Private equity involves investing in private companies or buying out public companies to restructure and grow their value before eventually selling at a profit. This strategy leverages deep market analysis and active management to unlock potential, offering high risks alongside significant returns. Explore the full article to understand how private equity can impact your investment portfolio and wealth growth.

Table of Comparison

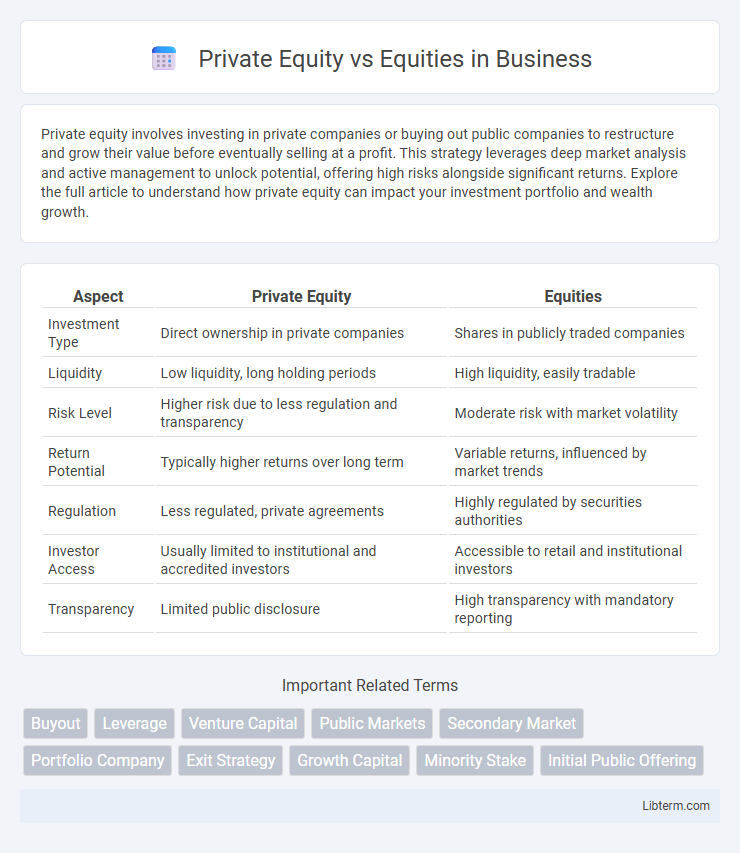

| Aspect | Private Equity | Equities |

|---|---|---|

| Investment Type | Direct ownership in private companies | Shares in publicly traded companies |

| Liquidity | Low liquidity, long holding periods | High liquidity, easily tradable |

| Risk Level | Higher risk due to less regulation and transparency | Moderate risk with market volatility |

| Return Potential | Typically higher returns over long term | Variable returns, influenced by market trends |

| Regulation | Less regulated, private agreements | Highly regulated by securities authorities |

| Investor Access | Usually limited to institutional and accredited investors | Accessible to retail and institutional investors |

| Transparency | Limited public disclosure | High transparency with mandatory reporting |

Introduction to Private Equity and Equities

Private equity involves investing directly in private companies or conducting buyouts of public companies to delist them from stock exchanges, targeting long-term value creation and higher returns through active management. Equities represent ownership shares in publicly traded companies, offering liquidity and market-driven price fluctuations while enabling investors to participate in dividends and capital appreciation. Understanding the fundamental differences in risk, liquidity, and investment horizons between private equity and equities is essential for informed portfolio diversification.

Key Definitions: Private Equity vs. Public Equities

Private equity refers to investments made directly into private companies or buyouts of public companies that result in their delisting, focusing on long-term value creation through active management and operational improvements. Public equities represent shares traded on stock exchanges, offering liquidity and transparent pricing, reflecting ownership in publicly listed companies. Private equity investments are illiquid with longer investment horizons, while public equities provide daily liquidity and market-driven valuation.

Investment Structures and Accessibility

Private equity investments involve committing capital to privately held companies through limited partnership structures, often requiring substantial minimum investments and long lock-up periods. Equities represent shares traded on public stock exchanges, offering higher liquidity and easier access for individual investors via brokerage accounts. The structural differences impact risk profiles, investment horizons, and accessibility, with private equity favoring institutional and high-net-worth investors, while equities cater to a broad retail market.

Risk and Return Profiles

Private equity investments typically exhibit higher risk and potential for superior returns compared to public equities due to their illiquid nature and longer investment horizons. Public equities offer greater liquidity and transparency, resulting in more moderate risk and more predictable, though generally lower, returns. Institutional investors often allocate to private equity to achieve diversification benefits and enhance portfolio performance despite increased risk exposure.

Liquidity Differences Explained

Private equity investments typically have lower liquidity compared to publicly traded equities due to longer lock-in periods and limited secondary markets. Equities offer higher liquidity, allowing investors to buy and sell shares quickly on stock exchanges with minimal price impact. This difference significantly impacts portfolio flexibility and risk management strategies for investors.

Time Horizons and Exit Strategies

Private equity investments typically involve longer time horizons, ranging from five to ten years, as firms seek to enhance portfolio company value before exit. Exit strategies for private equity often include initial public offerings (IPOs), mergers and acquisitions (M&A), or secondary sales to realize returns. In contrast, public equities offer more liquidity and shorter investment durations, with investors able to buy or sell shares readily in stock markets.

Due Diligence and Transparency

Private equity due diligence involves comprehensive analysis of financials, management teams, market conditions, and operational risks, often requiring access to detailed, non-public information. Equities benefit from higher transparency due to regulatory requirements, with publicly available financial statements and disclosures providing investors with standardized data. The rigorous, bespoke nature of private equity due diligence contrasts with the more accessible, real-time transparency characteristic of public equity markets.

Regulatory Environment and Compliance

Private equity operates within a distinct regulatory environment characterized by less stringent disclosure requirements compared to publicly traded equities, allowing for greater flexibility in investment strategies. Regulatory frameworks such as the Investment Company Act of 1940 and the Dodd-Frank Act impose compliance obligations on private equity firms, including registration and reporting, yet these are often less rigorous than the Securities Exchange Act mandates governing equities. Equities face continuous disclosure rules enforced by the SEC, ensuring transparency, market fairness, and investor protection through periodic filings like 10-K and 10-Q reports.

Fee Structures and Cost Considerations

Private equity typically involves higher fee structures, including a management fee of around 2% of committed capital and a performance fee of 20% on profits, known as carried interest, whereas traditional equities often incur lower fees, primarily brokerage commissions and management fees averaging 0.5% to 1%. Cost considerations for private equity also include longer lock-up periods and less liquidity, resulting in higher opportunity costs, while equities offer greater liquidity and more transparent pricing. Investors must weigh the total cost impact, including fees, liquidity constraints, and the potential for higher returns in private equity compared to the lower-cost, more liquid nature of public equities.

Choosing Between Private Equity and Equities

Choosing between private equity and equities depends on your investment goals, risk tolerance, and liquidity preferences. Private equity offers access to high-growth private companies with potential for substantial returns but entails longer investment horizons and lower liquidity compared to public equities. Equities provide easier market access, daily liquidity, and transparent valuation, making them suitable for investors seeking flexibility and regular income through dividends.

Private Equity Infographic

libterm.com

libterm.com