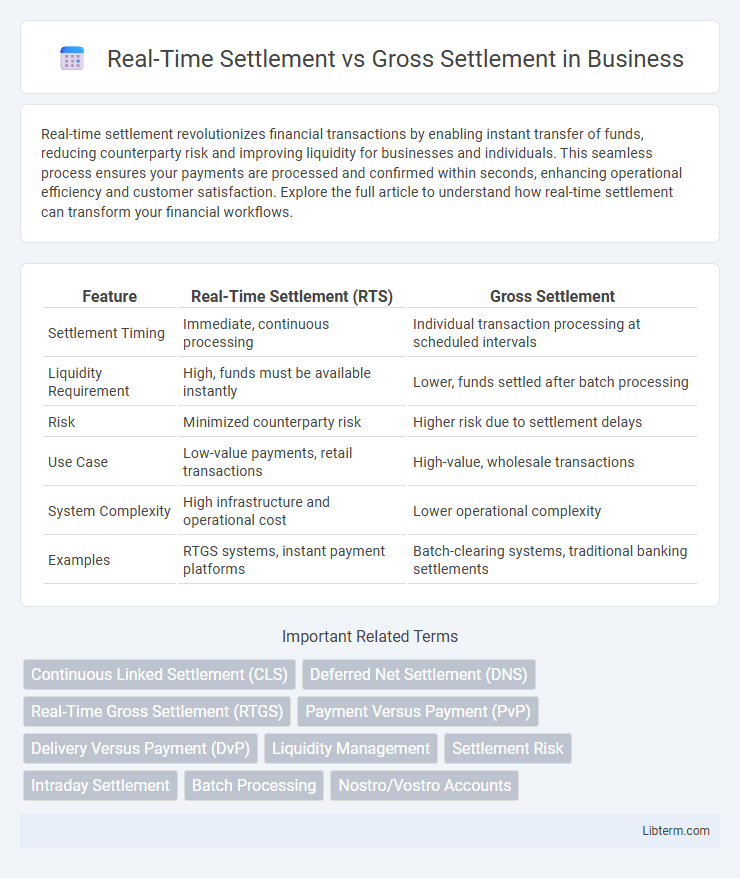

Real-time settlement revolutionizes financial transactions by enabling instant transfer of funds, reducing counterparty risk and improving liquidity for businesses and individuals. This seamless process ensures your payments are processed and confirmed within seconds, enhancing operational efficiency and customer satisfaction. Explore the full article to understand how real-time settlement can transform your financial workflows.

Table of Comparison

| Feature | Real-Time Settlement (RTS) | Gross Settlement |

|---|---|---|

| Settlement Timing | Immediate, continuous processing | Individual transaction processing at scheduled intervals |

| Liquidity Requirement | High, funds must be available instantly | Lower, funds settled after batch processing |

| Risk | Minimized counterparty risk | Higher risk due to settlement delays |

| Use Case | Low-value payments, retail transactions | High-value, wholesale transactions |

| System Complexity | High infrastructure and operational cost | Lower operational complexity |

| Examples | RTGS systems, instant payment platforms | Batch-clearing systems, traditional banking settlements |

Introduction to Payment Settlement Systems

Real-time settlement processes transactions instantly, ensuring immediate transfer of funds between accounts, while gross settlement processes each transaction individually without netting, providing finality per transfer. Payment settlement systems facilitate secure, efficient financial transactions by managing the timing and method of fund transfers, crucial for liquidity and risk management. Understanding the distinction between real-time and gross settlement is vital for optimizing payment infrastructure and aligning with regulatory compliance standards.

Understanding Real-Time Settlement

Real-time settlement refers to the immediate transfer and finalization of funds between parties upon transaction initiation, eliminating settlement risk and enhancing liquidity management. Unlike gross settlement systems, which process transactions individually without netting, real-time settlement ensures instant clearing and minimizes counterparty risk. This mechanism is crucial in high-frequency financial markets where timely fund availability impacts operational efficiency and risk mitigation.

What is Gross Settlement?

Gross Settlement refers to the process where each financial transaction is settled individually and immediately on a one-to-one basis without netting debits against credits. This method ensures finality and irrevocability in payments, reducing settlement risk by processing transactions in real time. Real-Time Gross Settlement (RTGS) systems are widely used by central banks and large financial institutions for high-value and time-critical payments.

Key Differences Between Real-Time and Gross Settlement

Real-Time Settlement processes transactions individually and instantaneously, ensuring funds are immediately available, whereas Gross Settlement processes each payment separately but may involve delays due to batch processing or clearing cycles. Real-Time Settlement systems, like RTGS, reduce settlement risk by finalizing payments instantly, while Gross Settlement can expose participants to credit risk until transactions complete. The core difference lies in timing and risk management: Real-Time Settlement achieves immediate finality, whereas Gross Settlement prioritizes sequential processing but may compromise on speed and immediacy.

Transaction Speed and Efficiency

Real-Time Settlement processes transactions instantly, enhancing transaction speed by eliminating delays between initiation and finalization, which significantly improves liquidity and operational efficiency for financial institutions. In contrast, Gross Settlement settles each transaction individually and immediately, ensuring finality but often requires higher liquidity reserves and infrastructure to handle peak volumes without delays. Comparing both, Real-Time Settlement optimizes transaction throughput and can reduce systemic risk, while Gross Settlement provides absolute finality but may face scalability challenges impacting overall efficiency.

Risk Management in Settlements

Real-time settlement significantly reduces settlement risk by ensuring transactions are processed individually and instantly, minimizing exposure to counterparty default. In contrast, gross settlement systems handle transactions separately but may delay finality, increasing liquidity risk and the potential for payment failures. Effective risk management in settlements prioritizes real-time systems to enhance liquidity control and reduce systemic risk in financial markets.

Cost Implications of Each Method

Real-Time Settlement (RTS) typically incurs lower operational costs due to continuous transaction processing, reducing the need for large liquidity reserves and minimizing settlement risk. In contrast, Gross Settlement requires higher liquidity as each transaction is settled individually on a one-to-one basis, leading to increased funding costs and potential inefficiencies. Financial institutions favor RTS for cost efficiency in high-frequency payment systems, while Gross Settlement ensures security in large-value transactions despite its higher expenses.

Use Cases and Practical Applications

Real-time settlement systems, such as Continuous Linked Settlement (CLS) in foreign exchange, enable immediate transfer of funds, minimizing credit risk and improving liquidity management for financial institutions and corporates. Gross settlement systems, exemplified by the Real-Time Gross Settlement (RTGS) systems used by central banks worldwide, facilitate the high-value interbank payments individually and irrevocably, ensuring finality and reducing systemic risk. Real-time settlement suits retail transactions and high-frequency trading, while gross settlement is essential for large-value, time-critical payments like interbank transfers and central bank operations.

Challenges and Limitations

Real-Time Settlement systems face challenges such as higher operational costs, increased liquidity demands, and the need for continuous system availability to process transactions instantly. Gross Settlement systems encounter limitations related to delayed finality and potential settlement risks, as transactions are processed individually, often requiring longer clearing cycles. Both systems must address complexities in managing liquidity, risk, and infrastructure resilience to ensure efficient and secure payment settlements.

Future Trends in Settlement Systems

Real-time settlement systems are increasingly favored for their ability to reduce counterparty risk by processing transactions instantly, whereas gross settlement processes each transaction individually but can create liquidity strains. Future trends indicate a convergence of these models through hybrid systems leveraging blockchain and distributed ledger technologies to enhance transparency, speed, and security. Integration of AI and machine learning is also expected to optimize liquidity management and reduce settlement failures across both settlement types.

Real-Time Settlement Infographic

libterm.com

libterm.com