity, ideal for small businesses and individuals. Core principles include recognizing income only upon receipt and expenses only when paid, ensuring clear tracking of cash availability and financial liquidity. This method contrasts with cost accounting, which focuses on allocating costs to products or services for internal decision-making rather than real-time cash movements.

Major Differences Between Cost and Cash Accounting

Cost accounting tracks all expenses related to production, including direct materials, labor, and overhead, providing detailed insights into manufacturing costs and inventory valuation. Cash accounting records transactions only when cash changes hands, focusing on actual cash inflows and outflows without considering accounts receivable or payable. The primary difference lies in cost accounting's emphasis on expense allocation and profit analysis, whereas cash accounting prioritizes cash flow monitoring and simple transaction recording.

Advantages of Cost Accounting

Cost accounting provides detailed insights into production costs, enabling businesses to identify inefficiencies and optimize resource allocation for improved profitability. It supports accurate budgeting and strategic planning by tracking variable and fixed costs comprehensively. Unlike cash accounting, cost accounting facilitates informed decision-making through real-time cost control and performance evaluation.

Advantages of Cash Accounting

Cash accounting offers the advantage of simplicity and ease of tracking actual cash flow, making it ideal for small businesses with straightforward financial activities. This method provides a clear, real-time view of income and expenses by recording transactions only when cash changes hands, enhancing cash management and reducing the complexity of accounting processes. Furthermore, cash accounting helps in avoiding tax liabilities on income not yet received, offering potential tax deferral benefits for businesses.

Disadvantages and Limitations of Both Methods

Cost accounting often fails to provide a real-time financial picture since it includes non-cash expenses like depreciation, leading to potential misinterpretation of cash flow health. Cash accounting ignores accrued expenses and revenues, which can distort long-term financial performance and mislead stakeholders about actual profitability. Both methods present limitations: cost accounting complicates cash management decisions, while cash accounting lacks comprehensive insight into operational costs and liabilities.

Choosing the Right Accounting Method for Your Business

Selecting the appropriate accounting method hinges on your business size, industry, and financial goals, with cost accounting providing detailed insights into production expenses, ideal for manufacturing and inventory management. Cash accounting, tracking actual cash flow, suits small businesses and freelancers seeking simplicity and clear cash position. Evaluating factors like regulatory requirements, tax implications, and financial reporting needs ensures the chosen method optimally supports strategic decision-making and operational efficiency.

Summary and Final Thoughts

Cost accounting provides detailed insights into manufacturing and operational expenses, enabling precise product costing and profitability analysis. Cash accounting tracks actual cash inflows and outflows, offering simplicity and real-time cash flow management ideal for small businesses. Choosing between cost and cash accounting depends on organizational complexity and the need for internal cost control versus straightforward cash tracking.

Cost Accounting Infographic

libterm.com

libterm.com