Forfeiture involves the legal process where an individual loses property or assets due to involvement in unlawful activities or breach of a contractual clause. Understanding the complexities of civil and criminal forfeiture procedures is crucial to protect your rights and property effectively. Discover more about how forfeiture laws impact you and the steps to take in the full article.

Table of Comparison

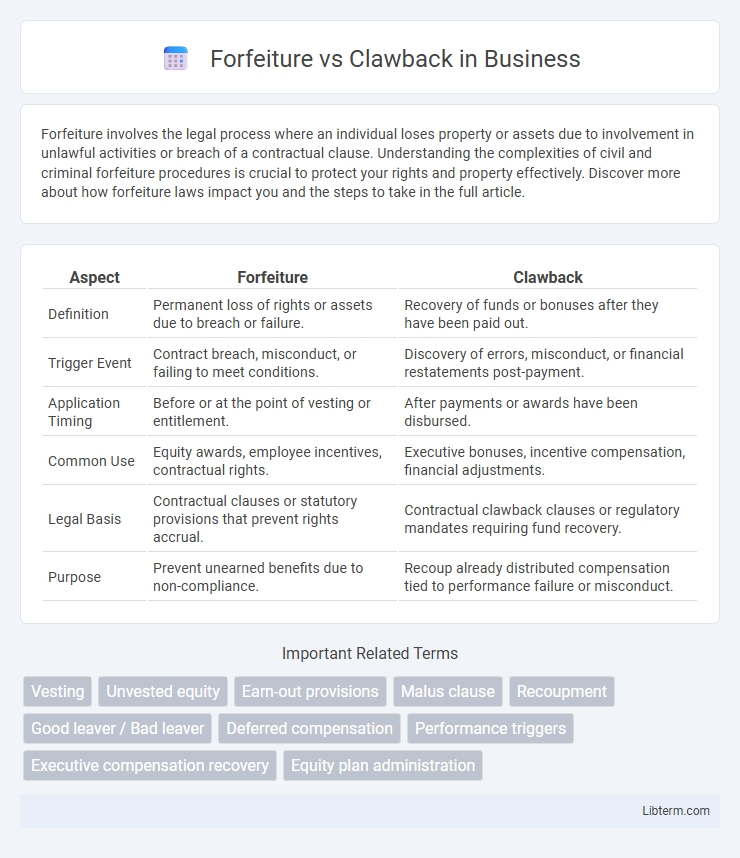

| Aspect | Forfeiture | Clawback |

|---|---|---|

| Definition | Permanent loss of rights or assets due to breach or failure. | Recovery of funds or bonuses after they have been paid out. |

| Trigger Event | Contract breach, misconduct, or failing to meet conditions. | Discovery of errors, misconduct, or financial restatements post-payment. |

| Application Timing | Before or at the point of vesting or entitlement. | After payments or awards have been disbursed. |

| Common Use | Equity awards, employee incentives, contractual rights. | Executive bonuses, incentive compensation, financial adjustments. |

| Legal Basis | Contractual clauses or statutory provisions that prevent rights accrual. | Contractual clawback clauses or regulatory mandates requiring fund recovery. |

| Purpose | Prevent unearned benefits due to non-compliance. | Recoup already distributed compensation tied to performance failure or misconduct. |

Introduction: Understanding Forfeiture and Clawback

Forfeiture refers to the loss of rights or assets as a result of violating contractual or legal obligations, often applied in employee compensation or investment agreements. Clawback is a mechanism used by organizations to reclaim money or benefits previously granted, typically in cases of fraud, misconduct, or financial restatements. Both concepts play critical roles in ensuring accountability and compliance in corporate governance and financial management.

Defining Forfeiture: Key Concepts and Applications

Forfeiture involves the loss of rights, property, or money as a penalty for violating laws or contractual terms, commonly applied in legal and financial contexts. Key concepts include automatic forfeiture when certain conditions are breached, such as in employee stock options or criminal asset seizures. Applications of forfeiture range from contractual penalties in business agreements to government actions to reclaim ill-gotten gains or enforce compliance.

What Is a Clawback? Overview and Purpose

A clawback is a contractual provision allowing an employer to reclaim previously paid compensation or bonuses if specific conditions, such as financial restatements, misconduct, or failure to meet performance targets, are met. It serves to protect companies from losses caused by employee actions or errors and incentivizes accountability and ethical behavior. Clawbacks are commonly used in executive compensation agreements, especially in industries with regulatory compliance requirements like finance and healthcare.

Legal Framework: Forfeiture vs. Clawback

Forfeiture involves the permanent loss of assets or rights as a penalty under criminal or civil law, typically governed by statutes related to asset seizure in illegal activities. Clawback provisions, embedded in contract law or corporate governance policies, allow the recovery of bonuses, incentives, or compensation if certain conditions, such as misconduct or financial restatements, occur. The legal framework for forfeiture centers on public law enforcement mechanisms, while clawback is primarily a civil remedy focused on correcting unjust enrichment within private agreements.

Use Cases: Common Scenarios for Forfeiture

Forfeiture typically occurs in employment contracts when an employee leaves a company before the vesting period of stock options or bonuses, resulting in the loss of unvested benefits. This mechanism is common in incentive-based compensation plans to align employee behavior with long-term company goals. Forfeiture also applies in legal contexts where assets tied to criminal activity are surrendered to authorities before final judgment.

Clawback Provisions: Where and Why They Apply

Clawback provisions commonly apply in executive compensation agreements, financial services, and government contracts to recoup bonuses or incentives tied to misstated earnings or misconduct. These clauses protect organizations by enabling recovery of funds when performance metrics are later revised or regulatory breaches occur. Industries like banking and public companies often face stringent clawback rules to promote accountability and deter fraud.

Comparative Analysis: Key Differences Between Forfeiture and Clawback

Forfeiture involves the loss of rights or property without compensation due to breach of contract or failure to meet specified conditions, often seen in employee stock options or bonuses. Clawback refers to the recovery of previously disbursed funds or benefits, typically triggered by misconduct, financial restatements, or violation of company policies. The key difference lies in timing and intent: forfeiture prevents future entitlement, while clawback retrieves already granted compensation.

Financial and Tax Implications

Forfeiture involves the permanent loss of assets or compensation, often resulting in immediate tax consequences where the forfeited amount is not deductible. Clawback provisions require repayment of previously received funds, potentially triggering complex tax adjustments, including amendments to income declarations or tax credits. Both mechanisms affect financial statements by altering liabilities and equity, influencing corporate tax planning and compliance strategies.

Best Practices for Employers and Employees

Employers and employees should clearly define forfeiture and clawback policies in employment contracts to ensure transparency and legal compliance. Regular training on these clauses helps both parties understand conditions under which bonuses or benefits may be reclaimed, minimizing disputes. Implementing consistent documentation and communication practices supports enforceability and fosters trust in managing compensation adjustments.

Conclusion: Choosing the Right Approach

Forfeiture and clawback both serve as essential mechanisms for recovering incentives or compensation in cases of misconduct or failure to meet agreed terms, but they differ in timing and enforceability. Selecting the right approach depends on factors such as the contractual framework, legal jurisdiction, and the specific circumstances surrounding the breach or violation. Carefully evaluating these elements ensures the chosen method effectively enforces accountability while minimizing legal risks and operational disruption.

Forfeiture Infographic

libterm.com

libterm.com