An administration fee is a charge imposed to cover the costs associated with processing and managing services or transactions. This fee is typically applied in various sectors, including finance, real estate, and event management, ensuring smooth and efficient operations. Discover how understanding administration fees can help you make informed decisions by reading the rest of the article.

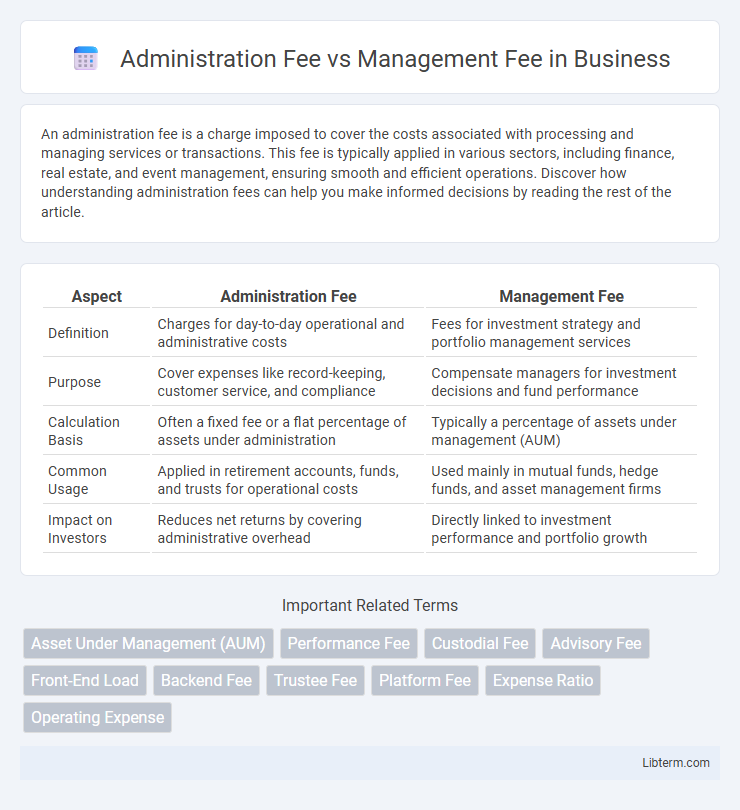

Table of Comparison

| Aspect | Administration Fee | Management Fee |

|---|---|---|

| Definition | Charges for day-to-day operational and administrative costs | Fees for investment strategy and portfolio management services |

| Purpose | Cover expenses like record-keeping, customer service, and compliance | Compensate managers for investment decisions and fund performance |

| Calculation Basis | Often a fixed fee or a flat percentage of assets under administration | Typically a percentage of assets under management (AUM) |

| Common Usage | Applied in retirement accounts, funds, and trusts for operational costs | Used mainly in mutual funds, hedge funds, and asset management firms |

| Impact on Investors | Reduces net returns by covering administrative overhead | Directly linked to investment performance and portfolio growth |

Understanding Administration Fees

Administration fees refer to charges imposed by investment funds or financial institutions to cover operational expenses such as recordkeeping, customer service, and regulatory compliance. These fees are typically distinct from management fees, which compensate portfolio managers for investment decisions and strategy execution. Understanding administration fees is crucial for investors as they directly impact the net returns of funds and vary based on service complexity and fund structure.

What Are Management Fees?

Management fees are charges levied by investment managers or fund companies for overseeing and making decisions about a portfolio or fund, typically calculated as a percentage of assets under management (AUM). These fees compensate for services including asset selection, portfolio rebalancing, and ongoing investment strategy adjustments. Unlike administration fees, management fees directly pertain to active investment management and advisory activities.

Key Differences Between Administration and Management Fees

Administration fees cover the operational costs of record-keeping, compliance, and customer service, ensuring the smooth functioning of an investment fund. Management fees compensate investment managers for portfolio selection, strategy execution, and performance oversight, directly influencing fund returns. The primary difference lies in administration fees being fixed and related to fund maintenance, while management fees fluctuate based on assets under management and investment expertise.

Common Structures for Administration Fees

Common structures for administration fees typically include fixed monthly charges, percentage-based fees calculated on assets under management, or a combination of both to cover operational costs such as record-keeping, compliance, and reporting. These fees are distinct from management fees, which primarily compensate portfolio managers for investment decision-making and strategy execution. Administration fees ensure the smooth functioning of administrative tasks, often ranging from 0.1% to 0.5% of assets, depending on the complexity and scale of the service provided.

How Management Fees Are Calculated

Management fees are typically calculated as a fixed percentage of assets under management (AUM), often ranging from 0.5% to 2% annually, depending on the investment fund or portfolio size. These fees are designed to cover the costs of portfolio management, research, and advisory services provided by fund managers. Unlike administration fees, which cover operational expenses such as record-keeping and regulatory compliance, management fees directly compensate for active investment decision-making and ongoing asset supervision.

Impact of Fees on Investment Returns

Administration fees and management fees both reduce overall investment returns by directly lowering the net asset value of a portfolio, with management fees typically being higher and more impactful due to active fund oversight costs. Administration fees cover operational expenses like record-keeping and regulatory compliance, often fixed or modest, while management fees fluctuate with the fund's assets and investment strategies, potentially eroding returns significantly over time. Investors should analyze fee structures carefully, as even small differences in combined fees can compound and substantially affect long-term investment performance.

Industry Standards for Fee Structures

Industry standards for fee structures differentiate administration fees and management fees by their purpose and calculation methods. Administration fees typically cover operational costs such as record-keeping and reporting, often charged as a flat rate or a small percentage of assets under management (AUM), generally ranging from 0.1% to 0.3%. Management fees, commonly between 0.5% and 2.0% of AUM annually, compensate portfolio managers for investment decision-making and active fund management, reflecting the fund's strategy and complexity.

Pros and Cons of Administration and Management Fees

Administration fees typically cover the operational costs of managing accounts, providing transparency and consistent funding for essential services; however, they can increase overall expenses without directly impacting investment returns. Management fees compensate portfolio managers for their expertise in selecting and overseeing investments, potentially enhancing portfolio performance but may reduce net gains if excessively high. Both fees affect the investor's net returns and should be evaluated carefully against the value and services provided.

Tips for Evaluating Fee Transparency

Evaluating fee transparency requires closely examining administration fees and management fees to understand their scope and impact on investment returns. Look for clear disclosures that itemize charges, avoid bundled fees, and provide detailed explanations of services covered by each fee category. Comparing fee structures across funds or service providers helps identify hidden costs and ensures that investors make informed decisions about the true cost of managing their assets.

Choosing the Right Fee Structure for Your Needs

Choosing the right fee structure between administration fees and management fees depends on your financial goals and service requirements. Administration fees typically cover operational costs and are fixed or predictable, while management fees vary based on assets under management and reflect active portfolio oversight. Evaluating the cost-benefit balance, including fee impact on returns and service level, is essential to align fees with your investment strategy.

Administration Fee Infographic

libterm.com

libterm.com