Understanding mortgage options is crucial for securing the best financing terms for your home purchase. Factors like interest rates, loan types, and repayment plans directly impact your monthly payments and overall financial health. Explore the full article to learn how to navigate mortgage choices effectively and make informed decisions.

Table of Comparison

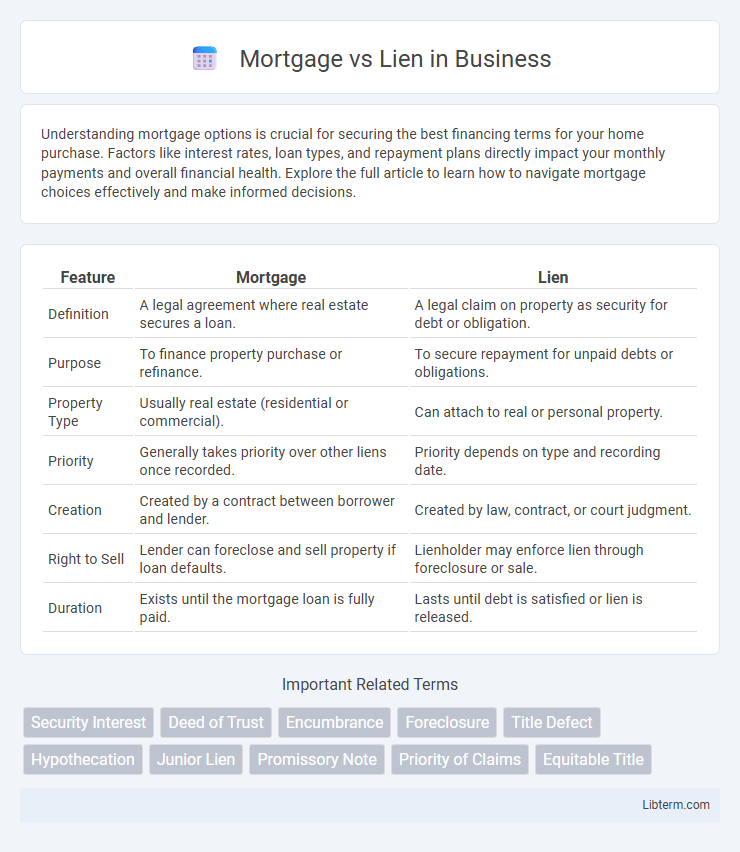

| Feature | Mortgage | Lien |

|---|---|---|

| Definition | A legal agreement where real estate secures a loan. | A legal claim on property as security for debt or obligation. |

| Purpose | To finance property purchase or refinance. | To secure repayment for unpaid debts or obligations. |

| Property Type | Usually real estate (residential or commercial). | Can attach to real or personal property. |

| Priority | Generally takes priority over other liens once recorded. | Priority depends on type and recording date. |

| Creation | Created by a contract between borrower and lender. | Created by law, contract, or court judgment. |

| Right to Sell | Lender can foreclose and sell property if loan defaults. | Lienholder may enforce lien through foreclosure or sale. |

| Duration | Exists until the mortgage loan is fully paid. | Lasts until debt is satisfied or lien is released. |

Introduction to Mortgage vs Lien

A mortgage is a specific type of lien that gives a lender the right to take possession of a property if the borrower defaults on the loan, serving as collateral for the mortgage debt. Liens, in general, represent a legal claim or hold on assets to secure payment of a debt or obligation, and they can arise from various sources such as unpaid taxes, judgments, or contractor services. Understanding the differences between a mortgage and other types of liens is essential for property owners and buyers to manage legal and financial responsibilities effectively.

Defining Mortgage: Key Concepts

A mortgage is a legal agreement in which a borrower pledges real property as security for a loan, ensuring repayment to the lender while retaining possession of the property. It establishes a lien, meaning the lender has a claim against the property until the debt is fully paid. Key elements include principal amount, interest rate, term length, and conditions for default, which differentiate mortgages from general liens that may be used for various types of debt.

Understanding Liens: Types and Purposes

A lien is a legal claim or right against a property, typically used to secure the payment of a debt or obligation, with common types including mortgage liens, tax liens, and mechanics liens. Mortgage liens specifically arise when a borrower pledges real estate as collateral for a loan, giving the lender the right to foreclose if payments are not made. Understanding the differences between liens helps property owners manage obligations and protect their ownership rights while creditors use liens to ensure debt recovery.

Major Differences Between Mortgage and Lien

A mortgage is a specific type of lien that grants a lender the legal right to property as collateral for a loan, typically used in real estate financing. Liens, in contrast, are broader claims or legal holds on property to secure payment of a debt or obligation, which can arise from various circumstances such as unpaid taxes, judgments, or contractor claims. The major difference lies in the purpose and scope: a mortgage is a consensual lien created through a loan agreement, while liens can be either consensual or non-consensual and encompass a wider range of claims beyond just loans.

Legal Rights of Lenders and Borrowers

A mortgage grants lenders a legal claim on a property as collateral until the borrower fulfills the repayment terms, providing the lender the right to foreclose if payments default. Liens represent a broader category of legal claims that can be placed by various creditors, including contractors or tax authorities, securing repayment through the encumbered asset. Borrowers retain ownership rights but must satisfy all lien or mortgage obligations to clear the title and prevent enforced sale or legal penalties.

Process of Establishing a Mortgage

Establishing a mortgage involves a legal agreement where the borrower pledges real property as security for a loan, requiring a promissory note and a mortgage deed recorded with the local government. The mortgage process includes a thorough property appraisal, credit evaluation, and formal approval by the lender before the transaction is finalized at closing. This recorded mortgage creates a lien against the property, allowing the lender to initiate foreclosure if the borrower defaults on loan payments.

How Liens Are Placed and Released

Liens are legal claims placed on a property by creditors to secure payment of a debt or obligation, often initiated through court judgments, tax authorities, or contractors who have not been paid. They are filed publicly, typically with the county recorder or land registry, and become effective once recorded, thereby restricting the owner's ability to sell or refinance the property without clearing the lien. Liens are released officially through a satisfaction document or lien release, filed upon full payment or settlement of the debt, ensuring the property title is free from encumbrances.

Impact on Property Ownership and Transfer

A mortgage creates a secured loan against the property, allowing the lender to claim the asset if the borrower defaults, but the borrower retains ownership and the right to transfer the property subject to mortgage payoff. A lien is a legal claim or encumbrance placed on the property for unpaid debts, which can restrict the owner's ability to sell or transfer the title until the lien is resolved. Both mortgages and liens affect property ownership by imposing financial obligations that must be cleared to enable a clear transfer of ownership.

Risks and Benefits for Property Owners

A mortgage provides property owners with the benefit of financing a home purchase while retaining ownership, but carries the risk of foreclosure if payments are missed. A lien, such as a tax or mechanics lien, can encumber the property by legally restricting sale or transfer until the debt is settled, posing risks of forced sale or credit damage. Understanding the differences in priority and release conditions between mortgages and liens is crucial for managing financial liabilities and protecting property rights.

Choosing Between Mortgage and Lien: Key Considerations

Choosing between a mortgage and a lien depends on factors such as property ownership rights, priority in repayment, and the specific legal obligations involved. Mortgages grant a lender security interest tied directly to the property for loan repayment, while liens may arise from various claims like unpaid taxes or judgments. Understanding the differences in enforceability, duration, and impact on credit helps in selecting the most suitable option for securing debt.

Mortgage Infographic

libterm.com

libterm.com