Money Market Accounts offer higher interest rates than regular savings accounts while providing easy access to your funds through checks and debit cards. These accounts combine the benefits of liquidity and competitive returns, making them ideal for managing your short-term savings. Discover how a Money Market Account can enhance your financial strategy by exploring the rest of this article.

Table of Comparison

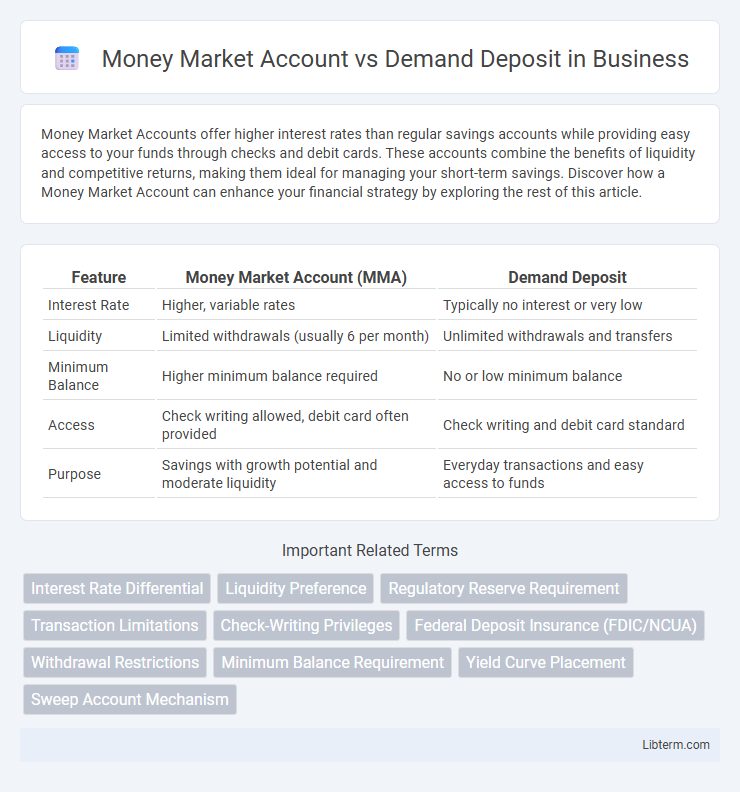

| Feature | Money Market Account (MMA) | Demand Deposit |

|---|---|---|

| Interest Rate | Higher, variable rates | Typically no interest or very low |

| Liquidity | Limited withdrawals (usually 6 per month) | Unlimited withdrawals and transfers |

| Minimum Balance | Higher minimum balance required | No or low minimum balance |

| Access | Check writing allowed, debit card often provided | Check writing and debit card standard |

| Purpose | Savings with growth potential and moderate liquidity | Everyday transactions and easy access to funds |

Introduction to Money Market Accounts and Demand Deposits

Money Market Accounts (MMAs) are interest-bearing deposit accounts that typically offer higher interest rates than regular savings accounts, combining features of checking and savings accounts with limited check-writing privileges. Demand Deposits, primarily represented by checking accounts, provide account holders with immediate access to funds through withdrawals or drafts without interest earnings. Both account types serve different financial needs: MMAs prioritize interest income with restricted liquidity, while demand deposits focus on easy and unlimited access to funds for daily transactions.

What is a Money Market Account?

A Money Market Account (MMA) is a type of savings account that typically offers higher interest rates compared to regular demand deposit accounts, combining features of both savings and checking accounts. MMAs require a higher minimum balance and allow limited check-writing and debit card transactions, providing liquidity while earning competitive returns. These accounts invest in short-term, low-risk securities such as government bonds and certificates of deposit, making them a safer option for managing cash reserves.

What is a Demand Deposit Account?

A demand deposit account (DDA) is a type of bank account that allows unlimited withdrawals and deposits without prior notice, typically used for daily transactions. Unlike money market accounts, DDAs usually offer lower interest rates but provide high liquidity and easy access to funds through checks, debit cards, and electronic transfers. Common examples include checking accounts that facilitate seamless money management for personal or business use.

Key Differences Between Money Market Accounts and Demand Deposits

Money Market Accounts typically offer higher interest rates and limited check-writing privileges, while Demand Deposits provide immediate access to funds with no interest earned. Money Market Accounts often require higher minimum balances and may impose withdrawal limits, contrasting with the no minimum balance requirement and unlimited transactions in Demand Deposits. The distinct regulatory frameworks, with Money Market Accounts governed by Federal Reserve Regulation D and Demand Deposits by Regulation CC, further differentiate these two financial products.

Interest Rates: Money Market vs Demand Deposit

Money Market Accounts typically offer higher interest rates compared to Demand Deposit accounts due to their investment in short-term, low-risk securities. Interest rates on Money Market Accounts often fluctuate with market conditions, potentially yielding better returns than the relatively fixed and lower rates found in Demand Deposit accounts. Choosing a Money Market Account can maximize interest earnings while maintaining liquidity, unlike most Demand Deposit accounts which prioritize immediate access over higher yields.

Accessibility and Withdrawal Limits

Money Market Accounts typically offer limited accessibility with restrictions on monthly withdrawals, often capped at six transactions per statement cycle due to federal regulations. Demand Deposit Accounts, commonly known as checking accounts, provide unlimited accessibility and withdrawals, making them ideal for frequent transactions and daily use. The higher withdrawal limits of Demand Deposit Accounts ensure greater flexibility, while Money Market Accounts may impose fees or penalties for exceeding transaction limits.

Safety and FDIC Insurance Protection

Money Market Accounts (MMAs) and Demand Deposits both offer FDIC insurance protection up to $250,000 per depositor, ensuring principal safety against bank failure. MMAs typically provide higher interest rates due to regulatory reserve requirements, while demand deposit accounts prioritize liquidity with immediate access to funds. Both account types maintain low risk profiles, making them secure options for preserving capital under FDIC coverage.

Fees and Minimum Balance Requirements

Money Market Accounts (MMAs) often require higher minimum balances, typically ranging from $1,000 to $2,500, whereas Demand Deposit Accounts (DDAs) usually have lower or no minimum balance requirements. MMAs may charge monthly maintenance fees if the minimum balance is not maintained, while many DDAs offer fee-free options or waive fees through direct deposit or minimum balance criteria. Understanding these fee structures and balance tiers is essential to avoid penalties and maximize account benefits.

Which Account Should You Choose?

Choosing between a Money Market Account and a Demand Deposit depends on your financial goals and liquidity needs. Money Market Accounts typically offer higher interest rates and limited check-writing privileges, making them suitable for savers who want to earn more while maintaining some access to funds. Demand Deposits, such as regular checking accounts, provide unlimited transactions and easy access but usually offer little to no interest, ideal for daily spending and bill payments.

Conclusion: Money Market or Demand Deposit – Which is Better?

Money market accounts typically offer higher interest rates and limited check-writing privileges, making them ideal for savers seeking better returns with moderate liquidity. Demand deposit accounts provide immediate access to funds with no restrictions but generally yield lower interest, suited for everyday transactions and frequent withdrawals. Choosing between the two depends on balancing the need for accessibility against the desire for higher earnings.

Money Market Account Infographic

libterm.com

libterm.com