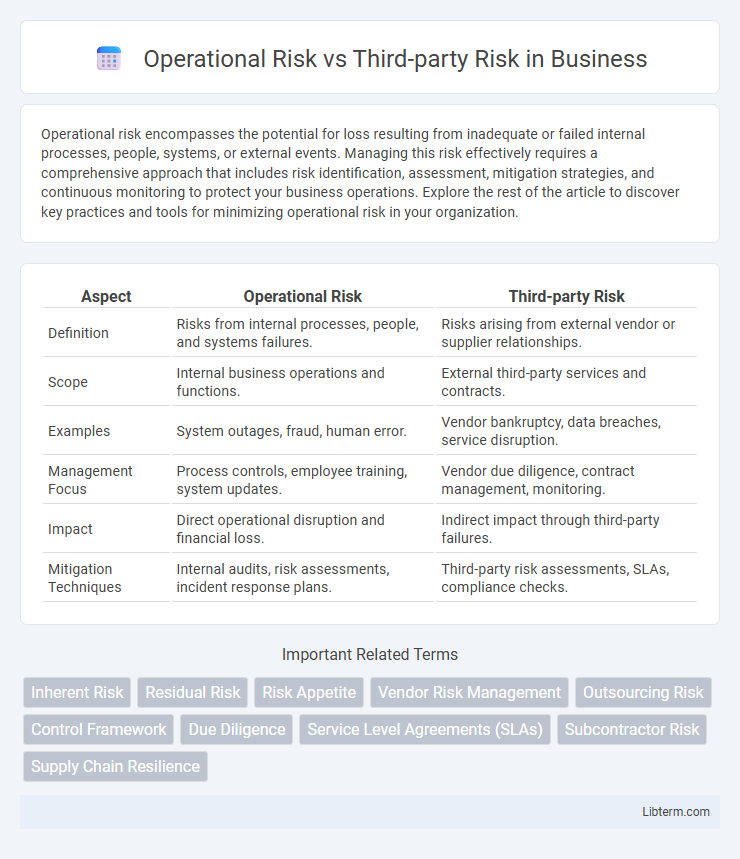

Operational risk encompasses the potential for loss resulting from inadequate or failed internal processes, people, systems, or external events. Managing this risk effectively requires a comprehensive approach that includes risk identification, assessment, mitigation strategies, and continuous monitoring to protect your business operations. Explore the rest of the article to discover key practices and tools for minimizing operational risk in your organization.

Table of Comparison

| Aspect | Operational Risk | Third-party Risk |

|---|---|---|

| Definition | Risks from internal processes, people, and systems failures. | Risks arising from external vendor or supplier relationships. |

| Scope | Internal business operations and functions. | External third-party services and contracts. |

| Examples | System outages, fraud, human error. | Vendor bankruptcy, data breaches, service disruption. |

| Management Focus | Process controls, employee training, system updates. | Vendor due diligence, contract management, monitoring. |

| Impact | Direct operational disruption and financial loss. | Indirect impact through third-party failures. |

| Mitigation Techniques | Internal audits, risk assessments, incident response plans. | Third-party risk assessments, SLAs, compliance checks. |

Understanding Operational Risk: Definition and Scope

Operational risk refers to the potential losses resulting from inadequate or failed internal processes, people, systems, or external events within an organization. It encompasses a wide range of threats including fraud, system failures, human errors, and regulatory breaches, impacting the integrity and efficiency of business operations. Understanding operational risk is crucial for developing effective risk management strategies that protect organizational assets and ensure continuity.

Defining Third-Party Risk: Key Components

Third-party risk refers to potential threats arising from outsourcing business processes or services to external vendors, impacting operational continuity and regulatory compliance. Key components include vendor risk management, contractual obligations, data security, and third-party performance monitoring. Effective mitigation requires thorough due diligence, ongoing risk assessments, and robust communication channels to ensure alignment with organizational standards.

Key Differences Between Operational and Third-Party Risk

Operational risk involves internal processes, systems, and human errors that can disrupt business functions, while third-party risk arises from external vendors, suppliers, or partners that may impact an organization's operations. Key differences include origin: operational risk is inherent within the company's internal environment, whereas third-party risk depends on the performance and reliability of external entities. Management strategies differ as operational risk focuses on improving internal controls and employee training, while third-party risk emphasizes vendor due diligence, contract management, and continuous monitoring of external relationships.

Common Sources of Operational Risk

Common sources of operational risk include system failures, human errors, fraud, and inadequate internal processes impacting business continuity. Third-party risk specifically arises from reliance on external vendors whose failures or non-compliance can disrupt operations and reputation. Effective risk management requires continuous monitoring of internal controls and third-party relationships to mitigate financial and operational losses.

Typical Third-Party Risk Scenarios

Typical third-party risk scenarios involve supply chain disruptions, vendor data breaches, and compliance failures, which can directly impact an organization's operational stability. Operational risk generally arises from internal processes, system failures, or human errors, whereas third-party risk stems from external entities that provide services or products. Effective risk management requires continuous monitoring of third-party performance and stringent due diligence to mitigate potential threats.

Impact of Operational Risk on Business Continuity

Operational risk, arising from internal processes, systems, or human errors, significantly disrupts business continuity by causing unplanned downtime, financial losses, and reputational damage. Third-party risk, linked to external vendors or partners, also threatens continuity but operational risk directly affects core internal operations and decision-making capabilities. Effective management of operational risk ensures resilience and stability by minimizing interruptions and safeguarding critical business functions.

Managing Third-Party Risk: Best Practices

Managing third-party risk requires robust due diligence processes, including thorough vendor assessments and continuous monitoring to identify emerging threats. Implementing clear contractual agreements with defined risk mitigation responsibilities and service level agreements (SLAs) helps ensure accountability and compliance. Leveraging technology for real-time risk analytics and fostering strong communication channels between internal teams and third-party vendors enhances risk management effectiveness.

Integrating Operational and Third-Party Risk Management

Integrating operational risk and third-party risk management enhances organizational resilience by creating a unified framework that identifies, assesses, and mitigates risks across internal processes and external vendor relationships. Leveraging centralized risk data analytics and continuous monitoring enables proactive risk identification and timely response to potential disruptions. Organizations adopting integrated risk management achieve stronger compliance, cost efficiencies, and improved decision-making across the risk ecosystem.

Regulatory Requirements for Risk Management

Regulatory requirements for operational risk mandate comprehensive frameworks to identify, assess, monitor, and mitigate risks arising from internal processes, systems, and personnel. Third-party risk regulations emphasize due diligence, continuous monitoring, and compliance assessments of external vendors to ensure service reliability and data security. Both regulatory domains require robust documentation, reporting protocols, and alignment with standards such as Basel III and GDPR to mitigate financial and reputational impacts.

Future Trends in Operational and Third-Party Risk

Future trends in operational risk emphasize increased integration of advanced analytics and artificial intelligence to enhance real-time risk detection and mitigation strategies. Third-party risk management evolves with the rise of digital supply chains, requiring more robust cybersecurity measures and continuous monitoring of vendor compliance to address escalating cyber threats and regulatory demands. Both domains witness growing adoption of automation and predictive modeling, enabling organizations to proactively manage complex risk environments and ensure operational resilience.

Operational Risk Infographic

libterm.com

libterm.com