Growth investing focuses on buying shares in companies expected to grow at an above-average rate compared to their industry or the overall market. Investors prioritize capital appreciation, seeking stocks with strong revenue and earnings potential rather than current income. Discover how growth investing can enhance your portfolio by reading the rest of this article.

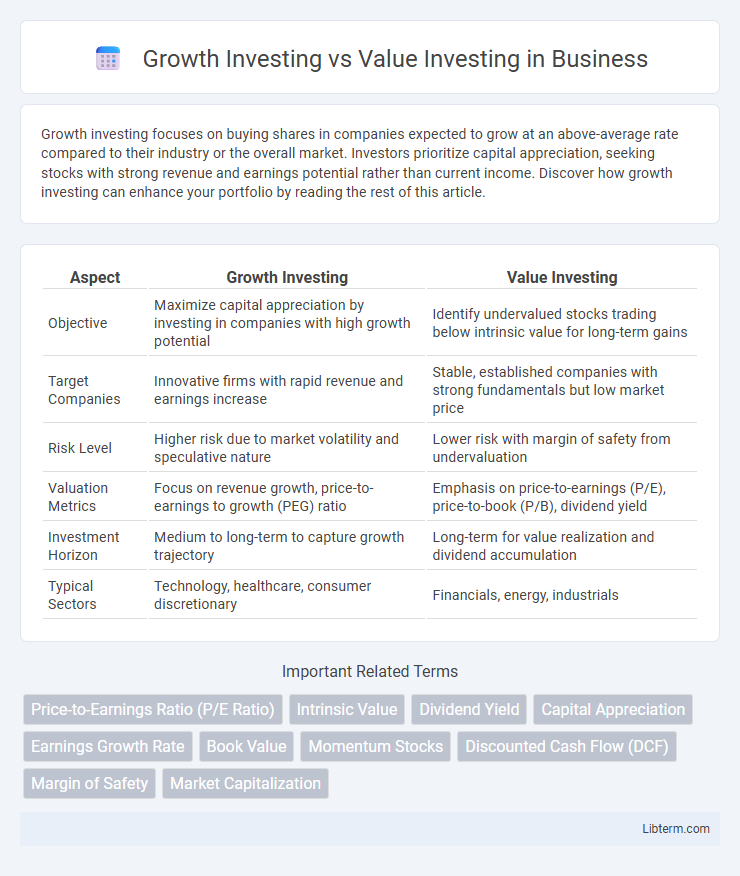

Table of Comparison

| Aspect | Growth Investing | Value Investing |

|---|---|---|

| Objective | Maximize capital appreciation by investing in companies with high growth potential | Identify undervalued stocks trading below intrinsic value for long-term gains |

| Target Companies | Innovative firms with rapid revenue and earnings increase | Stable, established companies with strong fundamentals but low market price |

| Risk Level | Higher risk due to market volatility and speculative nature | Lower risk with margin of safety from undervaluation |

| Valuation Metrics | Focus on revenue growth, price-to-earnings to growth (PEG) ratio | Emphasis on price-to-earnings (P/E), price-to-book (P/B), dividend yield |

| Investment Horizon | Medium to long-term to capture growth trajectory | Long-term for value realization and dividend accumulation |

| Typical Sectors | Technology, healthcare, consumer discretionary | Financials, energy, industrials |

Introduction to Growth Investing vs Value Investing

Growth investing targets companies with above-average earnings growth potential, emphasizing future revenue and profit expansion. Value investing seeks undervalued stocks trading below their intrinsic value, focusing on financial stability and dividend yield. Both strategies require thorough market analysis but differ in risk tolerance and investment horizon.

Defining Growth Investing: Key Characteristics

Growth investing targets companies with above-average earnings growth potential, often in innovative industries like technology or healthcare. Key characteristics include high price-to-earnings (P/E) ratios, reinvestment of earnings into business expansion, and substantial revenue increases. Investors prioritize capital appreciation over dividend income, seeking long-term gains through market share expansion and product development.

Understanding Value Investing: Core Principles

Value investing centers on identifying undervalued stocks trading below their intrinsic worth by analyzing financial statements, earnings stability, and dividend history. Investors prioritize companies with strong fundamentals, low price-to-earnings ratios, and consistent cash flow, aiming for long-term capital appreciation and reduced downside risk. Key principles include margin of safety, thorough fundamental analysis, and patience to allow market corrections.

Historical Performance Comparison

Growth investing has historically outperformed value investing during bull markets, driven by strong earnings growth and high price-to-earnings ratios, particularly in technology and innovation sectors. Conversely, value investing has shown resilience and superior returns during market downturns and periods of economic recovery, benefiting from undervalued stocks with solid fundamentals. Long-term studies, such as those analyzing the S&P 500 data from 1927 to 2023, reveal that while growth strategies deliver higher average annual returns, value investing often yields lower volatility and better risk-adjusted performance.

Risk Profiles and Volatility

Growth investing typically involves higher risk profiles and increased volatility due to its focus on companies with rapid earnings expansion and future potential, often leading to price fluctuations in response to market sentiment. Value investing emphasizes lower risk by targeting undervalued stocks with stable fundamentals, resulting in comparatively reduced volatility and a margin of safety against market downturns. Investors seeking capital preservation may favor value strategies, while those aiming for higher returns accept the elevated risk and price swings inherent in growth investing.

Stock Selection Criteria

Growth investing prioritizes companies with strong revenue and earnings growth potential, emphasizing metrics like high earnings per share (EPS) growth, increasing sales figures, and robust return on equity (ROE). Value investing targets undervalued stocks by analyzing low price-to-earnings (P/E) ratios, price-to-book (P/B) ratios below industry averages, and high dividend yields that signal financial stability. Stock selection in growth investing centers on future potential and market trends, while value investing focuses on intrinsic value and margin of safety.

Typical Industries and Sectors Targeted

Growth investing typically targets technology, biotechnology, and consumer discretionary sectors, where companies demonstrate high revenue and earnings growth potential. Value investing focuses on sectors like financials, energy, and industrials, seeking undervalued companies trading below intrinsic worth with stable cash flows. Growth investors prioritize innovation-driven firms, whereas value investors emphasize established industries with strong fundamentals and dividend yields.

Famous Investors: Growth vs Value Approaches

Warren Buffett exemplifies value investing by targeting undervalued companies with strong fundamentals and long-term potential, while Peter Lynch embodies growth investing through investing in companies with high earnings growth prospects. Benjamin Graham, known as the father of value investing, emphasized analyzing intrinsic value and margin of safety, whereas Philip Fisher is celebrated for growth investing with a focus on innovative companies with scalable potential. These famous investors highlight the distinct strategies where value investing revolves around buying underpriced stocks, and growth investing aims at capitalizing on rapid business expansion.

Market Cycles and Strategy Outperformance

Growth investing typically outperforms during early and expansion phases of market cycles when economic growth accelerates and investor confidence is high, driving higher valuations for companies with strong earnings potential. Value investing tends to excel in late-stage or contraction phases as undervalued stocks with solid fundamentals become attractive amidst market pessimism and lower growth expectations. Long-term strategy outperformance often depends on market timing, risk tolerance, and sector rotation, with growth strategies benefiting from innovation-driven expansions and value strategies providing stability during downturns.

Choosing the Right Strategy for Your Portfolio

Growth investing targets companies with high earnings potential and rapid expansion, ideal for investors seeking capital appreciation in dynamic markets. Value investing focuses on undervalued stocks trading below intrinsic worth, appealing to those prioritizing margin of safety and long-term stability. Selecting the right strategy depends on risk tolerance, investment horizon, and market conditions to balance portfolio diversification and optimize returns.

Growth Investing Infographic

libterm.com

libterm.com