Invoice financing unlocks the cash tied up in unpaid invoices, providing your business with immediate working capital to maintain smooth operations and seize growth opportunities. This financial solution helps improve cash flow, manage expenses, and avoid the delays associated with traditional loan approvals. Discover how invoice financing can transform your cash flow management by reading the rest of the article.

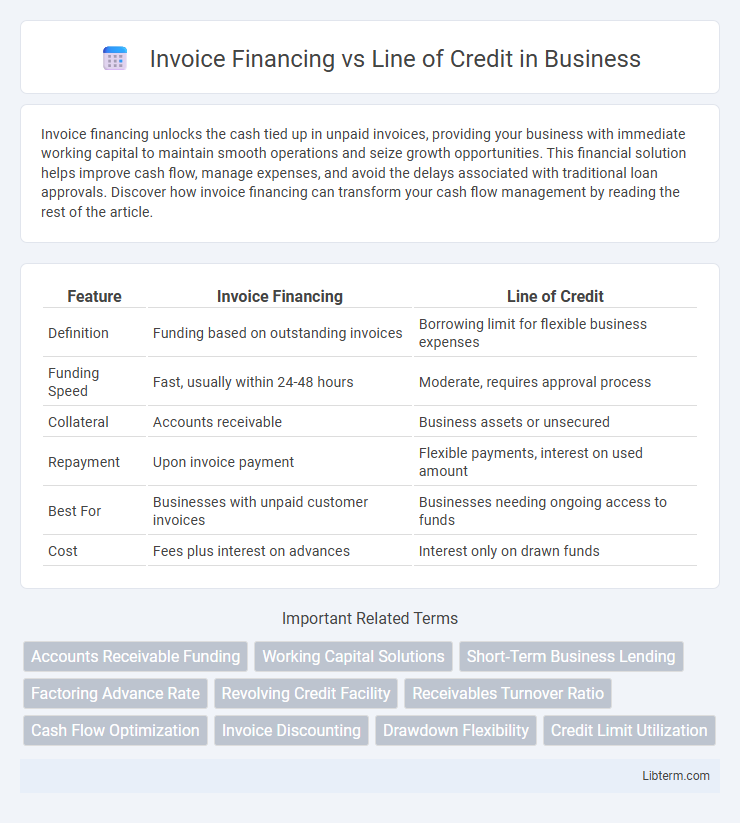

Table of Comparison

| Feature | Invoice Financing | Line of Credit |

|---|---|---|

| Definition | Funding based on outstanding invoices | Borrowing limit for flexible business expenses |

| Funding Speed | Fast, usually within 24-48 hours | Moderate, requires approval process |

| Collateral | Accounts receivable | Business assets or unsecured |

| Repayment | Upon invoice payment | Flexible payments, interest on used amount |

| Best For | Businesses with unpaid customer invoices | Businesses needing ongoing access to funds |

| Cost | Fees plus interest on advances | Interest only on drawn funds |

Understanding Invoice Financing

Invoice financing allows businesses to unlock cash tied up in outstanding invoices by selling them to a lender at a discount, improving cash flow without taking on traditional debt. This form of financing is particularly beneficial for companies with long payment cycles, providing immediate working capital based on accounts receivable. Unlike a line of credit, which offers a revolving borrowing limit, invoice financing directly leverages specific invoices as collateral, often accelerating access to funds.

What is a Line of Credit?

A Line of Credit (LOC) is a flexible borrowing option that allows businesses to access a predetermined amount of funds as needed, paying interest only on the amount used. Unlike Invoice Financing, which is based on outstanding receivables, a LOC offers broader financial support for various business expenses, including inventory purchase and operational costs. This revolving credit structure helps maintain cash flow stability without waiting for customer payments.

Key Differences Between Invoice Financing and Line of Credit

Invoice financing provides businesses with immediate cash by leveraging outstanding invoices as collateral, whereas a line of credit offers a flexible borrowing limit that can be drawn upon as needed for various expenses. Invoice financing typically involves factoring or invoice discounting, with repayment tied directly to invoice payment, while a line of credit requires interest payments only on the drawn amount without specific collateral. The primary difference lies in cash flow management: invoice financing accelerates receivables conversion, whereas a line of credit supports ongoing liquidity without relying on accounts receivable.

Pros and Cons of Invoice Financing

Invoice financing offers immediate cash flow by unlocking funds tied up in outstanding invoices, which helps businesses maintain operations without waiting for customer payments. However, it typically involves fees and interest rates that can be higher compared to traditional lines of credit, impacting overall profitability. Unlike a line of credit, invoice financing depends on the creditworthiness of your customers rather than your own, which may limit access if clients have poor payment histories.

Advantages and Disadvantages of Line of Credit

A line of credit offers flexible access to funds, enabling businesses to borrow up to a set limit and repay as needed, which supports cash flow management and unexpected expenses. The primary advantage includes lower interest costs since interest is only paid on the amount borrowed, but disadvantages involve potential fees, the risk of overspending, and stringent approval criteria based on creditworthiness. Unlike invoice financing, which is tied specifically to outstanding invoices, a line of credit provides broader financial freedom but may require more disciplined repayment to avoid negative impacts on credit score.

Eligibility Requirements for Each Financing Option

Invoice financing typically requires businesses to have outstanding invoices from creditworthy customers, a minimum monthly revenue often above $10,000, and a solid accounts receivable history. A line of credit usually demands a stronger credit score, often above 650, consistent cash flow, and sometimes collateral or personal guarantees depending on whether it is secured or unsecured. Both financing options prioritize business financial stability but invoice financing leans more on customer payment reliability, while lines of credit emphasize overall creditworthiness and operational cash flow.

Costs and Fees Comparison

Invoice financing typically involves fees ranging from 1% to 5% of the invoice value, often including discount rates and service charges, making it suitable for short-term cash flow needs. Line of credit expenses generally consist of interest rates between 7% and 25% annually, alongside potential maintenance or draw fees, providing more flexible access to funds. Comparing costs and fees, invoice financing can be more expensive upfront but offers quick liquidity tied to sales, whereas lines of credit might incur ongoing interest costs depending on usage and repayment terms.

Speed and Accessibility of Funds

Invoice financing provides rapid access to cash by leveraging outstanding invoices, often delivering funds within 24 to 48 hours, making it ideal for businesses needing immediate liquidity. Line of credit approvals can take longer due to credit checks and underwriting processes, though once established, funds are accessible on demand up to the credit limit. Small businesses benefit from invoice financing's quick turnaround, while lines of credit offer flexible, ongoing access but require more time upfront to secure.

Which Financing Option Fits Your Business Needs?

Invoice financing provides immediate cash flow by leveraging outstanding invoices, ideal for businesses with consistent sales and long payment cycles. A line of credit offers flexible access to funds up to a set limit, suitable for managing ongoing expenses and unpredictable cash flow needs. Choosing between invoice financing and a line of credit depends on your business's payment terms, cash flow stability, and short-term funding requirements.

Making an Informed Decision: Invoice Financing vs Line of Credit

Invoice financing provides immediate cash flow by leveraging outstanding invoices, ideal for businesses needing quick working capital without incurring debt, while a line of credit offers flexible borrowing up to a preset limit with potential ongoing access to funds, useful for managing variable expenses and long-term financial planning. Understanding factors such as interest rates, repayment terms, funding speed, and business cash flow cycles is essential for making an informed decision between these options. Evaluating your company's financial health and funding needs ensures selecting the best financing tool to optimize liquidity and support growth.

Invoice Financing Infographic

libterm.com

libterm.com