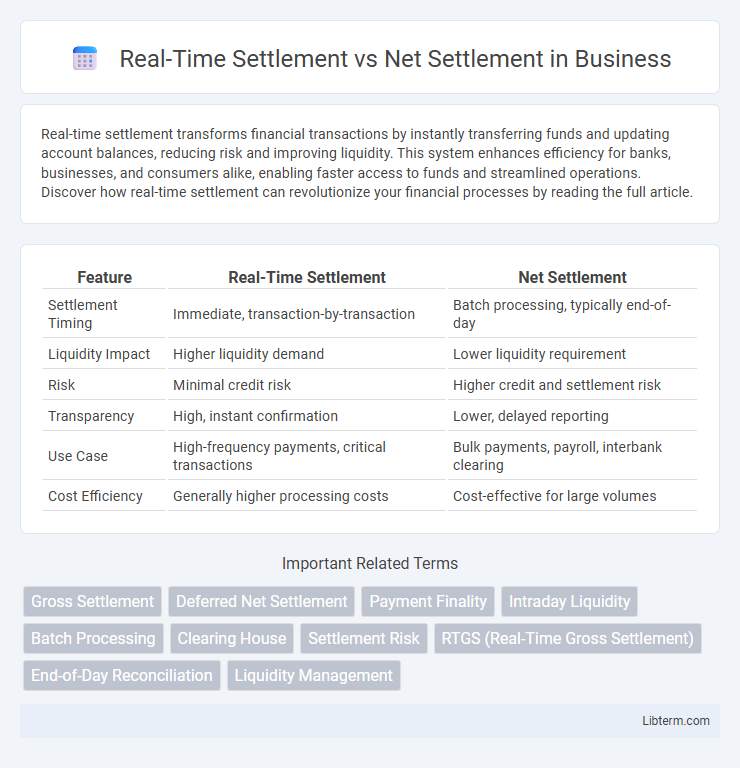

Real-time settlement transforms financial transactions by instantly transferring funds and updating account balances, reducing risk and improving liquidity. This system enhances efficiency for banks, businesses, and consumers alike, enabling faster access to funds and streamlined operations. Discover how real-time settlement can revolutionize your financial processes by reading the full article.

Table of Comparison

| Feature | Real-Time Settlement | Net Settlement |

|---|---|---|

| Settlement Timing | Immediate, transaction-by-transaction | Batch processing, typically end-of-day |

| Liquidity Impact | Higher liquidity demand | Lower liquidity requirement |

| Risk | Minimal credit risk | Higher credit and settlement risk |

| Transparency | High, instant confirmation | Lower, delayed reporting |

| Use Case | High-frequency payments, critical transactions | Bulk payments, payroll, interbank clearing |

| Cost Efficiency | Generally higher processing costs | Cost-effective for large volumes |

Introduction to Payment Settlement Systems

Real-time settlement processes payment transactions instantly, ensuring immediate fund transfer and reducing settlement risk by finalizing payments as they occur. Net settlement aggregates multiple transactions over a specified period and settles the net amount, optimizing liquidity but increasing exposure to risk until completion. Understanding these payment settlement systems is crucial for selecting appropriate infrastructure that balances speed, risk, and liquidity management in financial operations.

What is Real-Time Settlement?

Real-time settlement is a payment processing method where transactions are completed instantly, ensuring immediate transfer of funds between parties. This system reduces credit risk by eliminating delays between transaction initiation and completion. Financial institutions increasingly adopt real-time settlement to enhance liquidity management and improve cash flow efficiency.

What is Net Settlement?

Net settlement refers to the process of consolidating multiple payment obligations between parties into a single net payment, reducing the number of individual transactions processed. This method enhances efficiency by minimizing liquidity requirements and operational costs in financial systems. Unlike real-time settlement, net settlement occurs at predetermined intervals, which can delay the final transfer of funds.

Key Differences Between Real-Time and Net Settlement

Real-time settlement processes transactions individually, ensuring immediate fund transfers and reducing counterparty risk, whereas net settlement aggregates multiple transactions to clear at specific intervals, optimizing liquidity but increasing settlement lag. Real-time settlement requires robust infrastructure to handle continuous processing, promoting transparency and instant reconciliation, while net settlement depends on batch processing, which can delay finality and may expose parties to market fluctuations between cycles. The choice between these settlement methods impacts operational efficiency, risk management, and the liquidity demands of financial institutions and payment systems.

Advantages of Real-Time Settlement

Real-time settlement offers significant advantages by enabling instantaneous transfer of funds and ownership, reducing counterparty risk and enhancing liquidity management for businesses and financial institutions. It improves cash flow precision and mitigates settlement delays common in net settlement, which aggregates transactions and settles periodically. The enhanced transparency and immediate finality provided by real-time settlement support more efficient financial operations and stronger trust in payment ecosystems.

Advantages of Net Settlement

Net settlement reduces the volume of transactions processed by consolidating multiple payments into a single net amount, which lowers clearing costs and minimizes settlement risk. This system enhances liquidity management by allowing participants to maintain smaller reserves compared to real-time settlement. Consequently, net settlement improves overall efficiency in payment systems, especially for high-frequency, low-value transactions.

Risks Associated with Each Settlement Method

Real-time settlement reduces credit risk by ensuring transactions are completed instantly, minimizing the chance of default or delayed payments, but it requires robust liquidity management to handle continuous fund transfers. Net settlement aggregates multiple transactions over a period, lowering operational costs and liquidity demands, but increases settlement risk as the failure of one participant can affect the entire netted amount. Choosing between these methods involves balancing liquidity constraints against exposure to counterparty and systemic risks inherent in delayed settlements.

Impact on Financial Institutions and End-Users

Real-time settlement accelerates transaction finality, reducing credit risk for financial institutions and enhancing liquidity management, whereas net settlement aggregates transactions to lower processing costs but increases exposure to settlement risk during the clearing period. For end-users, real-time settlement offers immediate fund availability and improved transparency, fostering trust and operational efficiency. Conversely, net settlement can delay access to funds, potentially complicating cash flow management and decreasing transactional certainty.

Use Cases: When to Use Real-Time vs Net Settlement

Real-time settlement is ideal for high-frequency trading and retail payments requiring immediate fund transfer and reduced counterparty risk, such as point-of-sale transactions and instant payroll. Net settlement suits batch processing scenarios like interbank clearing and corporate payroll, where aggregating transactions minimizes transaction costs and liquidity requirements. Choosing between real-time and net settlement depends on the need for speed and liquidity management versus cost efficiency and transaction volume handling.

Future Trends in Settlement Systems

Real-time settlement systems enable instantaneous transaction finality, reducing counterparty risk and improving liquidity management, while net settlement aggregates multiple transactions to optimize capital efficiency but increases settlement risk. Future trends emphasize blockchain and distributed ledger technologies to enhance transparency, security, and speed in both settlement methods. Integration of artificial intelligence and machine learning promises predictive analytics for risk mitigation and automated compliance, driving significant evolution in settlement efficiency.

Real-Time Settlement Infographic

libterm.com

libterm.com