White Squire refers to a substantial minority shareholder in a company who supports the existing management during a hostile takeover attempt without seeking control. This strategic ally provides stability and defense against aggressive acquisition efforts while maintaining the current leadership structure. Discover how understanding the role of a White Squire can protect Your investments by reading the rest of the article.

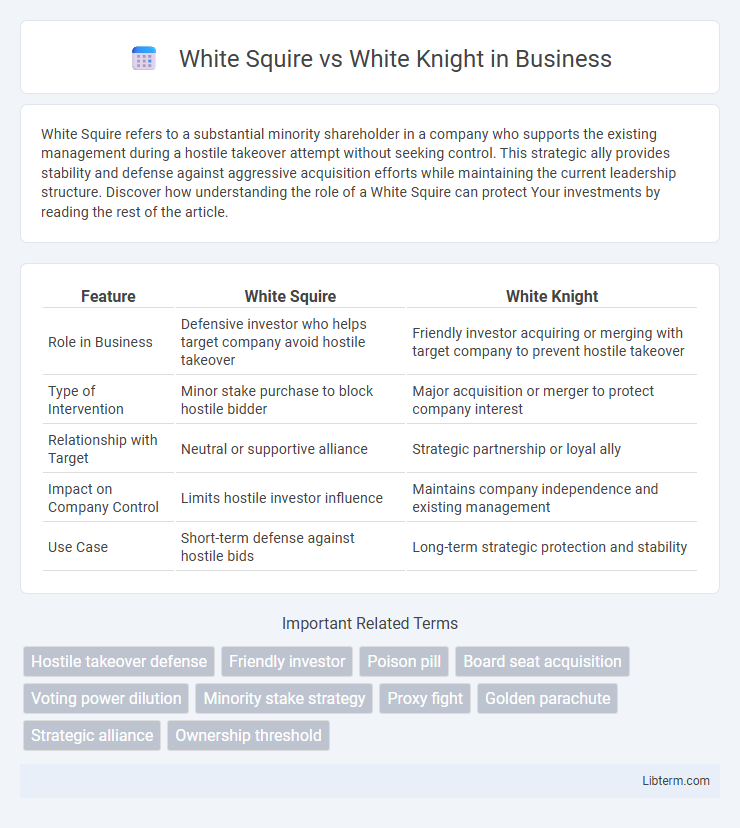

Table of Comparison

| Feature | White Squire | White Knight |

|---|---|---|

| Role in Business | Defensive investor who helps target company avoid hostile takeover | Friendly investor acquiring or merging with target company to prevent hostile takeover |

| Type of Intervention | Minor stake purchase to block hostile bidder | Major acquisition or merger to protect company interest |

| Relationship with Target | Neutral or supportive alliance | Strategic partnership or loyal ally |

| Impact on Company Control | Limits hostile investor influence | Maintains company independence and existing management |

| Use Case | Short-term defense against hostile bids | Long-term strategic protection and stability |

Introduction to White Squire and White Knight

White Squire refers to a minor shareholder or investor who acquires a small stake in a company to block hostile takeover attempts without seeking control, functioning as a friendly intermediary. White Knight represents a company or investor invited by the target firm to acquire a controlling interest, providing a favorable alternative to an unwelcome bidder during mergers and acquisitions. Both play strategic roles in corporate defense, with White Squires offering passive support and White Knights executing active rescue interventions.

Defining the White Squire Strategy

The White Squire strategy involves acquiring a substantial minority stake in a target company to block hostile takeovers without seeking full control, distinguishing it from the White Knight, who acquires the company entirely to fend off bids. This tactic allows the White Squire to exert influence and protect management while maintaining a passive investment stance. Key features include minority ownership typically ranging from 10% to 30% and strategic alliances that discourage unsolicited bids through shareholder solidarity.

Understanding the White Knight Approach

The White Knight approach in business involves a friendly investor or company acquiring a target firm to prevent hostile takeovers, contrasting with the aggressive White Squire who takes a significant but minority stake to block unwanted bids. White Knights offer strategic support, preserving company culture and management, thus maintaining stability during acquisition attempts. This method is preferred for protecting shareholder interests while avoiding the disruption of hostile acquisitions.

Key Differences Between White Squire and White Knight

White Squires are typically novices in knighthood, undergoing training and serving as apprentices, while White Knights are fully-fledged warriors renowned for their valor and chivalry. In heraldry, the White Knight often symbolizes purity and righteousness with a fully armored figure, whereas the White Squire represents youth and potential, usually depicted in partial armor or simpler attire. The White Knight commands respect and carries greater responsibilities on the battlefield compared to the White Squire, who supports and learns under the mentorship of experienced knights.

Benefits of White Squire Defense

White Squire Defense offers strategic benefits by allowing limited share acquisition to block hostile takeovers without triggering regulatory disclosures or shareholder alarms. This tactic maintains company control while preventing dilution of existing shareholders' equity, offering a less aggressive alternative to a White Knight. It enables management to leverage a friendly investor's support selectively, enhancing defense flexibility against unsolicited bids.

Advantages of the White Knight Procedure

The White Knight procedure offers strategic advantages by providing a friendly investor to rescue a target company from a hostile takeover, preserving its valuation and management structure. This approach minimizes disruption to operations and maintains shareholder confidence, often resulting in better financial terms compared to hostile bids. By ensuring cooperation between the White Knight and the target, this method helps sustain long-term growth and stability.

Real-world Examples of White Squire vs White Knight

White Squire and White Knight investments differ primarily in control and intervention levels during corporate takeovers. In real-world examples, White Squires such as Fairfax Financial Holdings' stake in BlackBerry provided significant support without pursuing full control, allowing management to retain autonomy. Conversely, a White Knight like Carl Icahn's intervention in Netflix exemplifies an investor stepping in with a full takeover offer to thwart hostile bids and restructure company strategy.

Strategic Considerations: When to Use Each

White Squire investments suit minority stakes where influence without control is desired, ideal for protecting against hostile takeovers or supporting management while preserving autonomy. White Knight engagements involve a friendly bidder acquiring a controlling interest to rescue a target company from a hostile bid, offering a preferred alternative for shareholders and management. Selecting between White Squire and White Knight strategies depends on the level of control required, urgency of defense, and long-term strategic alignment with the acquiring party.

Risks and Limitations of Both Strategies

White Squire strategies carry risks such as insufficient control acquisition, allowing the target company to remain vulnerable to hostile takeovers, while the investor may face limited influence over management decisions. White Knight approaches can result in reliance on a friendly acquiring company that may impose unfavorable terms or strategic directions, potentially diluting shareholder value. Both strategies also face limitations in market perception, where defensive maneuvers might trigger stock price volatility and impact long-term corporate governance.

Conclusion: Choosing the Right Takeover Defense

Selecting the appropriate takeover defense between a White Squire and a White Knight hinges on the level of control and cooperation desired by the target company's board. A White Knight provides a friendly acquirer with significant influence, potentially leading to strategic alignment but possible loss of autonomy. In contrast, a White Squire invests without seeking control, offering a less intrusive defense while maintaining greater independence for existing management.

White Squire Infographic

libterm.com

libterm.com