Operating income measures a company's profitability from its core business operations before interest and taxes are deducted. It is calculated by subtracting operating expenses, such as cost of goods sold and administrative costs, from gross profit, providing insight into how efficiently a business generates earnings from its primary activities. To understand how operating income impacts your financial decisions and business performance, continue reading the article.

Table of Comparison

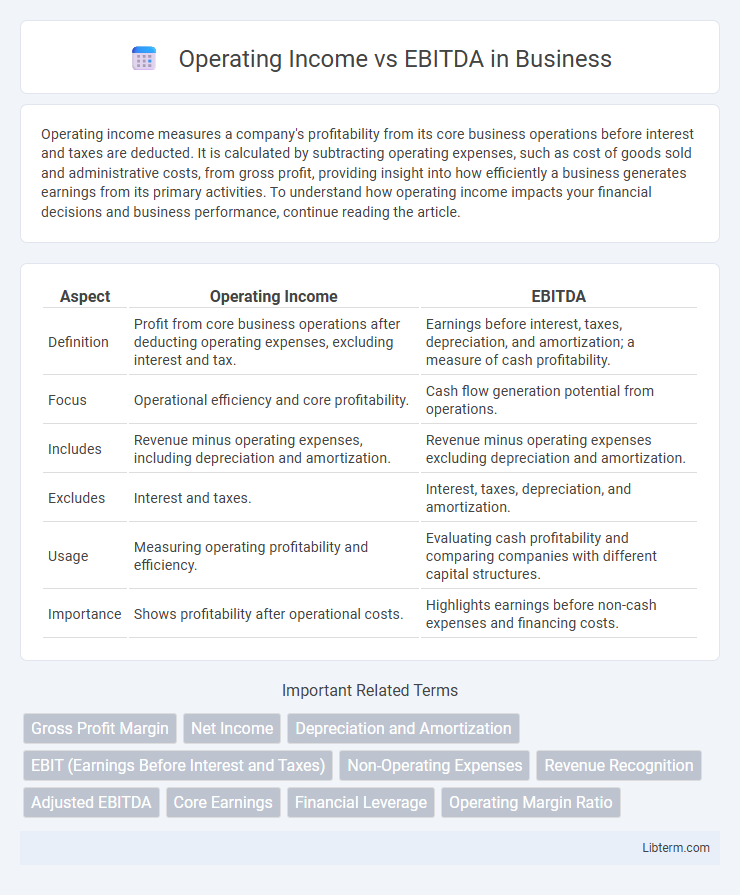

| Aspect | Operating Income | EBITDA |

|---|---|---|

| Definition | Profit from core business operations after deducting operating expenses, excluding interest and tax. | Earnings before interest, taxes, depreciation, and amortization; a measure of cash profitability. |

| Focus | Operational efficiency and core profitability. | Cash flow generation potential from operations. |

| Includes | Revenue minus operating expenses, including depreciation and amortization. | Revenue minus operating expenses excluding depreciation and amortization. |

| Excludes | Interest and taxes. | Interest, taxes, depreciation, and amortization. |

| Usage | Measuring operating profitability and efficiency. | Evaluating cash profitability and comparing companies with different capital structures. |

| Importance | Shows profitability after operational costs. | Highlights earnings before non-cash expenses and financing costs. |

Introduction to Operating Income and EBITDA

Operating Income, also known as operating profit, measures a company's profitability from core business operations, excluding non-operating expenses and incomes such as interest and taxes. EBITDA, which stands for Earnings Before Interest, Taxes, Depreciation, and Amortization, provides a clearer picture of operational cash flow by excluding non-cash expenses and financial costs. Both metrics are critical for assessing financial health, with Operating Income emphasizing profitability and EBITDA highlighting cash generation capabilities.

Definition of Operating Income

Operating Income, also known as operating profit, is a financial metric that measures a company's profitability from its core business operations, excluding non-operating income and expenses such as interest and taxes. It is calculated by subtracting operating expenses, including cost of goods sold (COGS), selling, general and administrative expenses (SG&A), and depreciation from gross profit. Operating Income provides insight into the efficiency and effectiveness of a company's operational management before the impact of financial and tax activities.

What is EBITDA?

EBITDA, or Earnings Before Interest, Taxes, Depreciation, and Amortization, is a key financial metric used to evaluate a company's operational performance by excluding non-operating expenses and non-cash charges. It provides a clearer picture of profitability from core business operations compared to Operating Income, which includes depreciation and amortization costs. Analysts use EBITDA to compare companies across industries by focusing on earnings before financing and accounting decisions impact the bottom line.

Key Differences Between Operating Income and EBITDA

Operating Income measures a company's profitability by subtracting operating expenses, including depreciation and amortization, from gross profit, reflecting core business operations. EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) excludes depreciation, amortization, interest, and taxes, emphasizing cash flow and operational efficiency. The key difference lies in EBITDA's exclusion of non-cash and financial costs, making it useful for comparing companies with different capital structures, while Operating Income provides a more comprehensive view of operational profitability.

Calculation Methods for Operating Income and EBITDA

Operating Income is calculated by subtracting operating expenses, such as selling, general and administrative expenses (SG&A), and depreciation from gross profit, reflecting core business profitability before interest and taxes. EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) is derived by adding back depreciation and amortization expenses to Operating Income, providing a clearer view of operational cash flow by excluding non-cash charges. Both metrics offer distinct insights, with Operating Income emphasizing operational efficiency and EBITDA focusing on cash generation potential.

Purpose and Use Cases in Financial Analysis

Operating Income measures a company's profitability from core business operations by subtracting operating expenses from gross profit, providing insight into operational efficiency. EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) excludes non-operating expenses and non-cash charges to highlight cash flow potential and operational performance without accounting policies' impacts. Analysts use Operating Income to assess sustainable earnings and operational control, while EBITDA aids in comparing companies across industries by standardizing earnings before capital structure and accounting differences.

Advantages and Limitations of Operating Income

Operating Income provides a clear measure of a company's profitability by focusing on core business operations, excluding non-operating revenues and expenses, which helps investors evaluate operational efficiency. It captures depreciation and amortization expenses, offering a more conservative and realistic view of ongoing expenses compared to EBITDA. The limitation of Operating Income lies in its exclusion of non-operational financial activities and potential distortions caused by accounting policies affecting depreciation and amortization methods.

Pros and Cons of EBITDA

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) provides a clear view of operational profitability by excluding non-cash expenses and financial costs, making it useful for comparing companies with different capital structures. However, EBITDA can be misleading by ignoring essential expenses like depreciation and interest, which affect long-term sustainability and cash flow. Operating Income accounts for these costs, offering a more comprehensive measure of a company's profitability despite variations in non-operating items.

Which Metric Do Investors Prefer?

Investors often prefer EBITDA over operating income because EBITDA provides a clearer picture of a company's core profitability by excluding non-operating expenses like depreciation and amortization, which can vary significantly between industries. Operating income includes these non-cash charges, making it less comparable across companies with different capital structures and asset bases. EBITDA allows investors to better assess cash flow potential and operational efficiency, making it a preferred metric for evaluating financial performance and valuation.

Conclusion: Choosing the Right Financial Metric

Operating Income provides a clear view of a company's core profitability by excluding non-operating expenses, while EBITDA offers insight into cash flow by adding back depreciation and amortization. Selecting the appropriate financial metric depends on the analysis goal: EBITDA suits cash flow evaluation and valuation comparisons, whereas Operating Income better reflects operational efficiency. Investors and analysts benefit from using both metrics in tandem to achieve a comprehensive understanding of financial health.

Operating Income Infographic

libterm.com

libterm.com