EBITDA, or Earnings Before Interest, Taxes, Depreciation, and Amortization, is a key financial metric used to assess a company's operating performance by focusing on its core profitability. This measure helps investors and analysts evaluate how efficiently a business generates earnings from its operations without the influence of financial and accounting decisions. Discover how understanding EBITDA can enhance your insight into a company's financial health by reading further.

Table of Comparison

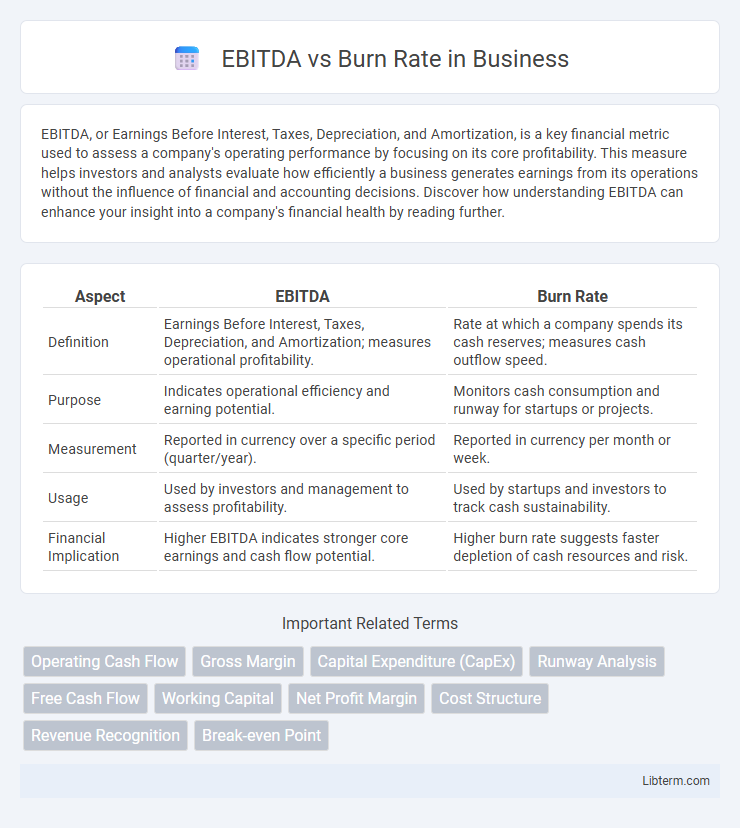

| Aspect | EBITDA | Burn Rate |

|---|---|---|

| Definition | Earnings Before Interest, Taxes, Depreciation, and Amortization; measures operational profitability. | Rate at which a company spends its cash reserves; measures cash outflow speed. |

| Purpose | Indicates operational efficiency and earning potential. | Monitors cash consumption and runway for startups or projects. |

| Measurement | Reported in currency over a specific period (quarter/year). | Reported in currency per month or week. |

| Usage | Used by investors and management to assess profitability. | Used by startups and investors to track cash sustainability. |

| Financial Implication | Higher EBITDA indicates stronger core earnings and cash flow potential. | Higher burn rate suggests faster depletion of cash resources and risk. |

Introduction to EBITDA and Burn Rate

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) measures a company's operational profitability by excluding non-operational expenses, offering insight into core financial performance. Burn Rate indicates how quickly a startup or company expends its cash reserves, directly reflecting cash flow sustainability and operational runway. Understanding both EBITDA and Burn Rate is crucial for evaluating business health, cash management, and long-term viability.

Defining EBITDA: Key Features and Calculation

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) measures a company's operating performance by excluding non-operational expenses, providing a clear view of core profitability. Key features include its focus on cash flow potential and operational efficiency, excluding accounting decisions and financial structure impacts. Calculating EBITDA involves adding net income, interest, taxes, depreciation, and amortization expenses to isolate earnings from core operations.

Understanding Burn Rate: What It Means for Startups

Burn rate measures the speed at which a startup spends its capital, reflecting the cash consumed monthly before reaching profitability. Unlike EBITDA, which evaluates operational profitability by excluding interest, taxes, depreciation, and amortization, burn rate focuses on cash flow and runway duration. Understanding burn rate is crucial for startups to manage resources effectively and ensure sufficient funding during growth phases.

Importance of EBITDA in Financial Analysis

EBITDA serves as a critical metric in financial analysis by measuring a company's operating performance and profitability before accounting for interest, taxes, depreciation, and amortization. It provides investors and analysts with a clear view of cash flow generated from core operations, enabling better assessment of financial health compared to burn rate, which primarily tracks cash outflow. Understanding EBITDA allows stakeholders to evaluate operational efficiency and sustainability, crucial for decision-making in both growth and crisis scenarios.

Significance of Burn Rate in Cash Flow Management

Burn Rate is critical in cash flow management as it quantifies the rate at which a company depletes its cash reserves, providing a clear indicator of financial runway and sustainability. Unlike EBITDA, which measures operational profitability by excluding non-cash expenses, Burn Rate directly reflects cash outflows and liquidity risks. Understanding Burn Rate enables startups and growing businesses to strategically plan funding requirements and operational adjustments to avoid insolvency.

EBITDA vs Burn Rate: Core Differences

EBITDA measures a company's operating profitability by excluding non-operating expenses such as interest, taxes, depreciation, and amortization, providing insight into core business performance. Burn rate quantifies the negative cash flow rate, showing how quickly a company is spending its available capital, crucial for startups and businesses reliant on external funding. The core difference lies in EBITDA reflecting operational earnings while burn rate highlights cash consumption and financial runway.

When to Focus on EBITDA vs Burn Rate

Focus on EBITDA when assessing a company's operational profitability and cash flow generation, essential for evaluating long-term financial health and investment potential. Burn Rate becomes critical for startups and high-growth companies that rely on external funding, as it measures the speed at which cash reserves are depleted. Prioritize EBITDA analysis in stable or profitable businesses while emphasizing Burn Rate monitoring during early-stage growth or cash flow constraints.

Impact of EBITDA and Burn Rate on Investor Decisions

EBITDA provides investors with a clear picture of a company's operational profitability, influencing decisions by highlighting sustainable earnings before interest, taxes, depreciation, and amortization. Burn rate signals the pace at which a startup or business exhausts its available capital, directly impacting investor confidence regarding the company's runway and need for further funding. Investors weigh EBITDA to assess financial health and use burn rate to evaluate urgency and risk, shaping investment strategies and valuation expectations.

Common Mistakes When Evaluating EBITDA and Burn Rate

Confusing EBITDA with burn rate often leads to misjudging a company's financial health since EBITDA measures earnings before interest, taxes, depreciation, and amortization, while burn rate indicates cash outflow speed. Ignoring non-cash expenses in EBITDA can create an inflated perception of profitability, whereas overlooking operational cash needs in burn rate analysis misrepresents the company's runway. Accurate evaluation requires understanding that EBITDA focuses on operating performance, whereas burn rate centers on liquidity and cash sustainability.

Best Practices for Managing Both Metrics

Effective management of EBITDA and burn rate requires continuous monitoring of operational efficiency and cash flow to ensure sustainable growth. Companies should implement detailed financial forecasting, aligning expense controls with revenue generation to maintain a positive EBITDA while mitigating excessive cash burn. Regular analysis of these metrics enables timely adjustments in business strategy, optimizing resource allocation and extending runway for startups or high-growth enterprises.

EBITDA Infographic

libterm.com

libterm.com