A Limited Liability Company (LLC) offers business owners personal liability protection while allowing flexible management and tax benefits. This structure combines the advantages of a corporation's limited liability with the operational ease of a partnership. Discover everything you need to know about forming and managing an LLC in the rest of this article.

Table of Comparison

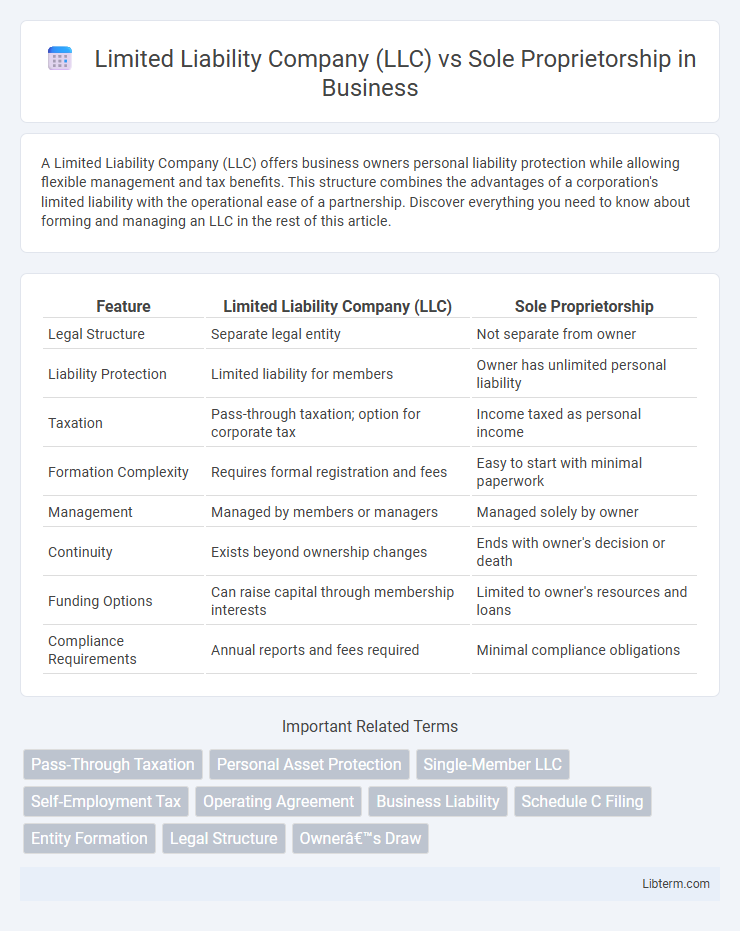

| Feature | Limited Liability Company (LLC) | Sole Proprietorship |

|---|---|---|

| Legal Structure | Separate legal entity | Not separate from owner |

| Liability Protection | Limited liability for members | Owner has unlimited personal liability |

| Taxation | Pass-through taxation; option for corporate tax | Income taxed as personal income |

| Formation Complexity | Requires formal registration and fees | Easy to start with minimal paperwork |

| Management | Managed by members or managers | Managed solely by owner |

| Continuity | Exists beyond ownership changes | Ends with owner's decision or death |

| Funding Options | Can raise capital through membership interests | Limited to owner's resources and loans |

| Compliance Requirements | Annual reports and fees required | Minimal compliance obligations |

Introduction to LLCs and Sole Proprietorships

Limited Liability Companies (LLCs) offer business owners personal liability protection by separating personal assets from business debts, unlike Sole Proprietorships where owners bear unlimited personal liability. Sole Proprietorships are simpler to establish with minimal regulatory requirements and tax filings, making them ideal for small, single-owner businesses. LLCs provide flexible management structures and allow profits to be taxed either as a corporation or pass-through entities, enhancing financial and operational control.

Definition and Key Features of an LLC

A Limited Liability Company (LLC) is a business structure that combines the liability protection of a corporation with the tax benefits and operational flexibility of a partnership. LLC owners, called members, are shielded from personal liability for business debts and legal actions, whereas sole proprietors bear unlimited personal liability. Key features of an LLC include pass-through taxation, fewer formalities compared to corporations, and flexibility in management and ownership.

Definition and Key Features of a Sole Proprietorship

A Sole Proprietorship is a business structure where a single individual owns and operates the business, bearing full personal liability for its debts and obligations. It features simple formation with minimal regulatory requirements, direct control over decision-making, and taxation based on the owner's personal income tax return. Unlike LLCs, sole proprietorships lack legal separation between the owner and the business, resulting in unlimited personal liability.

Legal Structure and Formation Requirements

A Limited Liability Company (LLC) provides a separate legal entity that shields owners from personal liability, requiring formal registration with state authorities and filing articles of organization. In contrast, a Sole Proprietorship has no legal distinction between the owner and business, with minimal formation requirements, often limited to obtaining local business licenses. LLCs involve more complex compliance and paperwork compared to the straightforward setup of Sole Proprietorships.

Liability Protection: LLC vs Sole Proprietorship

Limited Liability Companies (LLCs) provide owners with personal liability protection, separating personal assets from business debts and legal obligations. In contrast, sole proprietorships offer no liability protection, meaning owners are personally responsible for all financial and legal liabilities of the business. This fundamental difference makes LLCs a preferred choice for entrepreneurs seeking to minimize personal risk.

Taxation Differences Between LLC and Sole Proprietorship

An LLC offers flexible taxation options, allowing profits to be taxed as a pass-through entity or as a corporation, which can reduce self-employment taxes. In contrast, a sole proprietorship reports business income on the owner's personal tax return, with all profits subject to self-employment taxes. The ability of LLCs to elect S-corp status can lead to potential tax savings by splitting income between salary and distributions, minimizing Social Security and Medicare taxes.

Management and Operational Flexibility

Limited Liability Companies (LLCs) offer greater management and operational flexibility than sole proprietorships by allowing multiple members to participate in decision-making and customize management structures through operating agreements. LLCs can be member-managed or manager-managed, enabling roles to be assigned based on business needs, while sole proprietorships are managed solely by the owner with no legal distinction between personal and business decisions. The ability of LLCs to separate management duties enhances scalability and professional governance, unlike sole proprietorships, which have limited options for operational delegation.

Costs and Ongoing Compliance Obligations

Limited Liability Companies (LLCs) typically involve higher initial formation costs, including state filing fees averaging between $100 and $500, compared to sole proprietorships, which may only require minimal local permits or licenses. LLCs also face ongoing compliance obligations such as annual reports and franchise taxes, varying by state, whereas sole proprietorships generally have minimal regulatory requirements and simpler tax filings reported on personal income tax returns. The increased administrative burden and fees associated with LLCs are often balanced by liability protection and potential tax benefits not available to sole proprietors.

Pros and Cons of LLCs and Sole Proprietorships

Limited Liability Companies (LLCs) offer personal asset protection and flexible tax options, shielding owners from business liabilities, but they often incur higher formation and administrative costs compared to Sole Proprietorships. Sole Proprietorships provide simplicity, full control, and direct tax benefits since profits are taxed once, yet they expose owners to unlimited personal liability and may face challenges in raising capital. Understanding these trade-offs helps entrepreneurs choose the best structure for liability protection, taxation, and operational complexity.

Choosing the Right Business Structure for Your Needs

Choosing the right business structure depends on factors such as liability protection, tax implications, and operational complexity. A Limited Liability Company (LLC) provides personal asset protection by separating business debts from personal finances, whereas a Sole Proprietorship offers simplicity and direct control with fewer regulatory requirements but exposes the owner to unlimited personal liability. Evaluating your risk tolerance, growth plans, and tax preferences is crucial in selecting between an LLC and a Sole Proprietorship for optimal business performance.

Limited Liability Company (LLC) Infographic

libterm.com

libterm.com