Gross profit represents the difference between your revenue and the cost of goods sold, highlighting the profitability of core business operations. It serves as a critical indicator for assessing how efficiently your company produces and sells its products. Explore the rest of this article to learn how to improve your gross profit and boost overall financial health.

Table of Comparison

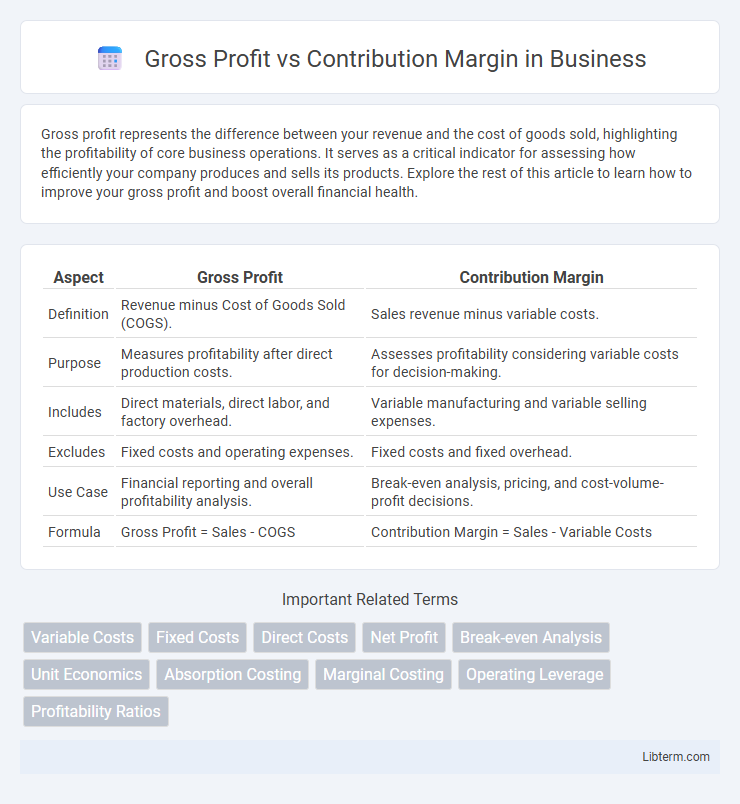

| Aspect | Gross Profit | Contribution Margin |

|---|---|---|

| Definition | Revenue minus Cost of Goods Sold (COGS). | Sales revenue minus variable costs. |

| Purpose | Measures profitability after direct production costs. | Assesses profitability considering variable costs for decision-making. |

| Includes | Direct materials, direct labor, and factory overhead. | Variable manufacturing and variable selling expenses. |

| Excludes | Fixed costs and operating expenses. | Fixed costs and fixed overhead. |

| Use Case | Financial reporting and overall profitability analysis. | Break-even analysis, pricing, and cost-volume-profit decisions. |

| Formula | Gross Profit = Sales - COGS | Contribution Margin = Sales - Variable Costs |

Understanding Gross Profit

Gross Profit represents the revenue remaining after subtracting the cost of goods sold (COGS), highlighting the profitability of core production activities. It is a key indicator of the efficiency in managing direct production costs but excludes operating expenses like marketing or administration. Understanding Gross Profit helps businesses assess product pricing, production efficiency, and inventory management to improve overall financial health.

Defining Contribution Margin

Contribution margin represents the amount remaining from sales revenue after variable costs are subtracted, highlighting the portion available to cover fixed costs and generate profit. Unlike gross profit, which deducts only the cost of goods sold (COGS), contribution margin accounts for all variable expenses directly tied to production and sales. This metric is essential for break-even analysis, pricing decisions, and understanding the impact of cost behavior on profitability.

Key Differences Between Gross Profit and Contribution Margin

Gross Profit represents the revenue remaining after subtracting the cost of goods sold (COGS), highlighting the profitability of core production or purchasing activities. Contribution Margin calculates the revenue left after deducting variable costs, emphasizing the amount available to cover fixed costs and generate profit. Key differences lie in cost inclusion: Gross Profit includes all direct production costs, while Contribution Margin focuses solely on variable costs, making it crucial for break-even and margin analysis.

Calculating Gross Profit: Formula and Example

Gross profit is calculated by subtracting the cost of goods sold (COGS) from total revenue, using the formula: Gross Profit = Revenue - COGS. For example, if a company generates $500,000 in sales revenue and incurs $300,000 in COGS, the gross profit equals $200,000. This metric highlights the profitability directly associated with production before accounting for operating expenses, differing from contribution margin which includes variable costs beyond just COGS.

Calculating Contribution Margin: Formula and Example

Contribution margin is calculated by subtracting variable costs from total sales revenue, expressed as Contribution Margin = Sales Revenue - Variable Costs. For example, if a company generates $200,000 in sales and incurs $120,000 in variable costs, the contribution margin is $80,000. This metric highlights the amount available to cover fixed costs and generate profit, distinct from gross profit which subtracts both variable and fixed costs.

Impact of Variable and Fixed Costs

Gross profit reflects revenues minus the cost of goods sold, which primarily includes variable costs directly tied to production, highlighting profitability before operating expenses. Contribution margin isolates the impact of variable costs by subtracting them from sales, showing the amount available to cover fixed costs and generate profit. Understanding the distinction clarifies how fixed costs influence net profit beyond the contribution margin's coverage of variable expenses.

Importance for Financial Decision-Making

Gross profit highlights the difference between sales revenue and cost of goods sold, reflecting overall product profitability and operational efficiency. Contribution margin isolates variable costs from sales, crucial for analyzing product-specific profitability and guiding pricing, budgeting, and break-even analysis. Financial decision-making benefits from both metrics by balancing fixed and variable cost insights to optimize resource allocation and strategic planning.

Role in Pricing Strategies

Gross profit indicates the overall profitability by subtracting the cost of goods sold from revenue, helping businesses assess the efficiency of production and pricing at a broader level. Contribution margin, calculated as sales revenue minus variable costs, plays a critical role in pricing strategies by directly showing the incremental profit generated per unit, guiding decisions on product pricing, promotional offers, and break-even analysis. Understanding both metrics enables firms to optimize pricing structures that cover fixed costs effectively while maximizing profit margins and competitive positioning.

Common Mistakes in Interpretation

Gross profit is often confused with contribution margin, despite their fundamental differences in cost classification; gross profit subtracts only the cost of goods sold from revenue, while contribution margin deducts all variable costs. A common mistake is interpreting gross profit as a measure of profitability for decision-making, ignoring fixed costs that contribution margin highlights for operational analysis. Misunderstanding these metrics can lead to incorrect assessments of product performance and pricing strategies, affecting financial planning accuracy.

Gross Profit vs Contribution Margin: Which Metric to Use?

Gross profit measures total revenue minus the cost of goods sold, reflecting overall profitability, while contribution margin calculates revenue minus variable costs, indicating the profitability of individual products or services. Use gross profit to assess long-term business viability and inventory management, whereas contribution margin is ideal for decision-making related to pricing, product prioritization, and cost control. Choosing between gross profit and contribution margin depends on whether the focus is on comprehensive financial health or on variable cost management and operational efficiency.

Gross Profit Infographic

libterm.com

libterm.com