Effective conglomerate integration requires careful alignment of diverse business units to create synergies and enhance overall value. Managing cultural differences, streamlining operations, and unifying strategic goals are essential to maximize the benefits of a diverse portfolio. Explore the rest of this article to discover key strategies for successful conglomerate integration and how you can apply them to your organization.

Table of Comparison

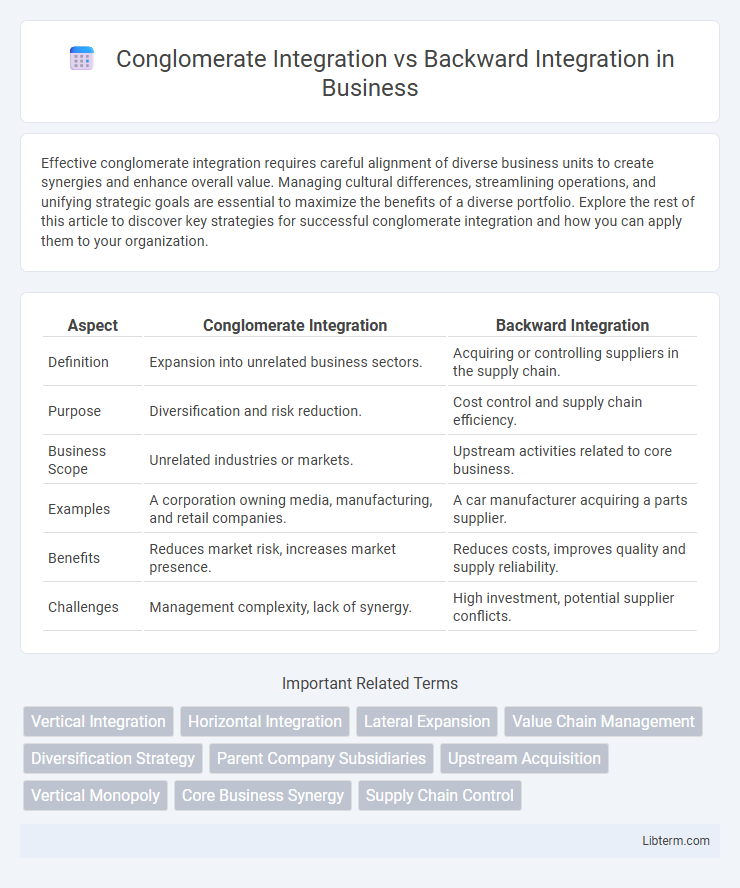

| Aspect | Conglomerate Integration | Backward Integration |

|---|---|---|

| Definition | Expansion into unrelated business sectors. | Acquiring or controlling suppliers in the supply chain. |

| Purpose | Diversification and risk reduction. | Cost control and supply chain efficiency. |

| Business Scope | Unrelated industries or markets. | Upstream activities related to core business. |

| Examples | A corporation owning media, manufacturing, and retail companies. | A car manufacturer acquiring a parts supplier. |

| Benefits | Reduces market risk, increases market presence. | Reduces costs, improves quality and supply reliability. |

| Challenges | Management complexity, lack of synergy. | High investment, potential supplier conflicts. |

Introduction to Conglomerate and Backward Integration

Conglomerate integration involves the merger or acquisition of companies operating in entirely different industries, aiming to diversify business operations and reduce risk by entering unrelated markets. Backward integration refers to a firm's strategic move to acquire or control its suppliers, enhancing supply chain efficiency and reducing production costs by gaining direct access to raw materials or components. Both integration strategies serve distinct purposes: conglomerate integration focuses on diversification, while backward integration emphasizes control over input sources to strengthen competitive advantage.

Defining Conglomerate Integration

Conglomerate integration involves the merger or acquisition of companies operating in entirely different industries, creating a diversified business portfolio to reduce risk and leverage cross-industry opportunities. This strategy contrasts with backward integration, which focuses on acquiring or merging with suppliers within the same industry to control raw materials and reduce production costs. Conglomerate integration emphasizes diversification and entering new markets, while backward integration aims at enhancing supply chain control and operational efficiency.

Understanding Backward Integration

Backward integration involves a company expanding its operations to control its supply chain by acquiring or merging with suppliers, thereby reducing dependency on external sources. This strategy enhances cost efficiency, improves supply chain coordination, and secures critical inputs for production processes. Unlike conglomerate integration, which diversifies into unrelated businesses, backward integration targets upstream activities within the same industry.

Key Differences Between Conglomerate and Backward Integration

Conglomerate integration involves the merger or acquisition of companies operating in unrelated industries, aiming to diversify business operations and reduce risks across sectors. Backward integration refers to a company expanding its control over its supply chain by acquiring or merging with suppliers, thereby enhancing efficiency and reducing dependency on external sources. The key difference lies in conglomerate integration emphasizing diversification across unrelated markets, while backward integration focuses on vertical control within the same industry to improve production and cost advantages.

Strategic Objectives of Conglomerate Integration

Conglomerate integration aims to diversify a company's portfolio by acquiring businesses in unrelated industries to reduce risks and exploit new market opportunities. Strategic objectives include expanding market reach, achieving financial stability through varied revenue streams, and enhancing overall corporate resilience against industry-specific downturns. This approach contrasts with backward integration, which focuses on controlling supply chains within the same industry to improve operational efficiency and cost control.

Strategic Objectives of Backward Integration

Backward integration aims to enhance supply chain control by acquiring or merging with suppliers, reducing dependency on external vendors, and lowering production costs. It strategically improves product quality, ensures timely availability of raw materials, and strengthens competitive advantage. This integration supports long-term sustainability by securing critical inputs and boosting operational efficiency within the value chain.

Advantages of Conglomerate Integration

Conglomerate integration enhances market diversification by enabling firms to enter entirely different industries, reducing dependence on a single sector and spreading risk. This strategy facilitates resource allocation across varied business units, promoting financial stability and growth opportunities through varied revenue streams. Furthermore, conglomerate integration can leverage financial synergies, optimizing capital utilization and enhancing overall corporate value.

Benefits of Backward Integration

Backward integration enhances supply chain control by enabling companies to produce raw materials internally, reducing dependency on external suppliers and minimizing costs. It improves production efficiency and quality assurance by allowing closer oversight of input materials and manufacturing processes. This strategy can also secure critical resources, leading to competitive advantages in pricing and market stability.

Challenges and Risks of Each Integration Strategy

Conglomerate integration involves merging with or acquiring unrelated businesses, posing challenges such as cultural clashes, management complexity, and lack of synergies, which can lead to inefficient resource allocation and decreased focus. Backward integration requires acquiring suppliers or controlling raw materials, exposing firms to risks including high capital investment, potential supply chain disruptions, and reduced flexibility in sourcing alternatives. Both strategies carry financial risks and operational complexities that can hinder overall strategic objectives if not carefully managed.

Choosing the Right Integration: Factors to Consider

Choosing the right integration strategy depends on the company's core business alignment and market expansion goals. Conglomerate integration suits firms seeking diversification into unrelated industries to reduce risk, while backward integration targets control over supply chains and cost efficiency within the same industry. Key factors include assessing operational synergies, capital investment capacity, competitive advantage, and long-term growth potential.

Conglomerate Integration Infographic

libterm.com

libterm.com