Sale-leaseback is a financial strategy where a company sells an asset, often real estate, and then leases it back to maintain operational use while freeing up capital. This approach enhances cash flow without disrupting your business activities and can improve balance sheet flexibility. Explore the rest of the article to understand how sale-leaseback can benefit your financial planning and asset management.

Table of Comparison

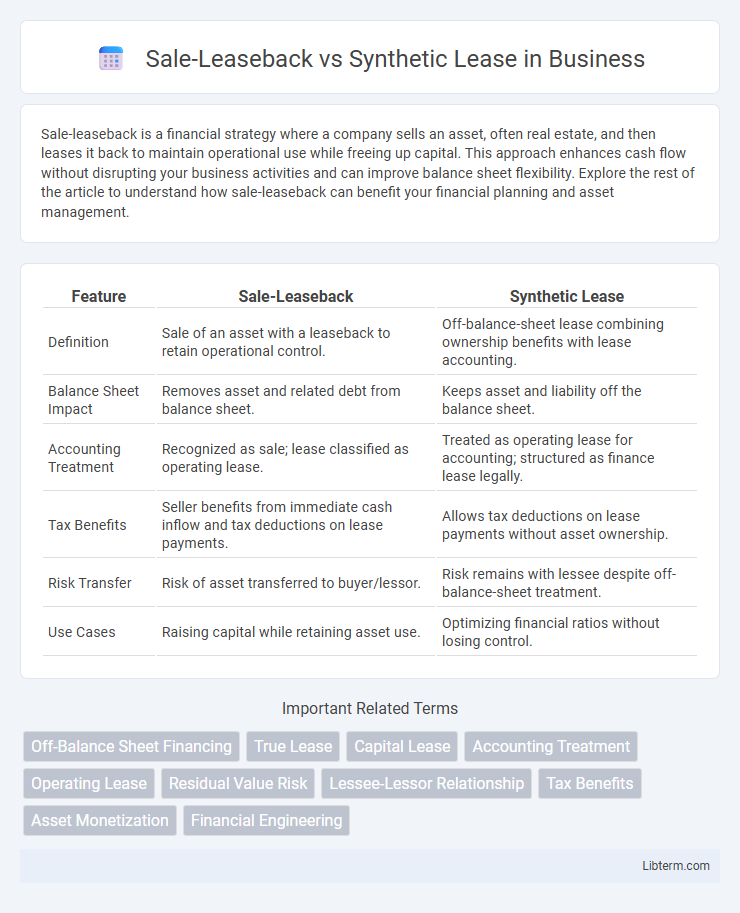

| Feature | Sale-Leaseback | Synthetic Lease |

|---|---|---|

| Definition | Sale of an asset with a leaseback to retain operational control. | Off-balance-sheet lease combining ownership benefits with lease accounting. |

| Balance Sheet Impact | Removes asset and related debt from balance sheet. | Keeps asset and liability off the balance sheet. |

| Accounting Treatment | Recognized as sale; lease classified as operating lease. | Treated as operating lease for accounting; structured as finance lease legally. |

| Tax Benefits | Seller benefits from immediate cash inflow and tax deductions on lease payments. | Allows tax deductions on lease payments without asset ownership. |

| Risk Transfer | Risk of asset transferred to buyer/lessor. | Risk remains with lessee despite off-balance-sheet treatment. |

| Use Cases | Raising capital while retaining asset use. | Optimizing financial ratios without losing control. |

Introduction to Sale-Leaseback and Synthetic Lease

Sale-leaseback is a financial transaction where an asset owner sells the asset and immediately leases it back, converting ownership into liquidity while retaining operational use. Synthetic lease combines off-balance-sheet financing with operational control, allowing companies to keep assets off their balance sheets while benefiting from tax advantages. Both structures offer strategic capital management solutions but differ in accounting treatment and flexibility.

Key Definitions: What Are Sale-Leaseback and Synthetic Lease?

Sale-leaseback is a financial transaction where a company sells an asset, typically real estate, to another party and simultaneously leases it back to retain operational use while raising capital. Synthetic lease is a structured financing arrangement allowing a company to keep an asset off its balance sheet by combining ownership benefits with lease accounting treatment. Both methods optimize asset management and financial reporting but differ in ownership transfer and balance sheet impact.

Structural Differences Between Sale-Leaseback and Synthetic Lease

Sale-Leaseback involves the outright sale of an asset to a buyer with the original owner leasing it back, transferring legal ownership but retaining operational control. Synthetic Lease, by contrast, is a financing structure where the lessee retains ownership on the balance sheet for accounting purposes while the lessor holds legal title, combining benefits of both ownership and off-balance-sheet treatment. Structurally, Sale-Leaseback results in true sale recognition with asset removal from the seller's balance sheet, while Synthetic Lease maintains asset control under complex legal and accounting arrangements to optimize financial reporting.

Accounting Treatment and Financial Reporting

Sale-leaseback transactions involve the seller transferring ownership of an asset to the buyer while simultaneously leasing it back, resulting in the asset's removal from the seller's balance sheet and recognition of any gain or loss on sale under US GAAP or IFRS. Synthetic leases, structured as operating leases under GAAP or IFRS, enable lessees to keep the asset and related debt off the balance sheet by meeting specific criteria, thus offering off-balance-sheet financing benefits without immediate gain or loss recognition. Both structures differ significantly in accounting treatment: sale-leasebacks require derecognition of the asset and immediate profit or loss impact, whereas synthetic leases maintain asset recognition with lease payments expensed over the lease term, affecting EBITDA and leverage ratios differently in financial reporting.

Tax Implications of Sale-Leaseback vs Synthetic Lease

Sale-leaseback transactions provide immediate tax benefits by allowing the seller-lessee to deduct lease payments as operating expenses while removing the asset from the balance sheet, potentially deferring capital gains tax. Synthetic leases, structured as off-balance-sheet financing, enable companies to keep the asset on the books and claim depreciation deductions, but lease payments often have different tax treatment, impacting overall tax liabilities. The choice between sale-leaseback and synthetic lease arrangements hinges on balancing immediate tax deductions with long-term tax depreciation benefits and compliance with IRS regulations on lease classification.

Benefits of Sale-Leaseback Transactions

Sale-leaseback transactions provide immediate liquidity by converting owned assets into cash while allowing continued use of the property under a lease agreement. These arrangements offer off-balance-sheet financing benefits, improving financial ratios and enhancing the company's borrowing capacity. Tax advantages such as deductible lease payments and potential depreciation benefits further optimize the company's financial and operational flexibility.

Advantages of Synthetic Lease Arrangements

Synthetic lease arrangements offer significant off-balance-sheet financing benefits, allowing companies to keep leased assets and related liabilities off their balance sheets while maintaining operational control. They enhance financial ratios by avoiding asset depreciation and interest expense recognition, improving return on assets and equity metrics. Tax advantages include deductibility of lease payments as operating expenses, optimizing cash flow management compared to traditional sale-leaseback structures.

Risks and Drawbacks: Sale-Leaseback vs Synthetic Lease

Sale-leaseback arrangements transfer asset ownership to a buyer while allowing the seller to lease back the asset, exposing the seller to potential loss of control and dependency on lease terms that may increase over time. Synthetic leases, structured to keep the asset off the balance sheet by combining elements of debt and lease financing, carry risks related to complex accounting treatment and potential reclassification by regulators, which can impact financial statements and credit ratings. Both structures pose risks in terms of future financial obligations and regulatory scrutiny, but sale-leasebacks can reduce flexibility in asset management, whereas synthetic leases risk balance sheet volatility if accounting rules change.

Ideal Scenarios: When to Choose Each Option

Sale-leaseback is ideal for companies seeking immediate cash flow improvement by selling an asset while retaining its use, often benefiting businesses needing capital without disrupting operations. Synthetic leases suit organizations aiming to keep assets off the balance sheet for favorable financial ratios and tax advantages, typically large corporations with complex financing strategies. Businesses should evaluate their liquidity needs, balance sheet impact, and tax considerations to determine the best leasing strategy.

Conclusion: Selecting the Right Financing Solution

Selecting the right financing solution between Sale-Leaseback and Synthetic Lease depends on a company's financial objectives and risk tolerance. Sale-Leaseback provides immediate liquidity and off-balance-sheet financing with potential tax benefits, while Synthetic Lease offers control over the asset and accounting flexibility without transferring ownership. Careful analysis of cash flow implications, balance sheet impact, and long-term strategic goals ensures the optimal lease structure aligns with corporate financial strategy.

Sale-Leaseback Infographic

libterm.com

libterm.com