Non-controlling interest represents the portion of equity ownership in a subsidiary not attributable to the parent company, reflecting third-party shareholders' stake. This interest affects consolidated financial statements by showing the share of net assets and profits belonging to minority shareholders. Discover how understanding non-controlling interest can enhance your grasp of corporate financial structures in the rest of this article.

Table of Comparison

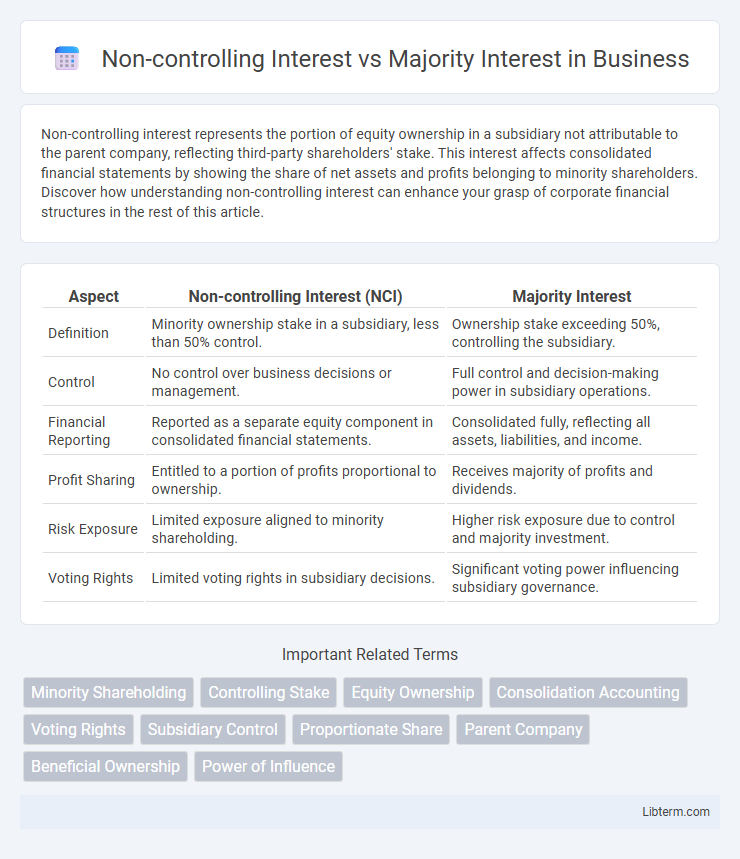

| Aspect | Non-controlling Interest (NCI) | Majority Interest |

|---|---|---|

| Definition | Minority ownership stake in a subsidiary, less than 50% control. | Ownership stake exceeding 50%, controlling the subsidiary. |

| Control | No control over business decisions or management. | Full control and decision-making power in subsidiary operations. |

| Financial Reporting | Reported as a separate equity component in consolidated financial statements. | Consolidated fully, reflecting all assets, liabilities, and income. |

| Profit Sharing | Entitled to a portion of profits proportional to ownership. | Receives majority of profits and dividends. |

| Risk Exposure | Limited exposure aligned to minority shareholding. | Higher risk exposure due to control and majority investment. |

| Voting Rights | Limited voting rights in subsidiary decisions. | Significant voting power influencing subsidiary governance. |

Introduction to Ownership Interests

Non-controlling interest represents the equity stake in a subsidiary held by shareholders other than the parent company, reflecting partial ownership without control. Majority interest indicates ownership exceeding 50%, granting control and decision-making authority over the subsidiary's operations and financial policies. Understanding the distinction between non-controlling and majority interests is vital for accurately consolidating financial statements and assessing governance influence.

Defining Non-Controlling Interest

Non-controlling interest (NCI) refers to the equity stake in a subsidiary not owned by the parent company, representing the minority shareholders' claim on net assets and earnings. It is reported in the consolidated financial statements to show the portion of equity and net income attributable to these minority shareholders, distinct from the majority interest held by the parent entity. Understanding non-controlling interest is crucial for accurate valuation, financial performance assessment, and allocation of profits between controlling and non-controlling shareholders.

Understanding Majority Interest

Majority interest represents ownership of more than 50% of a company's voting shares, granting control over corporate decisions and the ability to influence board appointments. This controlling stake allows majority shareholders to consolidate financial statements and determine company policies, reflecting full operational control. The distinction from non-controlling interest is crucial, as non-controlling shareholders hold less than 50% ownership and lack decision-making power, resulting in minority influence on corporate governance.

Key Differences Between Non-Controlling and Majority Interest

Non-controlling interest represents ownership in a subsidiary held by shareholders other than the parent company, often reflecting less than 50% ownership and lacking control over key decisions. Majority interest signifies ownership exceeding 50%, granting control and the ability to influence or direct corporate policies and operations. Key differences include control rights, consolidation in financial statements, and influence on strategic decisions, with majority interest holders consolidating financials while non-controlling interests are reported as minority shareholders.

Rights and Responsibilities of Non-Controlling Shareholders

Non-controlling shareholders possess limited voting rights compared to majority shareholders, typically restricting their influence over major corporate decisions and board appointments. Their responsibilities include safeguarding their investment by monitoring management performance and exercising voting rights in annual general meetings, while they do not bear full liability for company obligations. Non-controlling interest reflects the equity stake held by minority shareholders, highlighting their economic interests without conferring proportional control over corporate governance.

Powers and Privileges of Majority Interest Holders

Majority interest holders possess controlling powers, including the ability to influence key corporate decisions such as appointing board members, approving mergers, and setting strategic direction. They hold privileges that enable them to dictate voting outcomes and manage company policies, effectively steering operational and financial strategies. Non-controlling interest holders lack these decisive powers and have limited influence over the company's governance and decision-making processes.

Impact on Financial Reporting and Consolidation

Non-controlling interest represents the portion of equity ownership in a subsidiary not attributable to the parent company, impacting how consolidated financial statements reflect minority shareholders' claims. Majority interest, typically owning over 50% of voting rights, gives the parent company control, necessitating full consolidation of the subsidiary's assets, liabilities, revenues, and expenses. Financial reporting requires non-controlling interests to be presented separately within equity to accurately represent ownership stakes and avoid overstating the parent's financial position.

Legal Implications of Ownership Structures

Non-controlling interest represents the equity stake held by minority shareholders who do not have control over company decisions, while majority interest implies control and decision-making authority in a corporation. Legally, majority shareholders have the power to influence corporate governance, appoint directors, and approve major transactions under corporate law statutes. Minority shareholders possess protections against oppressive actions through fiduciary duties and regulatory frameworks designed to safeguard their investment rights and ensure fair treatment.

Pros and Cons of Non-Controlling vs Majority Interest

Non-controlling interest allows minority shareholders to benefit from a company's growth without bearing full responsibility for management, reducing financial risk but limiting decision-making power. Majority interest provides control and influence over strategic decisions, enabling consolidation of assets and revenues, yet it also entails greater liability and exposure to operational challenges. While non-controlling interest offers diversification and reduced obligations, majority interest is advantageous for governance and directing company policies.

Strategic Considerations for Investors

Non-controlling interest represents minority shareholders' stake, limiting their influence on corporate strategies, whereas majority interest grants controlling shareholders decisive power over business decisions and strategic direction. Investors prioritize majority interest for greater control in mergers, acquisitions, and operational changes, ensuring alignment with their financial and growth objectives. Understanding the balance between control rights and potential returns is crucial for evaluating investment opportunities and governance risks.

Non-controlling Interest Infographic

libterm.com

libterm.com