Bonds serve as a reliable investment vehicle that provides regular interest payments and helps diversify your portfolio, reducing overall risk. Understanding the different types of bonds, such as government, municipal, and corporate, is crucial to selecting the best options for your financial goals. Explore the rest of this article to learn how bonds can strengthen your investment strategy and secure your financial future.

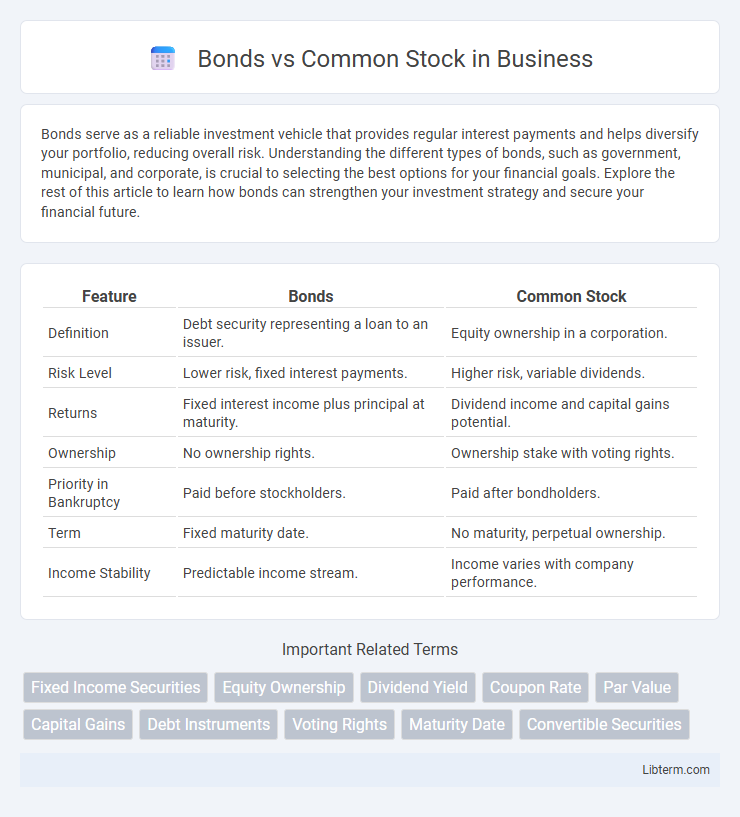

Table of Comparison

| Feature | Bonds | Common Stock |

|---|---|---|

| Definition | Debt security representing a loan to an issuer. | Equity ownership in a corporation. |

| Risk Level | Lower risk, fixed interest payments. | Higher risk, variable dividends. |

| Returns | Fixed interest income plus principal at maturity. | Dividend income and capital gains potential. |

| Ownership | No ownership rights. | Ownership stake with voting rights. |

| Priority in Bankruptcy | Paid before stockholders. | Paid after bondholders. |

| Term | Fixed maturity date. | No maturity, perpetual ownership. |

| Income Stability | Predictable income stream. | Income varies with company performance. |

Introduction to Bonds and Common Stocks

Bonds are fixed-income securities representing a loan made by an investor to a borrower, typically corporate or governmental, with scheduled interest payments and principal repayment at maturity. Common stocks signify ownership in a corporation, granting shareholders voting rights and potential dividends based on company performance. Understanding the fundamental differences between bonds and common stocks is crucial for portfolio diversification and managing risk and return expectations.

Key Differences Between Bonds and Common Stocks

Bonds represent debt obligations where investors receive fixed interest payments and principal repayment, providing lower risk and priority over common stockholders during liquidation. Common stocks signify ownership shares with variable dividends and voting rights, exposing investors to higher potential returns but greater volatility. The primary difference lies in bonds being debt instruments with fixed income, while common stocks offer equity ownership with profit-sharing and residual claims on assets.

Risk and Return Profiles

Bonds typically offer lower risk and more predictable returns through fixed interest payments and principal repayment, appealing to conservative investors seeking steady income. Common stock carries higher risk due to market volatility and the potential for loss of principal but provides greater return potential through capital appreciation and dividends. Investors evaluating risk and return profiles must balance the stability of bonds against the growth opportunities presented by common stock.

Dividend vs. Interest Payments

Bonds provide fixed interest payments to investors, offering predictable income streams regardless of company profits, while common stock dividends depend on the company's profitability and board approval, leading to variable and potentially higher returns. Interest payments on bonds have priority over dividends, ensuring bondholders receive payments before any distribution to shareholders. Common stock investors benefit from dividend growth and capital appreciation but assume higher risk compared to the contractual obligation to pay interest on bonds.

Ownership and Voting Rights

Bonds represent debt instruments where investors lend money to the issuer without gaining ownership or voting rights in the company. Common stockholders hold equity shares, granting them ownership stakes and the ability to vote on corporate matters such as electing the board of directors. The distinction between bonds and common stock highlights the trade-off between fixed income with no control and equity ownership with governance participation.

Market Volatility and Stability

Bonds generally offer greater stability and lower risk during periods of high market volatility due to fixed interest payments and priority over common stock in company assets. Common stock prices fluctuate more dramatically based on company performance and market sentiment, leading to higher potential returns but increased exposure to volatility. Investors seeking steady income and capital preservation often prefer bonds, while those pursuing growth may accept the unpredictable nature of common stock.

Suitability for Different Investor Types

Bonds suit risk-averse investors seeking stable income through fixed interest payments and capital preservation, especially retirees or conservative portfolios. Common stock appeals to growth-oriented investors willing to accept volatility for potential capital gains and dividend income, typically younger individuals or those with higher risk tolerance. Diversifying between bonds and stocks aligns portfolios with varied investment horizons and risk preferences.

Tax Implications

Bond interest payments are generally taxable as ordinary income at the federal and state levels, impacting the investor's after-tax return. In contrast, qualified dividends from common stock often benefit from lower tax rates, typically ranging from 0% to 20%, depending on the investor's tax bracket. Capital gains on stock sales may also be taxed at favorable long-term rates if held for more than one year, providing potential tax advantages over bond income.

Liquidity and Trading Considerations

Bonds generally offer higher liquidity due to established secondary markets and regular trading volumes, enabling investors to buy or sell them more easily compared to common stocks. Common stocks may experience greater price volatility and variable trading volumes, influencing liquidity depending on the company's market capitalization and investor interest. Institutional investors often prefer bonds for predictable cash flows and stable liquidity, while stocks attract those seeking growth opportunities with potentially less liquidity certainty.

Long-Term Growth Potential

Bonds typically offer lower long-term growth potential compared to common stock due to fixed interest payments and limited capital appreciation. Common stock provides investors with ownership in a company, enabling participation in earnings growth and share price appreciation over time. Stocks carry higher risk but often yield greater returns, making them preferable for investors seeking substantial wealth accumulation over the long term.

Bonds Infographic

libterm.com

libterm.com