The bid price represents the highest amount a buyer is willing to pay for a security or asset at a given time. Understanding the bid price is crucial for making informed decisions in trading and investment markets. Explore the rest of this article to learn how the bid price impacts your buying strategies and market dynamics.

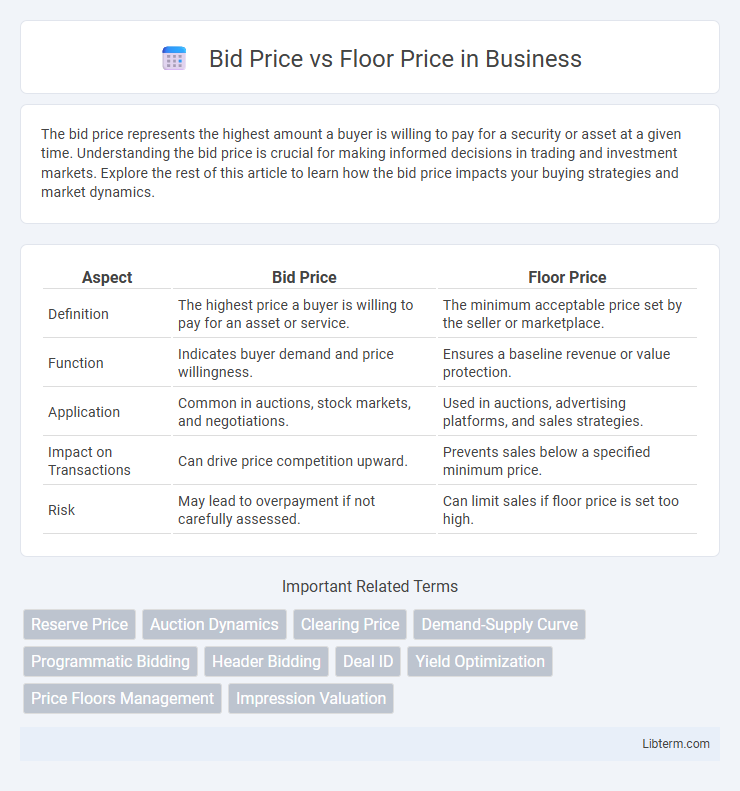

Table of Comparison

| Aspect | Bid Price | Floor Price |

|---|---|---|

| Definition | The highest price a buyer is willing to pay for an asset or service. | The minimum acceptable price set by the seller or marketplace. |

| Function | Indicates buyer demand and price willingness. | Ensures a baseline revenue or value protection. |

| Application | Common in auctions, stock markets, and negotiations. | Used in auctions, advertising platforms, and sales strategies. |

| Impact on Transactions | Can drive price competition upward. | Prevents sales below a specified minimum price. |

| Risk | May lead to overpayment if not carefully assessed. | Can limit sales if floor price is set too high. |

Understanding Bid Price: Definition and Importance

Bid price represents the highest amount a buyer is willing to pay for an asset or security in a transaction, serving as a critical indicator of demand in financial markets. It plays a pivotal role in determining the liquidity and price dynamics of stocks, bonds, and commodities, reflecting real-time market sentiment. Understanding bid price is essential for investors to make informed decisions, as it directly influences transaction execution and profitability.

What is Floor Price? Key Concepts

The floor price is the minimum acceptable bid set by a seller or auctioneer to ensure asset value protection and prevent undervaluation during bidding. It represents the lowest price at which a seller agrees to complete a transaction, acting as a baseline in auctions and sales agreements. Understanding the floor price is crucial for bidders to gauge the minimum threshold they must exceed to win the bid and for sellers to avoid selling below a set valuation.

Bid Price vs Floor Price: Core Differences

Bid price represents the highest amount a buyer is willing to pay for an asset, while floor price is the minimum acceptable price set by the seller or auctioneer. The core difference lies in the bid price being buyer-driven, reflecting demand, whereas the floor price is seller-driven, ensuring the asset is not sold below a certain threshold. Understanding this distinction is crucial for pricing strategies and successful auction outcomes.

How Bid Price Works in Online Advertising

Bid price in online advertising represents the maximum amount an advertiser is willing to pay for a click or impression within an auction-based system. It directly influences ad placement by competing against other bids to reach the target audience, with higher bids increasing the likelihood of winning the auction. The floor price serves as the minimum acceptable bid set by the publisher, ensuring revenues do not fall below a threshold, while the bid price must meet or exceed this floor to participate in the ad auction.

The Role of Floor Price in Auctions

The floor price in auctions sets the minimum acceptable bid, ensuring that the asset or item is not sold below a predetermined value, protecting the seller's interests. This baseline price influences bidder behavior by establishing a psychological anchor and can prevent lowball offers that might undervalue the auctioned item. The bid price must meet or exceed the floor price for the auction to result in a valid sale, making the floor price a critical factor in auction dynamics and market value discovery.

Factors Influencing Bid Price Strategies

Bid price strategies are influenced by market demand, competitor pricing, and the seller's reserve or floor price, which sets the minimum acceptable sale value. Economic conditions, urgency of sale, and product uniqueness also play crucial roles in determining how aggressively bidders set their offers above the floor price. Understanding auction dynamics and bidder behavior ensures optimized bid pricing that aligns with both seller expectations and market conditions.

Setting an Effective Floor Price: Best Practices

Setting an effective floor price requires analyzing market demand, competitor pricing, and product value to avoid undervaluation while maximizing revenue. Incorporate historical bidding data and customer willingness to pay to establish a threshold that discourages low bids without deterring serious buyers. Regularly review and adjust the floor price based on auction performance metrics to maintain competitiveness and profitability.

Impact of Bid and Floor Prices on Revenue

Bid Price directly influences the final selling price in auctions, potentially increasing revenue when competitive bids exceed the floor price. Floor Price establishes a minimum acceptable price, preventing sales below cost and protecting profit margins. Balancing bid and floor prices optimizes revenue by encouraging higher bids while safeguarding against undervaluation.

Optimizing Ad Performance: Balancing Bid and Floor Prices

Optimizing ad performance requires carefully balancing bid price and floor price to maximize revenue while maintaining competitive bidding. Setting the floor price too high can reduce bidder participation, limiting auction dynamics and lowering overall yield. Conversely, strategically adjusting the bid price to align with floor price thresholds encourages higher bids and improves fill rates, driving better ad performance and publisher revenue.

Common Mistakes to Avoid with Bid and Floor Prices

Confusing the bid price with the floor price often leads to miscalculations in auction settings, where the bid price represents the highest offer made while the floor price is the minimum acceptable amount set by the seller. Many sellers mistakenly set the floor price too close to the starting bid, which can discourage competitive bidding and potentially lower the final sale price. Avoiding the error of failing to clearly communicate the floor price to bidders helps prevent misunderstandings and promotes smoother auction transactions.

Bid Price Infographic

libterm.com

libterm.com