Private equity involves investing in private companies through direct capital infusion or buyouts, aiming for significant returns by improving business operations and strategic growth. These investments often require deep market knowledge and long-term commitment, making them a specialized asset class with unique risk and reward profiles. Explore the article to understand how private equity can impact your investment strategy and financial goals.

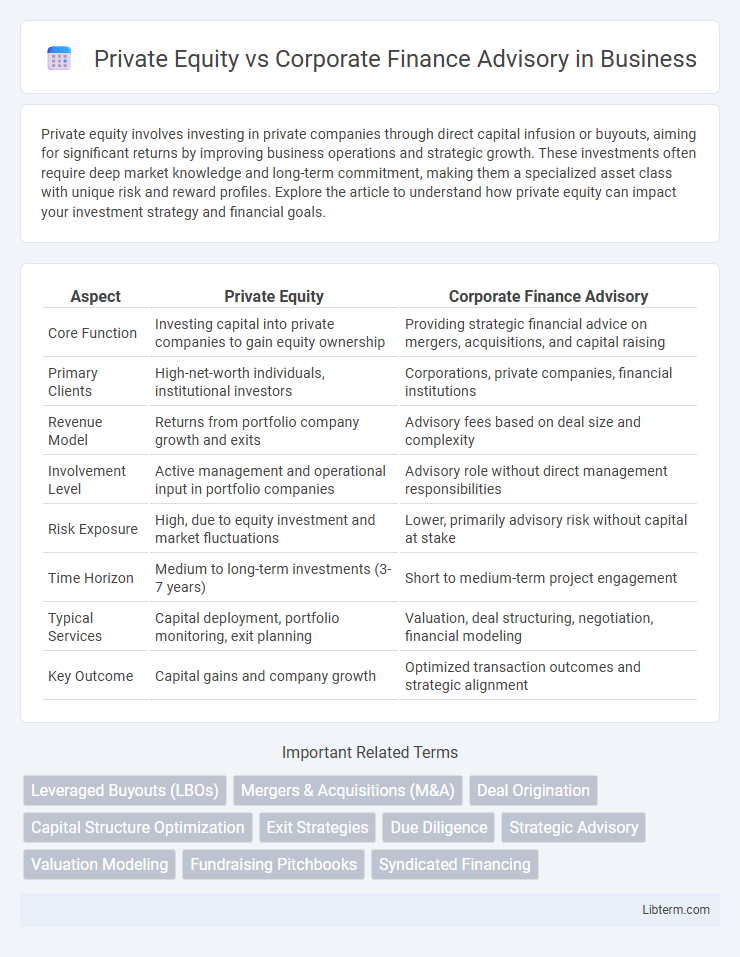

Table of Comparison

| Aspect | Private Equity | Corporate Finance Advisory |

|---|---|---|

| Core Function | Investing capital into private companies to gain equity ownership | Providing strategic financial advice on mergers, acquisitions, and capital raising |

| Primary Clients | High-net-worth individuals, institutional investors | Corporations, private companies, financial institutions |

| Revenue Model | Returns from portfolio company growth and exits | Advisory fees based on deal size and complexity |

| Involvement Level | Active management and operational input in portfolio companies | Advisory role without direct management responsibilities |

| Risk Exposure | High, due to equity investment and market fluctuations | Lower, primarily advisory risk without capital at stake |

| Time Horizon | Medium to long-term investments (3-7 years) | Short to medium-term project engagement |

| Typical Services | Capital deployment, portfolio monitoring, exit planning | Valuation, deal structuring, negotiation, financial modeling |

| Key Outcome | Capital gains and company growth | Optimized transaction outcomes and strategic alignment |

Introduction to Private Equity and Corporate Finance Advisory

Private Equity involves investing directly in private companies or conducting buyouts of public companies to restructure and increase their value before exiting through a sale or IPO. Corporate Finance Advisory focuses on providing expert guidance on mergers and acquisitions, capital raising, restructuring, and financial strategy to optimize a company's capital structure and maximize shareholder value. Both fields require strong financial analysis and strategic insight but differ in their roles, with Private Equity acting as an investor and Corporate Finance Advisory serving as a consultant.

Key Differences Between Private Equity and Corporate Finance Advisory

Private Equity involves investing capital directly into private companies to acquire ownership stakes, aiming for long-term value creation and eventual exit through sales or IPOs. Corporate Finance Advisory focuses on providing strategic financial guidance to companies on mergers, acquisitions, restructuring, and capital raising without investing directly. Key differences include Private Equity's role as an investor with active management influence, whereas Corporate Finance Advisory serves as a consultant facilitating transactions and optimizing financial strategies.

Roles and Responsibilities in Each Sector

Private equity professionals focus on sourcing investment opportunities, conducting detailed due diligence, structuring deals, and actively managing portfolio companies to enhance value and achieve profitable exits. Corporate finance advisors specialize in providing strategic advice on mergers and acquisitions, capital raising, financial restructuring, and valuation to optimize their clients' financial performance and support long-term growth. Both sectors require strong analytical skills, market knowledge, and negotiation expertise, but private equity emphasizes investment management, while corporate finance advisory prioritizes client-centric financial strategy and transaction execution.

Investment Strategies and Approaches

Private equity investment strategies emphasize acquiring controlling interests in companies to drive operational improvements and realize value through long-term growth or restructuring. Corporate finance advisory focuses on optimizing capital structure and transaction execution, providing tailored solutions such as mergers and acquisitions, debt financing, and equity placements to enhance shareholder value. While private equity takes an active ownership approach, corporate finance advisory delivers strategic guidance to facilitate financial decisions without direct ownership involvement.

Value Creation: Private Equity vs Corporate Finance Advisory

Private Equity focuses on value creation through active investment management, operational improvements, and strategic restructuring to enhance portfolio company profitability. Corporate Finance Advisory emphasizes value creation by providing tailored financial solutions such as mergers and acquisitions, capital raising, and restructuring advisory to optimize client financial performance. Both sectors drive value creation but differ in approach: Private Equity implements hands-on operational changes, while Corporate Finance Advisory offers strategic counsel to maximize transaction outcomes.

Typical Clients and Market Focus

Private equity firms typically serve institutional investors, high-net-worth individuals, and portfolio companies, focusing on acquiring, restructuring, and growing businesses across various industries. Corporate finance advisory targets corporations, governments, and financial institutions seeking strategic advice on mergers and acquisitions, capital raising, and financial restructuring. The private equity market emphasizes long-term investment and value creation, while corporate finance advisory centers on transactional support and optimizing financial outcomes within competitive market sectors.

Transaction Types and Deal Structures

Private equity transactions primarily involve leveraged buyouts, growth capital investments, and carve-outs, characterized by equity stakes and control-oriented deal structures that emphasize ownership transfer and value creation. Corporate finance advisory typically covers mergers and acquisitions, debt and equity financing, restructurings, and capital raising, with deal structures focusing on advisory roles, negotiation, and structuring to optimize client outcomes without necessarily acquiring control. Both sectors utilize tailored transaction types and deal frameworks, but private equity focuses on investment and ownership consolidation, while corporate finance advisory centers on strategic advisory and capital market solutions.

Required Skills and Career Pathways

Private equity professionals require strong analytical skills, financial modeling expertise, and deep industry knowledge to evaluate investment opportunities and manage portfolio companies. Corporate finance advisory specialists focus on strategic financial planning, debt and equity structuring, and M&A advisory, demanding skills in negotiation, valuation, and regulatory compliance. Career pathways in private equity typically progress from analyst roles to associate, principal, and partner levels, while corporate finance advisory careers often advance through analyst, consultant, director, and managing director positions.

Risk Management and Return Profiles

Private equity involves managing higher risk portfolios due to direct investment in private companies, aiming for outsized returns through active value creation and exit strategies, while corporate finance advisory focuses on optimizing a company's capital structure and financial strategy to balance risk and steady returns. Risk management in private equity requires thorough due diligence, portfolio diversification, and strategic operational improvements to mitigate inherent market and liquidity risks. Corporate finance advisory emphasizes structured financial planning, debt-equity balance, and regulatory compliance to ensure predictable cash flows and preserve enterprise value.

Choosing Between Private Equity and Corporate Finance Advisory

Choosing between private equity and corporate finance advisory depends on career goals and risk tolerance, as private equity involves direct investment in companies with high-growth potential and longer-term capital commitment, while corporate finance advisory focuses on providing strategic financial advice, mergers and acquisitions, and capital raising support. Private equity professionals often seek hands-on operational involvement and potential high returns with significant exposure to portfolio company performance. In contrast, corporate finance advisors prioritize deal structuring, financial modeling, and client relationships across various industries, emphasizing transactional expertise over investment risk.

Private Equity Infographic

libterm.com

libterm.com